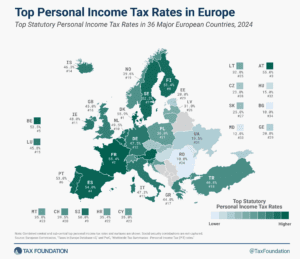

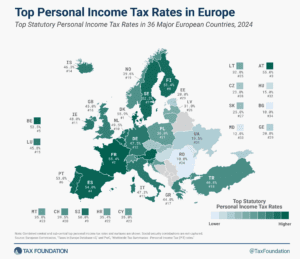

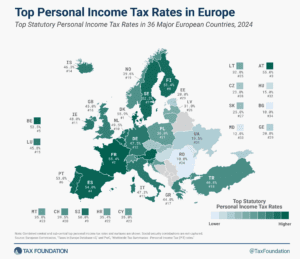

Top Personal Income Tax Rates in Europe, 2024

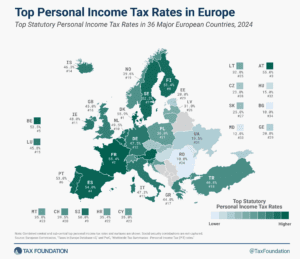

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your country collect revenue? Every week, we release a new tax map that illustrates one important measure of tax rates, collections, burdens and more.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

