Particularly as we head into the summer months, many Americans enjoy a cold beer at the end of a long day. However, beer taxes might dampen the vibe.

In the United States, taxes are the single most expensive ingredient in beer. The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

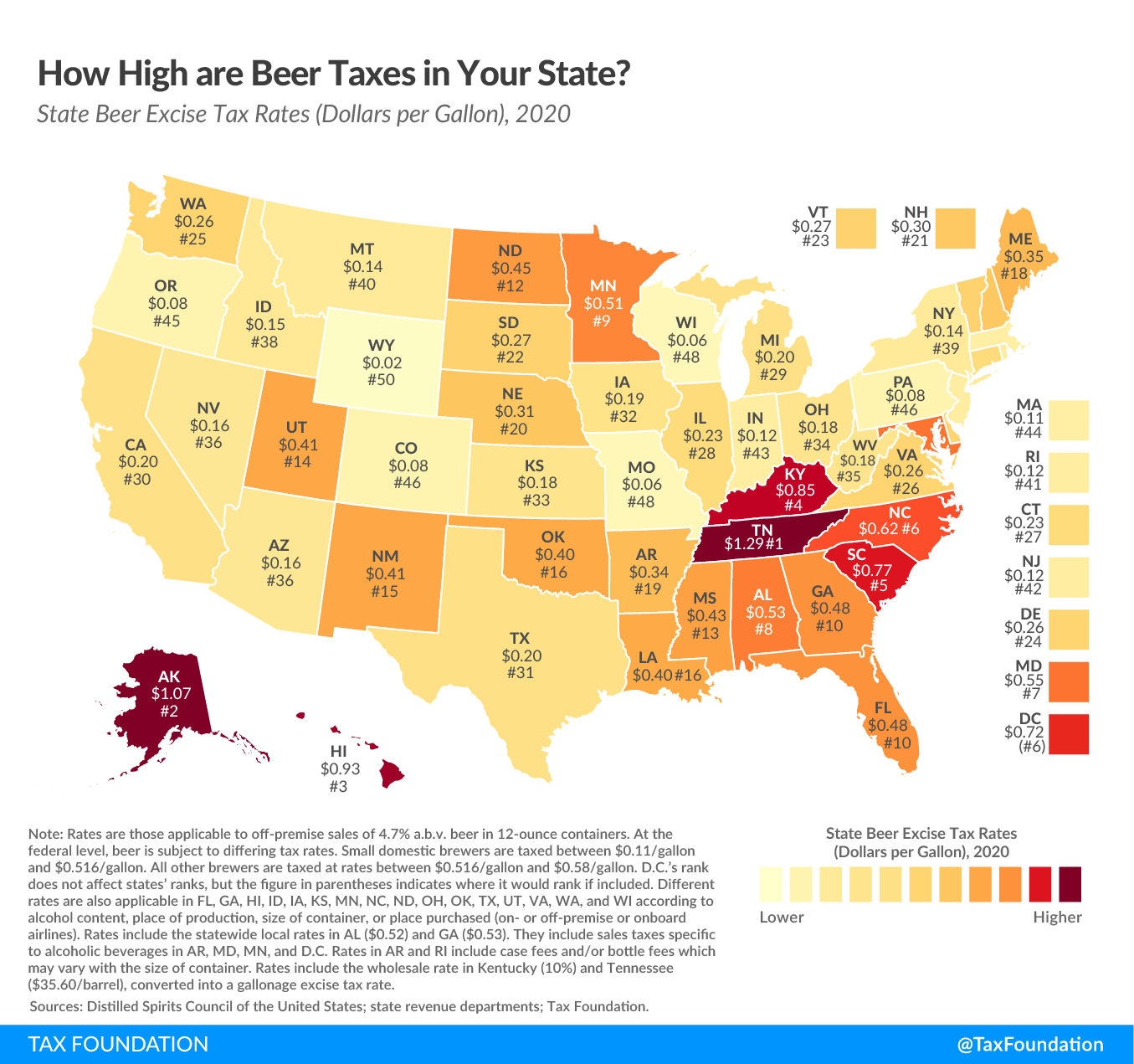

