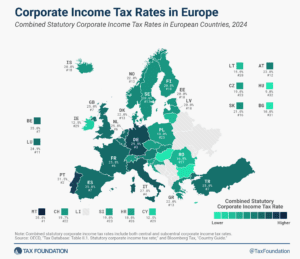

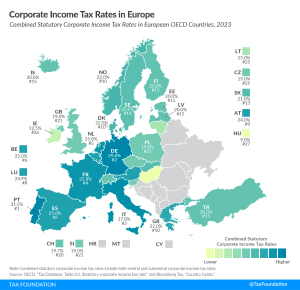

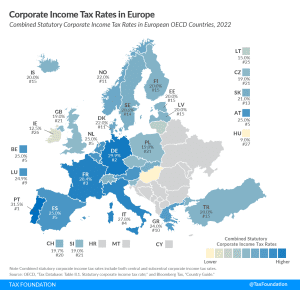

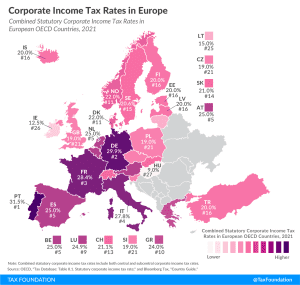

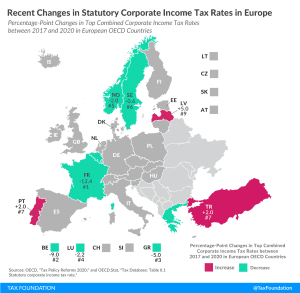

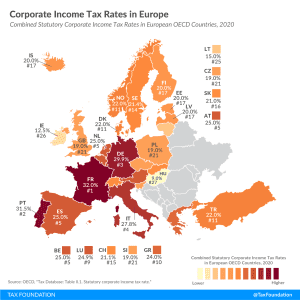

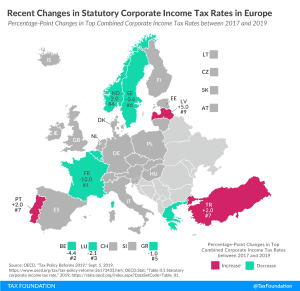

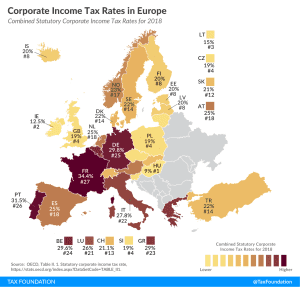

Corporate Income Tax Rates in Europe, 2024

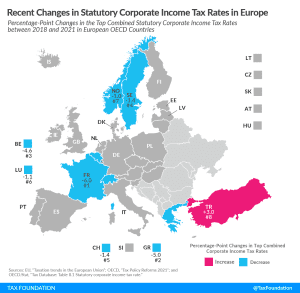

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read