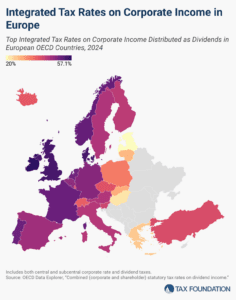

Integrated Tax Rates on Corporate Income in Europe, 2024

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

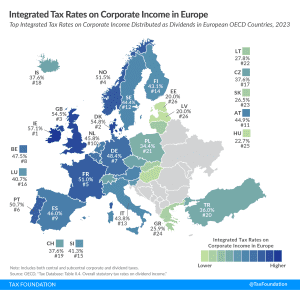

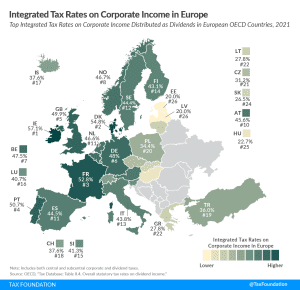

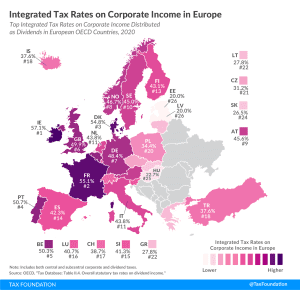

The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains tax—the total tax levied on corporate income. For dividends, Ireland’s top integrated tax rate was highest among European OECD countries, followed by France and Denmark

4 min read