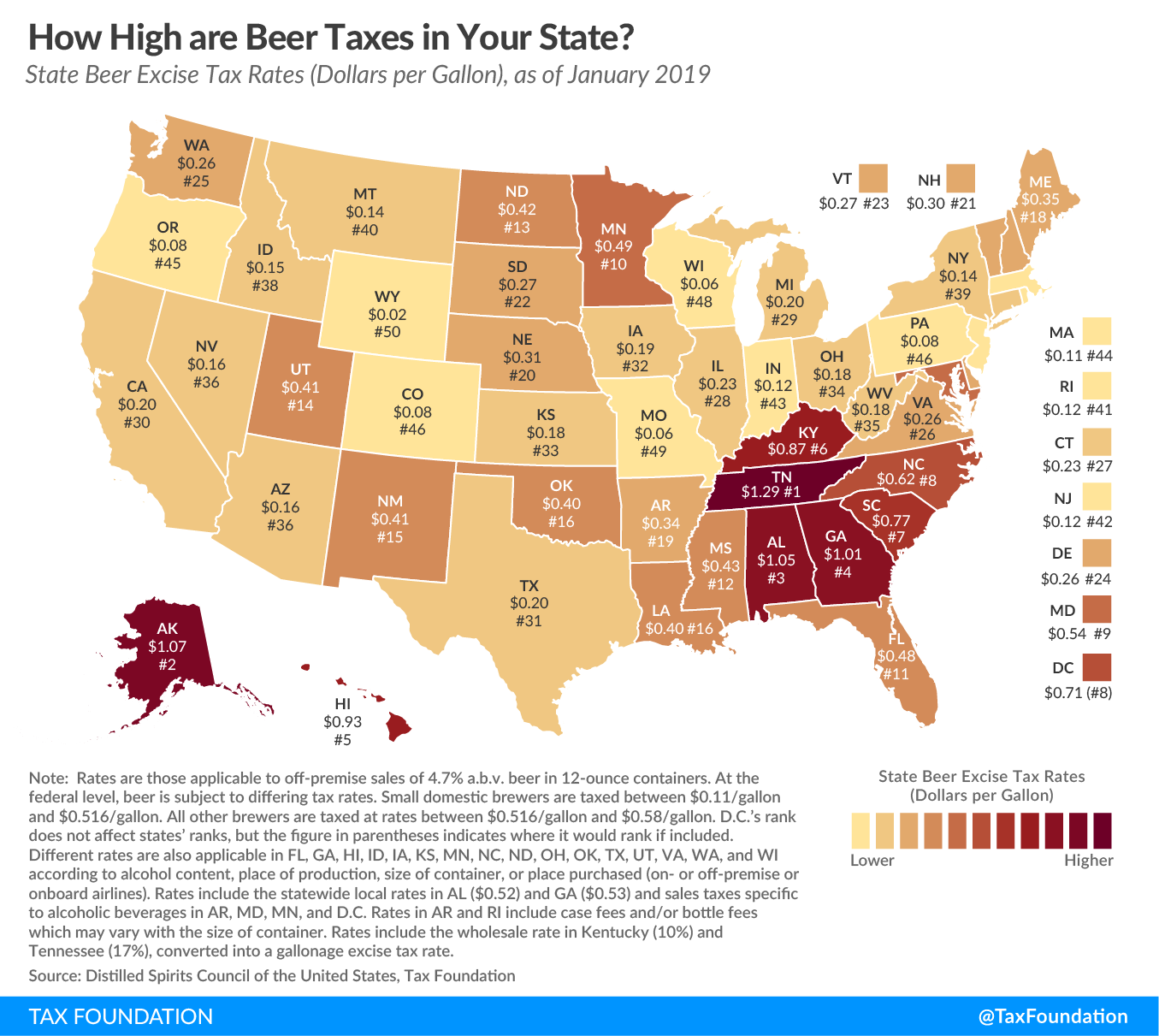

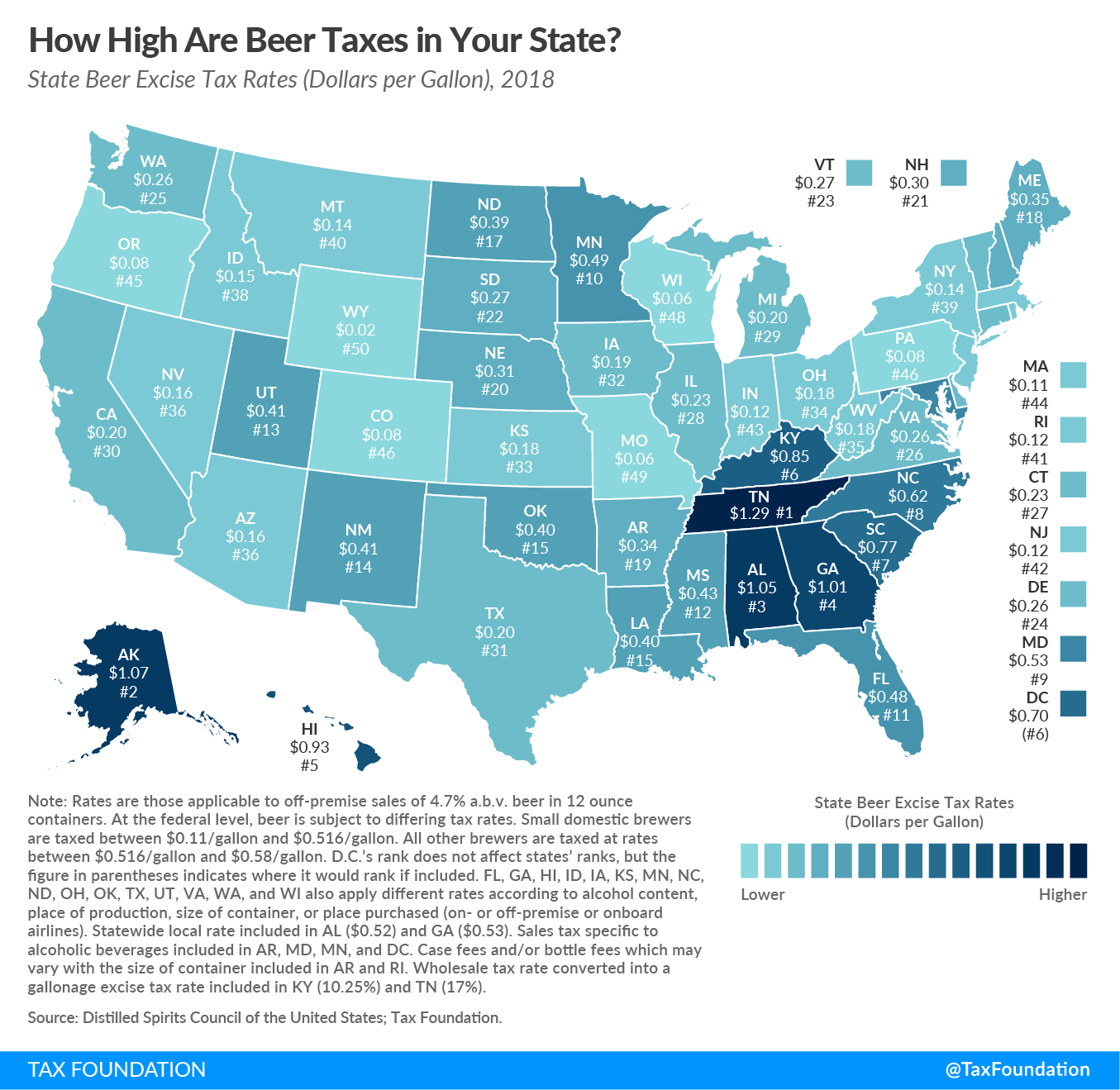

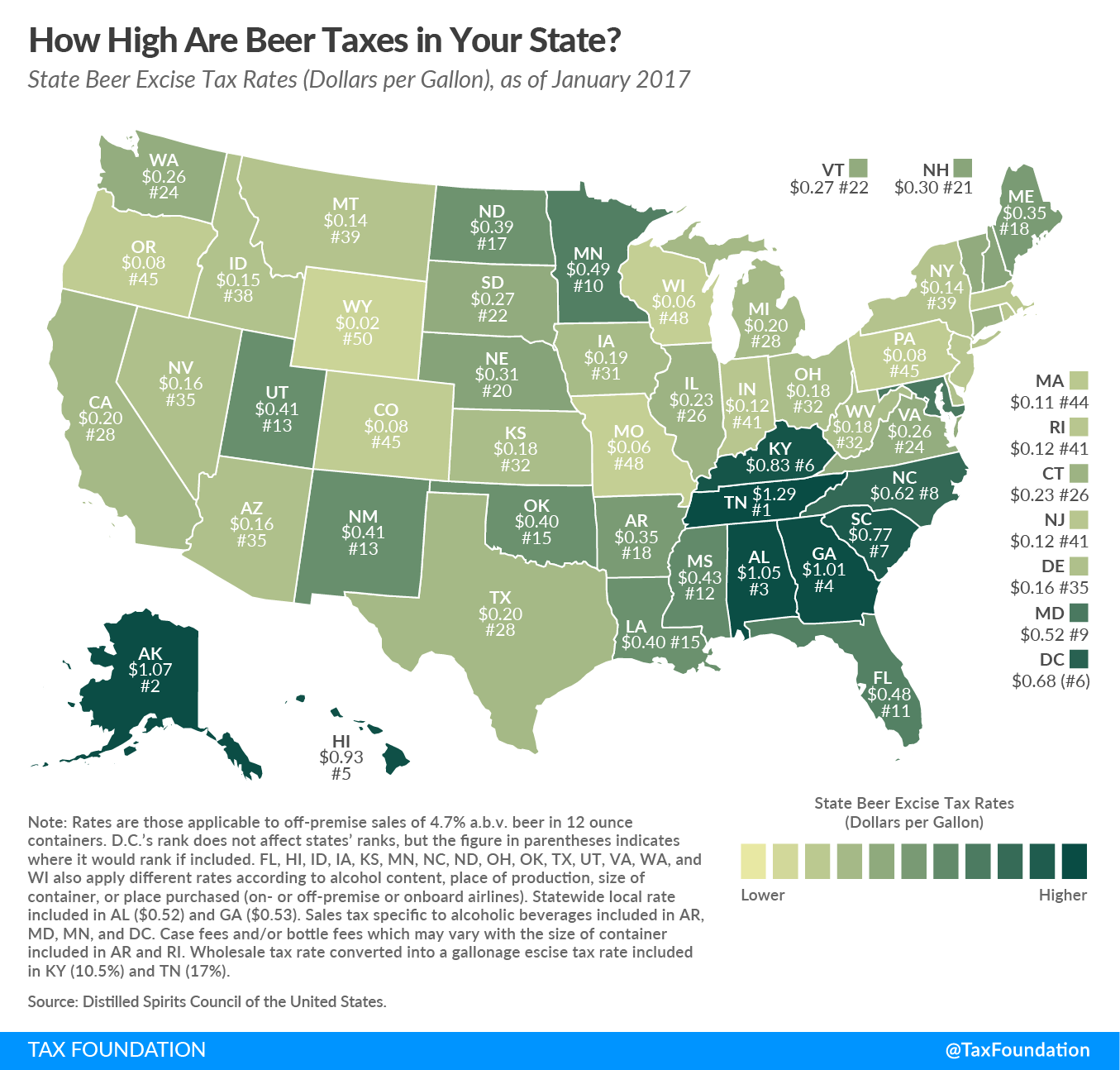

The United States levies a federal excise tax on beer that ranges from $0.113 per gallon for the first 60,000 barrels produced by small domestic brewers to $0.581 per gallon for imports. Each of the 50 states and the District of Columbia also levy their own excise taxes on beer, in addition to any applicable state and local sales taxes.

The total tax burden on beer combines traditional ad quantum excise taxes, retail sales taxes specifically levied on alcohol, case and bottle fees, and ad valorem taxes on producers or wholesalers where applicable.

