New York Lawmaker Floats a Scrooge Tax on Online Shopping

Just in time for the holidays, one lawmaker wants to tax New York City residents $3 for every package they order online, excluding food and medicine

3 min read

Just in time for the holidays, one lawmaker wants to tax New York City residents $3 for every package they order online, excluding food and medicine

3 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

Policymakers should consider finding ways to simplify the administration of relief during future crises. This will help ensure the relief is timely and targeted, key components of any successful relief package for this crisis or crises in the future.

3 min read

With days left until government funding runs out, congressional lawmakers are down to the wire to fund the government and provide additional pandemic-related relief to the households and businesses trying to make it through the winter.

3 min read

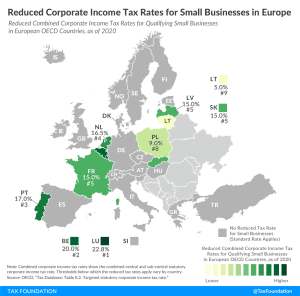

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read

It’s important for Poland to understand the main lesson of the Estonian approach: taxes should be designed with an overarching approach to maximize neutrality and minimize complexity and distortions. Instead of simply adopting a preference for small businesses, the Polish government should instead overhaul its corporate tax rules and truly adopt the Estonian approach to taxation.

2 min read

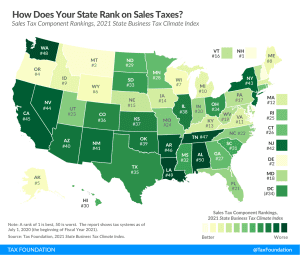

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate. Broad-based, low-rate tax structures minimize tax-induced economic distortions that can occur when people change their purchasing behavior because of tax differences.

3 min read

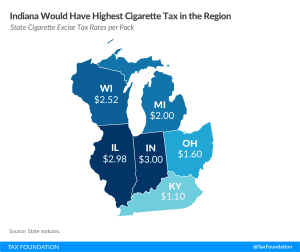

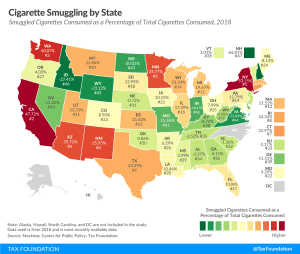

While increasing taxes on cigarettes may limit demand, a 200 percent hike may also result in a number of unintended consequences, such as increased smuggling.

2 min read

A bipartisan coalition of Senators unveiled a $908 billion COVID-19 relief bill on Tuesday, which includes, among other provisions, $160 billion in additional aid to state and local governments. It is worth briefly exploring what this would mean, and the amounts of aid your state might expect.

5 min read

While a sweeping tax policy bill is unlikely in the near future, lawmakers may be able to come together on a smaller scale. Pairing better cost recovery on a permanent basis with support for vulnerable households as well as additional pandemic-related relief would help promote a more rapid return to growth and help businesses and households weather the ongoing crisis.

4 min read

At the end of 2020, 33 temporary tax provisions are scheduled to expire at the federal level. These provisions generally fall under four categories: cost recovery, energy, individual, and other business provisions.

20 min read

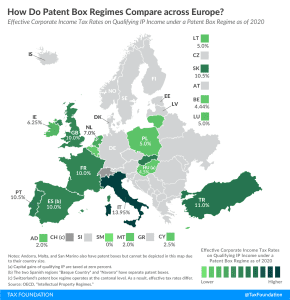

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP.

4 min read

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

Mississippi Governor Tate Reeves (R), in his budget proposal for fiscal year (FY) 2022, has announced his goal of phasing out the state’s income tax by 2030.

3 min read

New York already suffers from significant smuggling of untaxed tobacco products—smuggled cigarettes accounted for 53 percent of cigarettes consumed in the state in 2018—and further increasing tobacco taxes is likely to make matters worse.

3 min read

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

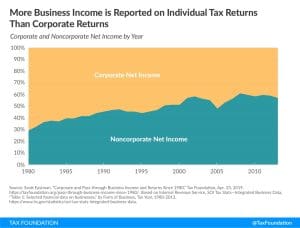

Economists have proposed taxing corporate income more uniformly through corporate integration, which can be done in a variety of ways. Biden’s plan goes in the opposite direction by making worse the double taxation of corporate income.

5 min read

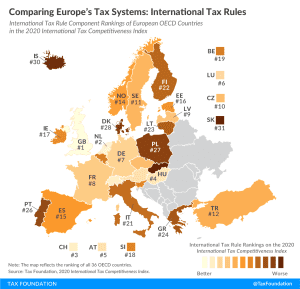

International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of a country’s tax code.

3 min read