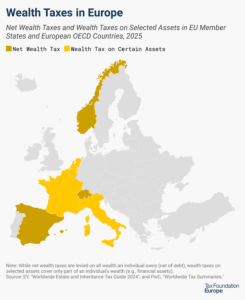

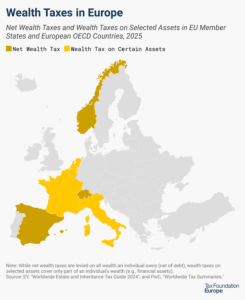

Wealth Taxes in Europe, 2025

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read

Wealth taxes not only collect little revenue and create legal uncertainty, but an OECD report argues that they can also disincentivize entrepreneurship, harming innovation and long-term growth.

5 min read

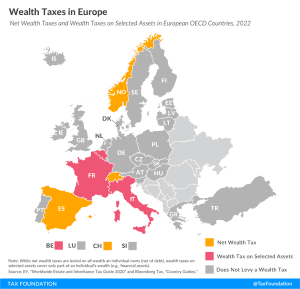

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Instead of reforming and hiking the wealth tax, perhaps policymakers should consider whether the tax is serving its intended objectives, and, if not, consider repealing the tax altogether.

4 min read

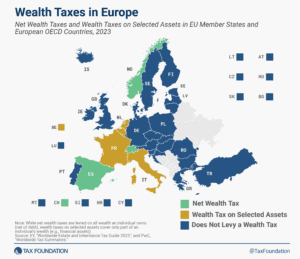

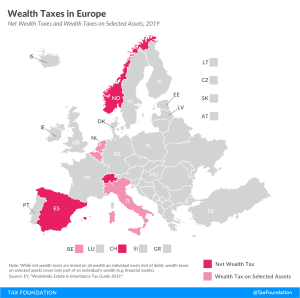

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

Net wealth taxes are recurrent taxes on an individual’s wealth, net of debt. The concept of a net wealth tax is similar to a real property tax. But instead of only taxing real estate, it covers all wealth an individual owns. As today’s map shows, only three European countries covered levy a net wealth tax, namely Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets but not on an individual’s net wealth per se.

3 min read

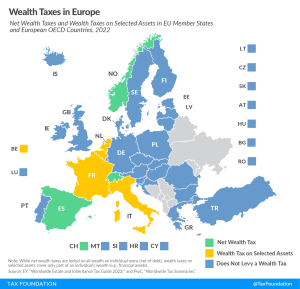

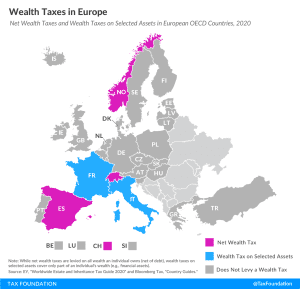

Only three European countries levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

3 min read