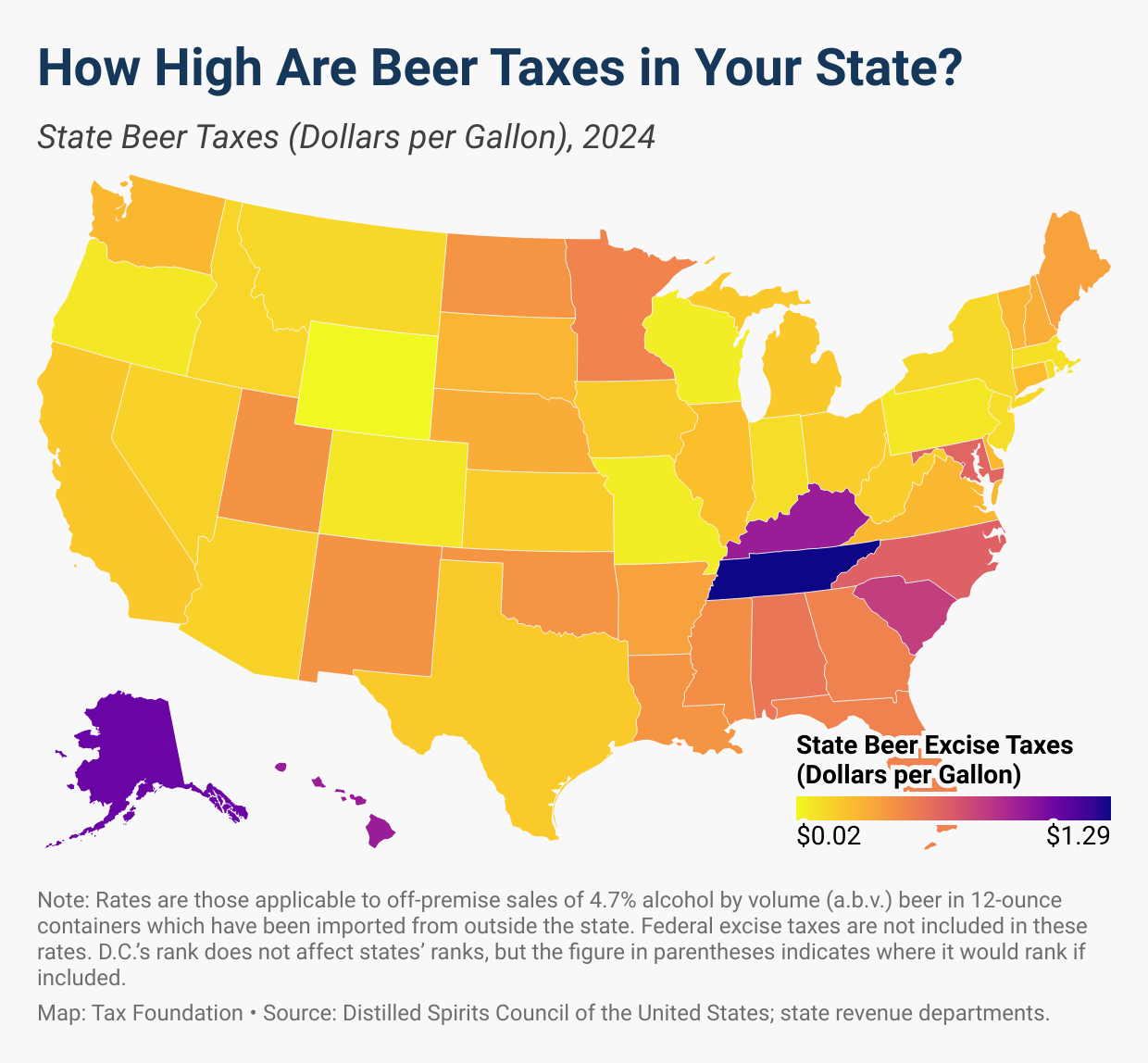

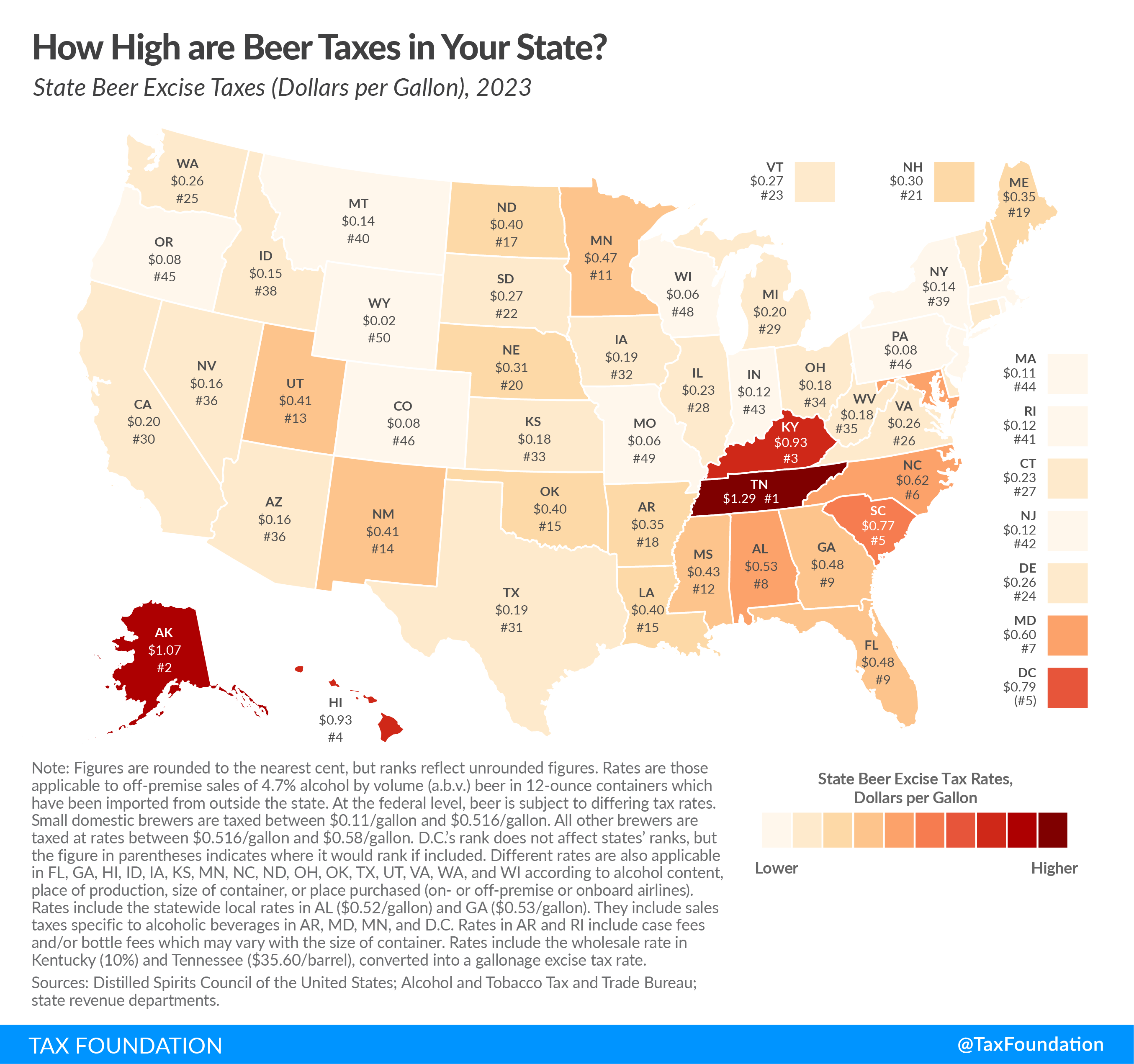

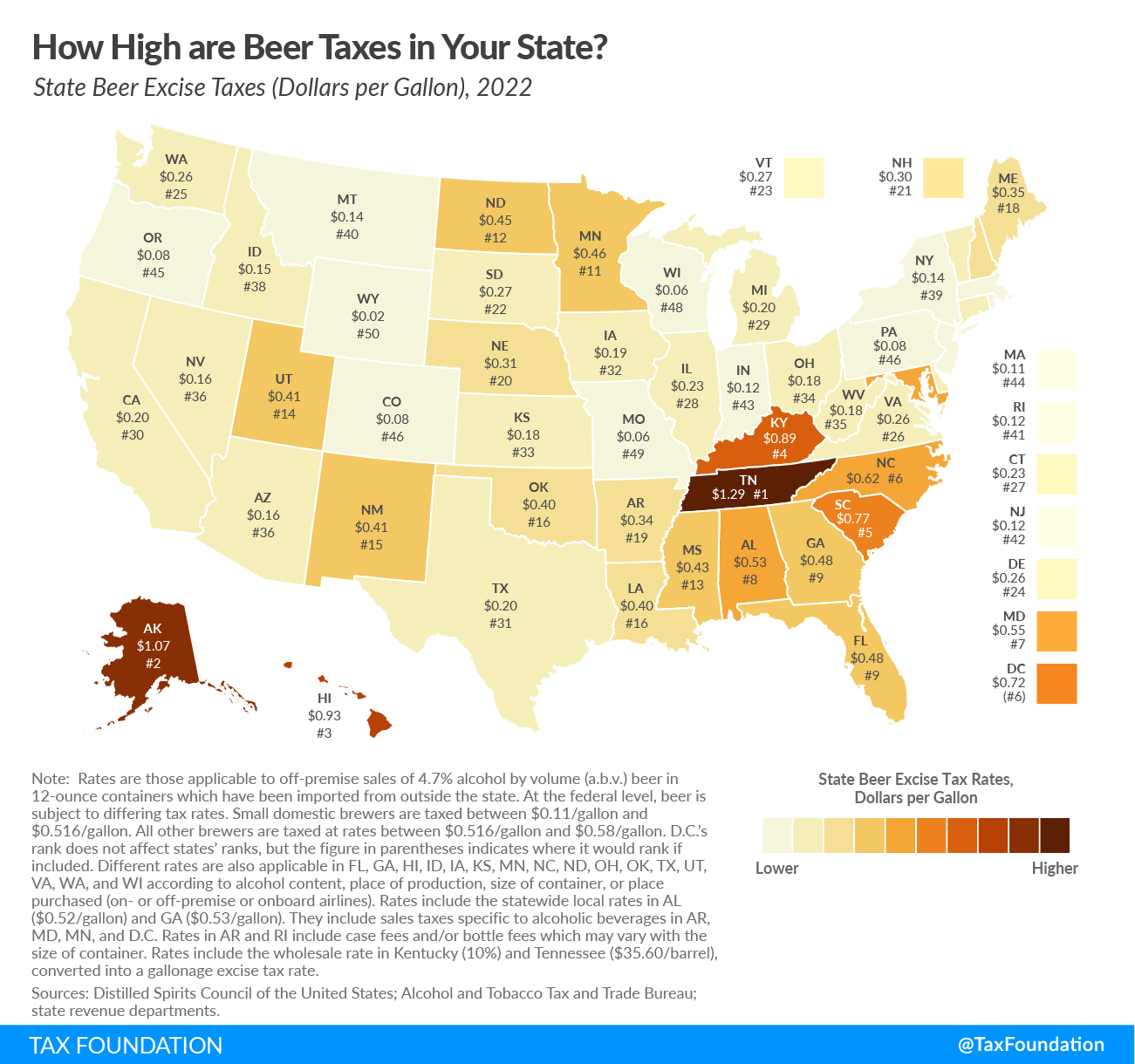