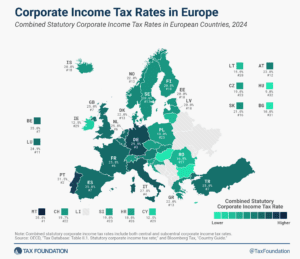

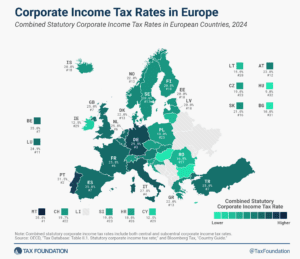

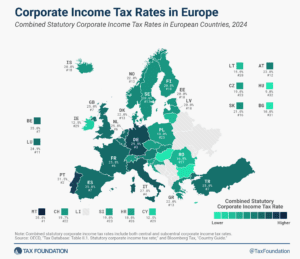

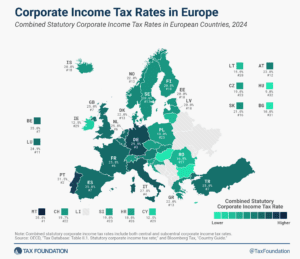

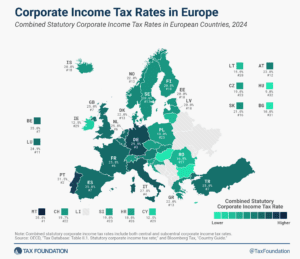

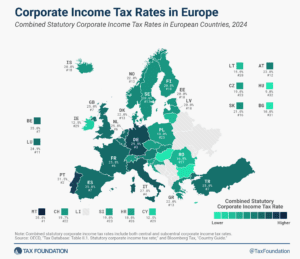

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

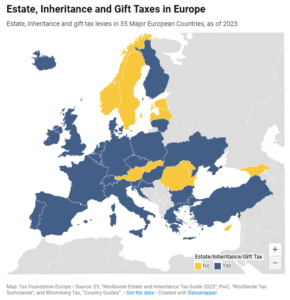

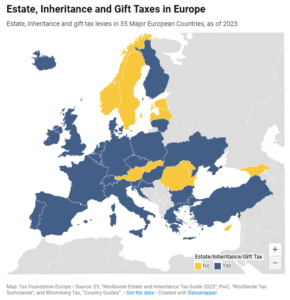

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

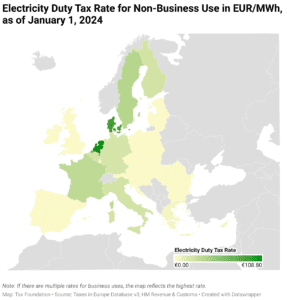

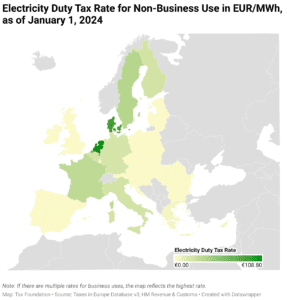

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

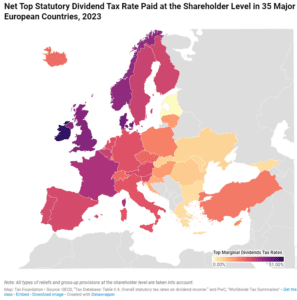

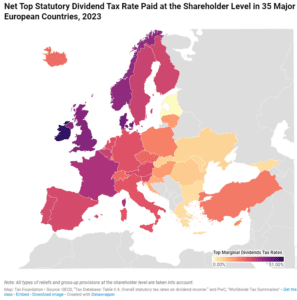

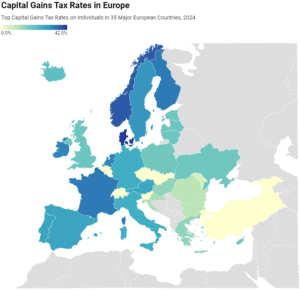

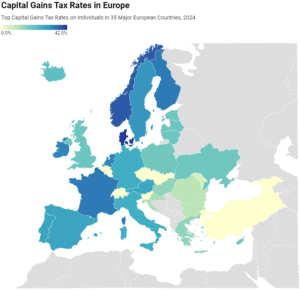

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

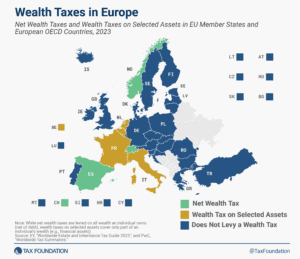

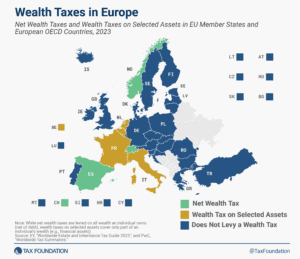

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

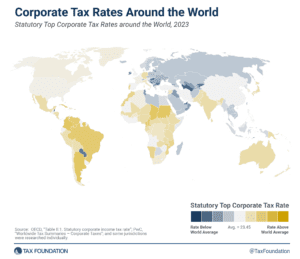

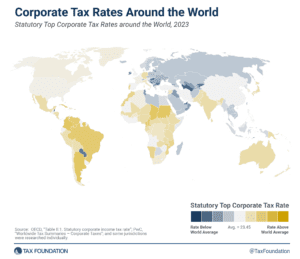

Of the 225 jurisdictions around the world, only six have increased their top corporate income tax rate in 2023, a trend that might be reversed in the coming years as more countries agree to implement the global minimum tax.

