Key Findings

- The value-added taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. (VAT) is a major source of revenue for EU countries and is one of the EU’s own resources. For Member States, it represents on average 17.8 percent of their total tax revenue. For the EU, VAT revenue represented roughly 7.5 percent of its total revenue in 2021.

- While the European Commission focuses on improving VAT compliance, policy is a major contributor to VAT revenue losses. The VAT Actionable Policy Gap—the additional VAT revenue that could realistically be collected by eliminating reduced rates and certain exemptions—is just above EUR 310 billion, more than triple the Compliance Gap—the additional VAT revenue that could be collected if all taxpayers, consumers, and businesses fully complied with the VAT rules.

- The largest Actionable Policy Gaps in the EU are in France (EUR 72 billion), Germany (EUR 68 billion), Italy (EUR 66 billion), and Spain (EUR 49 billion).

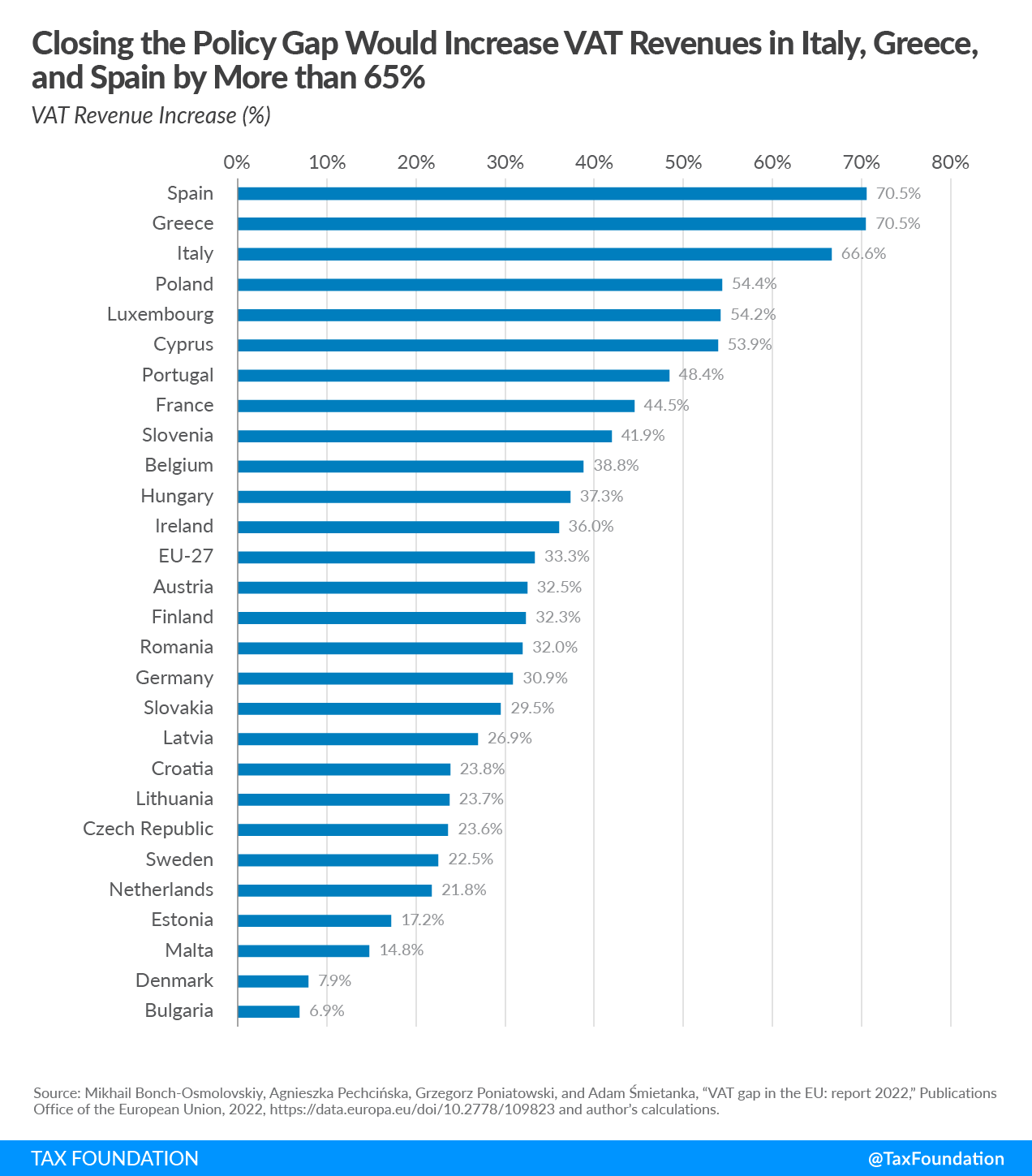

- Closing the Actionable Policy Gap would increase Spain’s and Greece’s VAT revenues by 70.5 percent and Italy’s by 66.6 percent.