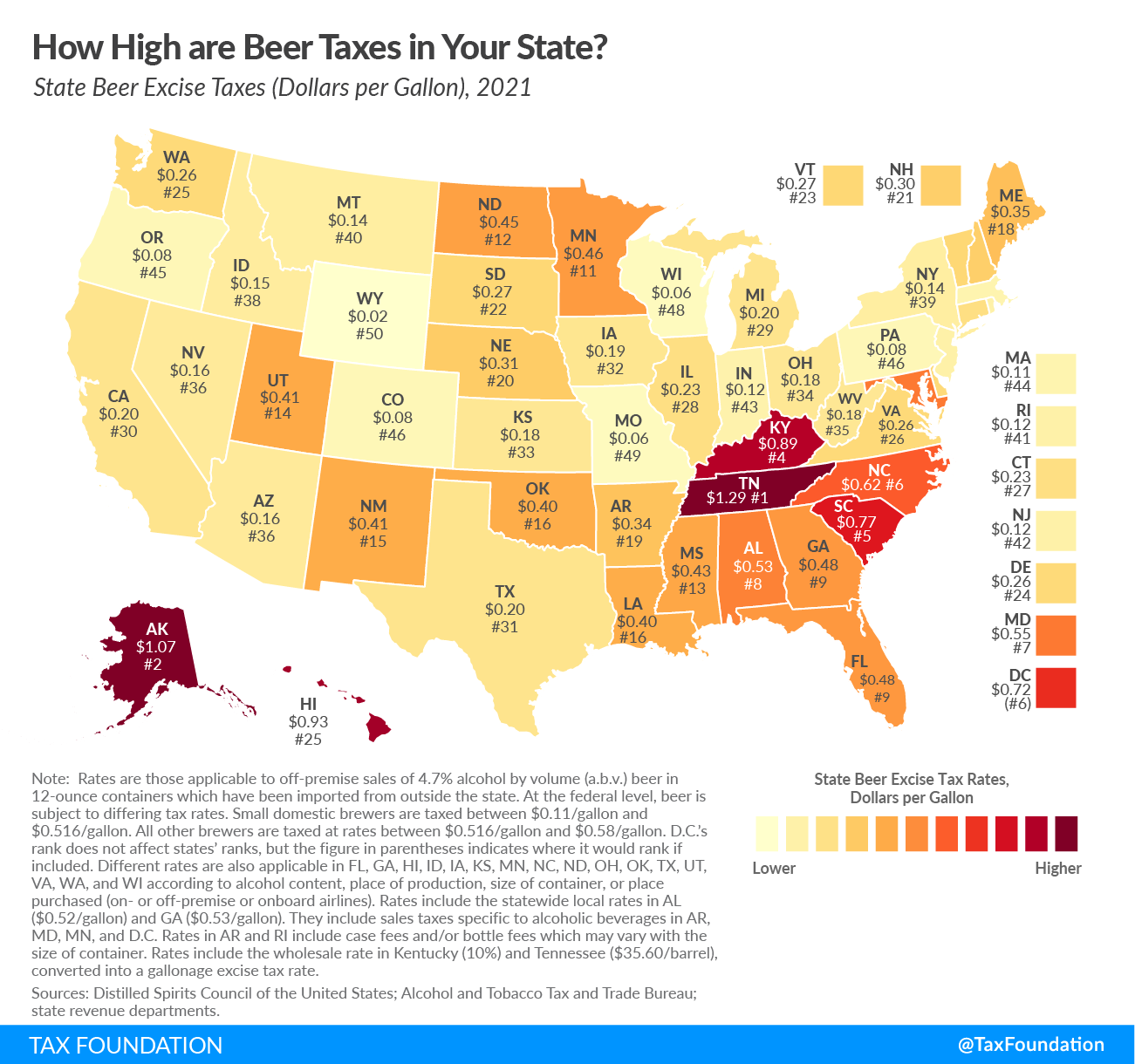

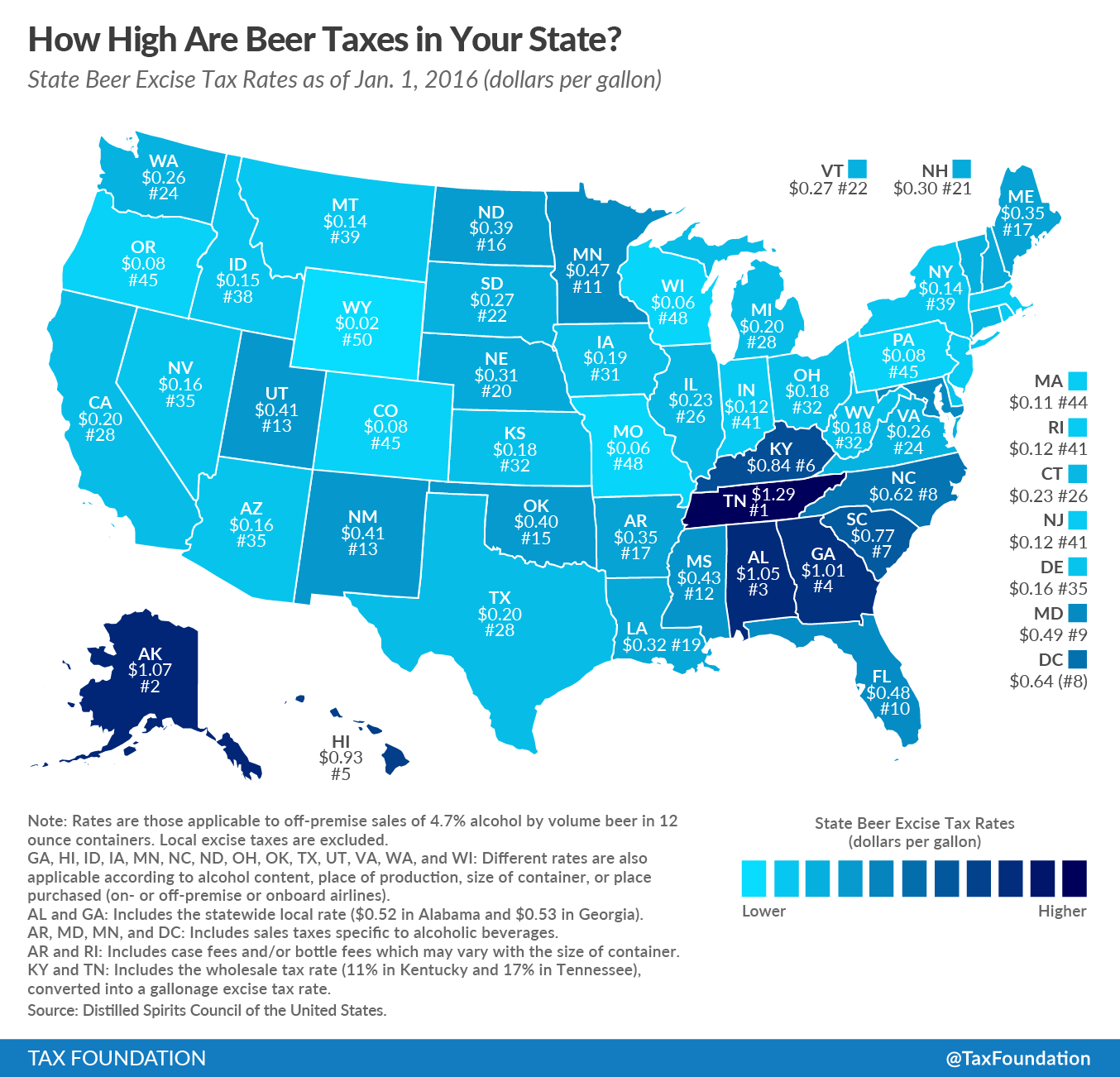

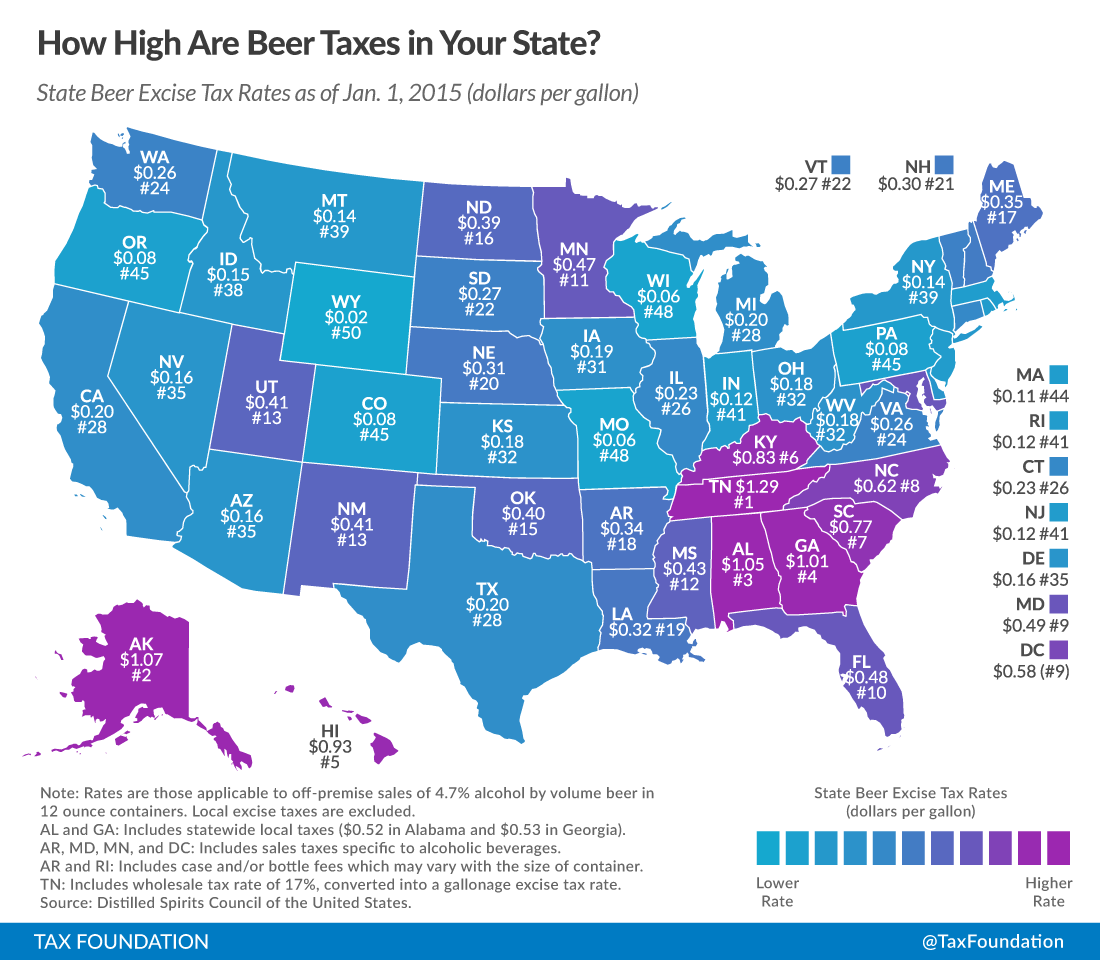

The states that place the highest tax burden on beer are Tennessee at $1.287 per gallon, Alaska at $1.07 per gallon, and Hawaii at $0.93 per gallon. The lowest tax burden is levied in Wyoming at $0.019 per gallon, followed by Missouri at $0.06 per gallon and Wisconsin at $0.065 per gallon.