16 min read

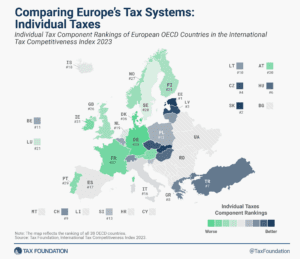

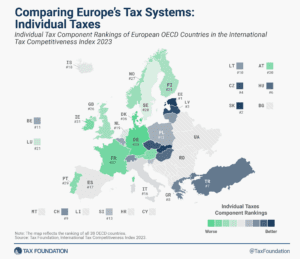

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

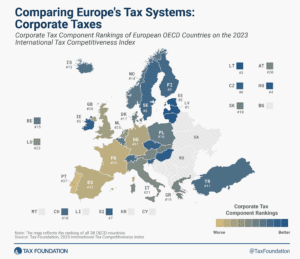

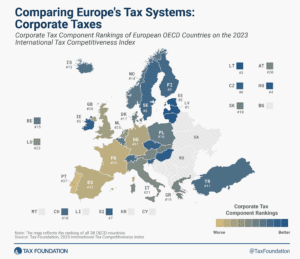

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

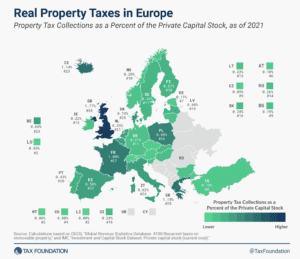

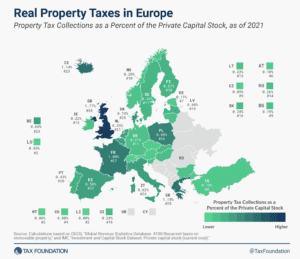

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

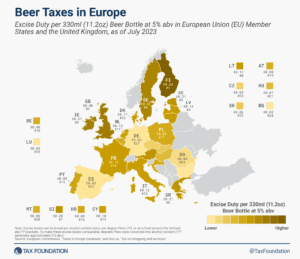

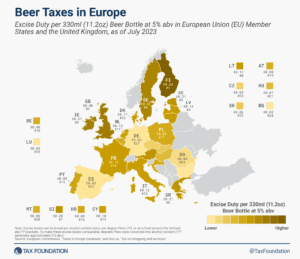

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

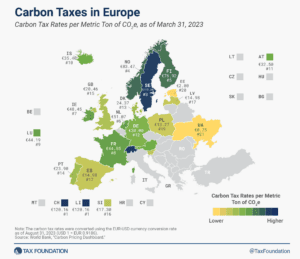

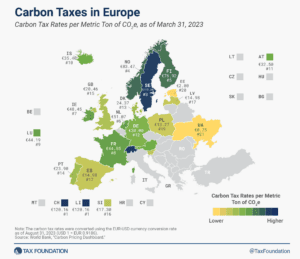

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

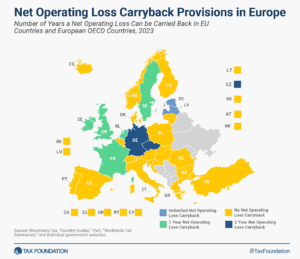

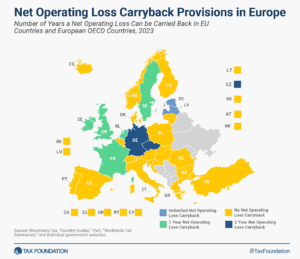

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

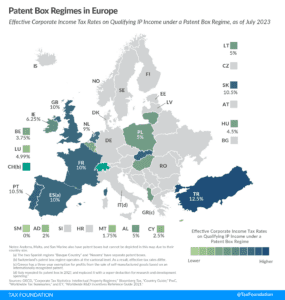

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

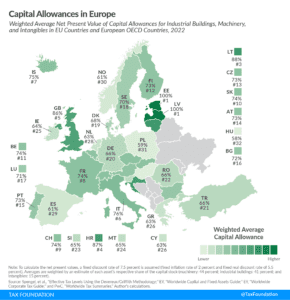

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

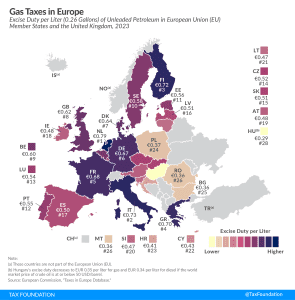

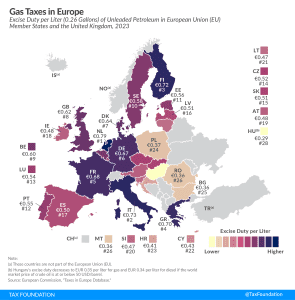

As the EU pursues massive changes in public policy as part of its green transition, expect fuel taxes to be central to any policy discussions.

4 min read

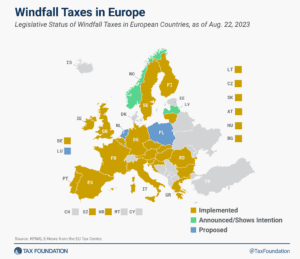

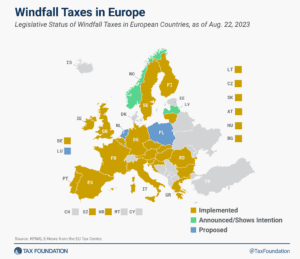

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read