- It would also provide enough revenue for Cyprus, Croatia, France, Greece, and Ireland to eliminate their income taxes altogether or reduce the EU’s VAT average standard rate from 22 percent to 15 percent.

- Closing the VAT Policy Gap would give governments the opportunity to simplify consumption and income taxes while supporting long-term growth.

Introduction

The value-added tax (VAT) is a major source of revenue for European Union (EU) countries. On average, in 2021, EU countries raised 17.8 percent of their total tax revenue from the VAT. In Croatia, almost 36.6 percent of the tax revenue comes from the VAT, compared to 15.6 percent in Italy and 15.1 percent in Belgium.[1] The VAT is also one of the EU’s “own resources,”[2] representing roughly 7.5 percent of the EU’s revenue in 2021.[3]

Given the importance of VAT revenue for EU countries and the EU as a whole, the VAT system’s revenue-raising efficiency is an important aspect that policymakers should consider. This report shows how improving a country’s VAT system efficiency would increase tax revenues by one-third, on average. More efficient VAT rules would raise enough revenue to enable countries like Cyprus, Croatia, France, Greece, and Ireland to eliminate their income taxes altogether. Alternatively, eliminating reduced VAT rates would enable the average standard VAT rate in the EU to drop from 22 percent to 15 percent. A more efficient VAT system could play an important role in addressing slow economic growth and budgetary deficits.[4] This is critical as the EU and its Member States will need additional resources to reimburse the large amounts of public debt accumulated over the last three years.[5]

Different Gaps in the EU VAT System

EU countries differ significantly in how efficiently they raise VAT revenue. One way to measure the efficiency of a country’s VAT system is by analyzing the difference between revenue that should be collected under an ideal VAT system and the amount that gets collected.

Empirical studies have found that the institutional factors driving the gap between ideal and actual revenues are high standard VAT rates and multiple VAT rates.[6] Complexity itself contributes to the VAT system’s revenue-raising capacity (or lack thereof). Additionally, tax rate increases have a strong base-eroding effect.[7] Other EU studies also found that tax compliance is associated with the quality of the judicial and legal systems.[8]

In practice, there are two types of gaps in a VAT system: the Compliance Gap and the Policy Gap.

The Compliance Gap

The Compliance Gap (commonly called the “VAT Gap”) is defined as the difference between the tax collected and the tax that should be collected if all taxpayers, consumers, and businesses fully complied with the VAT rules.[9] The VAT Gap includes not only VAT avoidance or gaps in enforcement but also unpaid VAT due to bankruptcies, insolvencies, or legal tax optimization. It is calculated as the difference between the VAT collected and the theoretical tax liability according to tax law, the VAT total tax liability (VTTL). The indicator is then expressed in relative terms as a percentage of VTTL.