State Beer Excise Tax Rates

(Dollars per Gallon) As of January 1, 2025

| State | Tax Rate | Rank |

|---|---|---|

| Alabama (a) | $0.533 | 8 |

| Alaska | $1.070 | 2 |

| Arizona | $0.160 | 36 |

| Arkansas (b, c) | $0.382 | 18 |

| California | $0.200 | 29 |

| Colorado | $0.080 | 46 |

| Connecticut | $0.194 | 30 |

| Delaware | $0.263 | 24 |

| Florida (d) | $0.480 | 9 |

| Georgia (a, d) | $0.480 | 9 |

| Hawaii (d) | $0.930 | 3 |

| Idaho (d) | $0.150 | 38 |

| Illinois | $0.231 | 27 |

| Indiana | $0.115 | 43 |

| Iowa (d) | $0.190 | 32 |

| Kansas | $0.180 | 33 |

| Kentucky (e) | $0.891 | 4 |

| Louisiana (d) | $0.403 | 16 |

| Maine | $0.350 | 19 |

| Maryland (b) | $0.600 | 7 |

| Massachusetts | $0.106 | 44 |

| Michigan | $0.203 | 28 |

| Minnesota (b, d) | $0.475 | 11 |

| Mississippi | $0.427 | 14 |

| Missouri | $0.060 | 49 |

| Montana | $0.139 | 40 |

| Nebraska | $0.310 | 20 |

| Nevada | $0.160 | 36 |

| New Hampshire | $0.300 | 21 |

| New Jersey | $0.120 | 42 |

| New Mexico | $0.410 | 15 |

| New York | $0.140 | 39 |

| North Carolina (d) | $0.617 | 6 |

| North Dakota (d) | $0.430 | 13 |

| Ohio (d) | $0.179 | 34 |

| Oklahoma (d) | $0.403 | 16 |

| Oregon | $0.084 | 45 |

| Pennsylvania | $0.080 | 46 |

| Rhode Island (c) | $0.124 | 41 |

| South Carolina | $0.768 | 5 |

| South Dakota | $0.274 | 22 |

| Tennessee (e) | $1.287 | 1 |

| Texas (d) | $0.194 | 31 |

| Utah (d) | $0.431 | 12 |

| Vermont | $0.265 | 23 |

| Virginia (d) | $0.256 | 26 |

| Washington (d) | $0.261 | 25 |

| West Virginia | $0.177 | 35 |

| Wisconsin (d) | $0.065 | 48 |

| Wyoming | $0.019 | 50 |

| District of Columbia (b) | $0.790 | (5) |

(b) Includes sales taxes specific to alcoholic beverages.

(c) Includes case fees and/or bottle fees which may vary with the size of container.

(d) Different rates also applicable according to alcohol content, place of production, size of container, or place purchased (on- or off-premise or onboard airlines).

(e) Includes the wholesale tax rate in Kentucky (10%) and Tennessee ($35.60 per barrel), converted into a gallonage excise tax rate.

Note: Rates are those applicable to off-premise sales of 4.7% alcohol by volume (a.b.v.) beer in 12-ounce containers which have been imported from outside the state. At the federal level, beer is subject to differing tax rates. Small domestic brewers are taxed between $0.11/gallon and $0.516/gallon. All other brewers are taxed at rates between $0.516/gallon and $0.58/gallon. D.C.’s rank does not affect states’ ranks, but the figure in parentheses indicates where it would rank if included.

Data compiled by Jacob Macumber-Rosin, Adam Hoffer

2025 Notable Changes

- Connecticut reduced the tax rate on beer from $0.24 per gallon to $0.19 per gallon.

- Kentucky reduced the tax rate on beer from $0.93 per gallon to $0.89 per gallon.

- Arkansas increased the tax rate on beer from $0.35 per gallon to $0.38 per gallon.

- North Dakota increased the tax rate on beer from $0.40 per gallon to $0.43 per gallon.

- Utah increased the tax rate on beer from $0.41 per gallon to $0.43 per gallon.

The per gallon rate shown reflects the tax applicable on an off-premises sale of a 4.7 percent alcohol by volume (ABV) beer in a 12-ounce container. In 16 states, the tax rate varies based on alcohol content, place of production, size of container, or place of purchase.

For instance, Virginia has a different tax per bottle for containers up to 7 ounces, up to 12 ounces, and greater than 12 ounces. Idaho levies triple the tax if the beer is over 5 percent ABV, which statutorily is taxed the same as wine at $0.45 per gallon rather than $0.15 per gallon.

Many states also generate revenue via licensing fees and permits from beer distributors and retailers. Other states manipulate the price of beer—and thus the minimum amount of ad valorem tax collected—by establishing statewide minimum price levels.

Federal and state taxes on beer are often levied on the manufacturer, wholesaler, or retailer, which are not explicitly broken out into a separate line item on a bill or receipt like a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . Instead, the tax burden is baked into the final retail price. Thus, consumers may not be cognizant of just how much they are paying in taxes on their drink of choice.

Beer exists within a complex taxation and regulatory landscape. Alcohol is generally taxed using a categorical system that treats beer, wine, and spirits differently even after adjusting for alcohol content. Modernizing the arcane categorical system by instead taxing according to actual alcohol content would make the broader alcohol tax system simpler and more neutral. Understanding the tax framework is crucial for both consumers and policymakers as the industry and the policy evolve for one of America’s most cherished beverages.