Top Personal Income Tax Rates in Europe, 2024

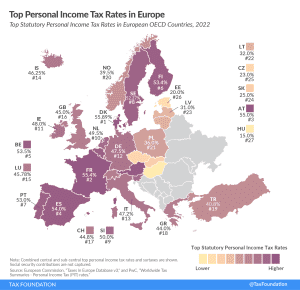

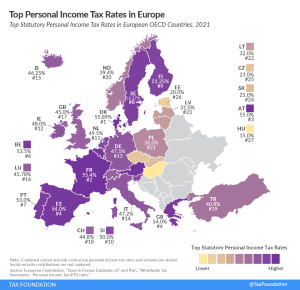

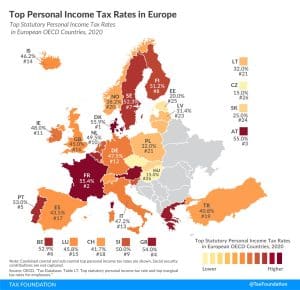

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

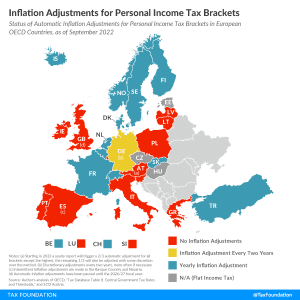

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

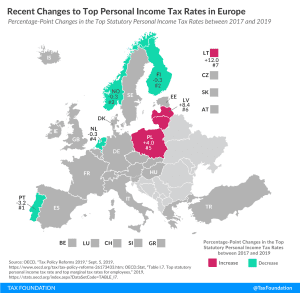

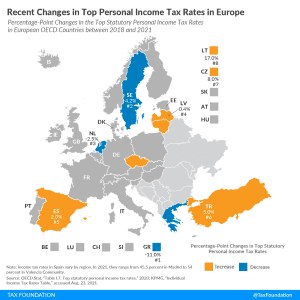

In the past three years, eight European OECD countries changed their top personal income tax rate, of which four of them cut their top personal income tax rates.

3 min read

Most countries’ personal income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across Europe, with Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) having the highest top statutory personal income tax rates among European OECD countries.

3 min read

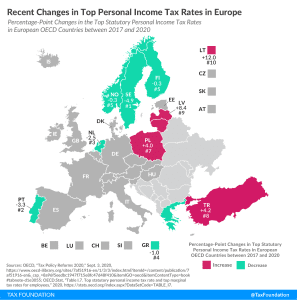

Ten European OECD countries recently changed their top personal income tax rates. Of the ten countries, six cut their top personal income tax rates while the other four raised their top rates.

4 min read