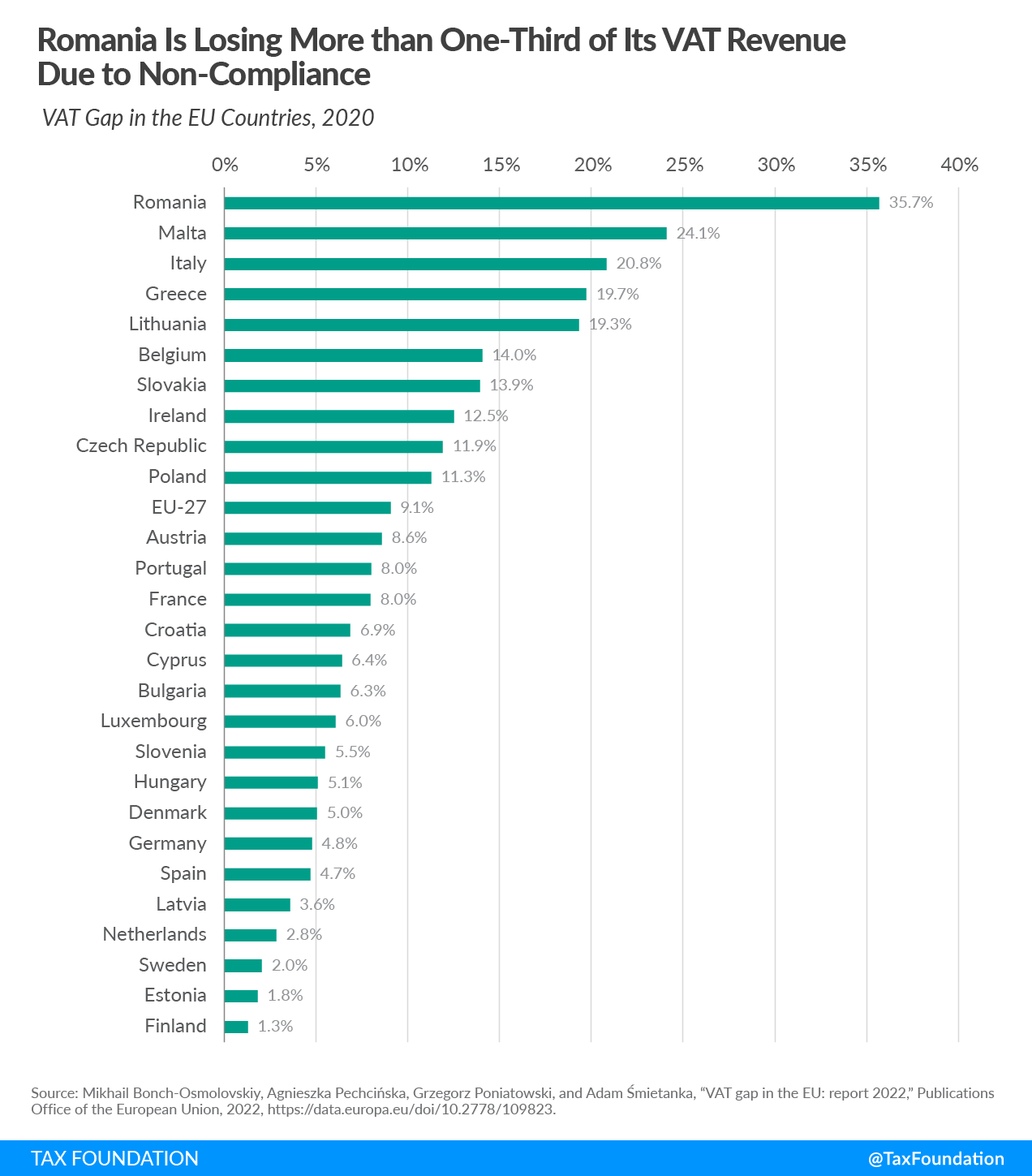

Although the VAT Gap remains relatively high at the EU level—over EUR 92.7 billion—it has declined from 20 percent in 2009 to 9.1 percent in 2020. The smallest VAT gaps among Member States are in Finland (1.3 percent), Estonia (1.8 percent), Sweden (2 percent), and the Netherlands (2.8 percent). The EU countries with the greatest percentage of forgone VAT revenue are Romania (35.7 percent), Malta (24.1 percent), Italy (20.8 percent), Greece (19.7 percent), and Lithuania (19.3 percent).

The Policy Gap

The Policy Gap is defined as the additional VAT revenue that could theoretically be collected if lawmakers decided to apply a uniform VAT rate on the final domestic use of all goods and services. It is made up of two components: the rate gap and the exemption gap.

The average Policy Gap in the EU was 45.75 percent in 2020 (Table 1). This means that under full compliance, the VAT only generates 54.25 percent of what could have been collected if reduced rates and exemptions were abolished and all final goods and services were taxed.

While the European Commission has focused its efforts on closing the Compliance Gap by improving taxpayer compliance and reducing tax fraud, the Policy Gap has been left untouched despite its greater magnitude.[10] The Commission’s lack of attention is likely due to the fact that national governments are responsible for designing exemptions and reduced rates within the parameters set by the EU VAT directive.[11]

All EU countries except Denmark apply reduced VAT rates not only to goods and services considered necessities like food and water, but also to medicine, health care, education, and housing. EU countries have a common framework that allows them to apply two reduced rates not lower than 5 percent to several goods and services and one super reduced rate below 5 percent.[12] However, only France, Ireland, Italy, Luxembourg, and Spain are currently applying reduced rates below 5 percent.[13]

Additionally, all EU countries make extensive use of exemptions.[14] Public services or activities that serve a social interest like education, health care, postal services, and charities are generally exempted from the VAT. Other VAT exemptions include financial or insurance services whose tax bases are difficult to determine, but these activities are normally subject to other specific taxes.

Such reduced rates and exemptions can lead to higher administrative and compliance costs. For EU companies, a 2018 study found that the total VAT compliance cost ranges from 1 percent to 4 percent of the company’s turnover.[15] For Swedish companies, another study evaluating the compliance costs of the VAT found that the additional cost of handling multiple VAT rates amounts to SEK 500 million (EUR 45 million).[16] Finally, the latest empirical evidence shows a correlation between the number of reduced VAT rates and compliance costs for individual companies.[17]

| Country | Policy Gap (%) | Rate Gap (%) | Exemption Gap (%) | Imputed Rents (%) | Public Services (%) | Financial Services (%) | Actionable Exemption Gap (3-4-5-6) (%) | Actionable Policy Gap (2+7) (%) |

|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Austria | 46.61 | 15.27 | 31.34 | 7.9 | 20.26 | 2.6 | 0.58 | 15.85 |

| Belgium | 53.11 | 11.89 | 41.22 | 7.45 | 26.41 | 3.61 | 3.75 | 15.64 |

| Bulgaria | 32.2 | 2.64 | 29.56 | 9.49 | 16.84 | 1.47 | 1.75 | 4.39 |

| Croatia | 37.97 | 10.42 | 27.55 | 7.2 | 14.98 | 2.04 | 3.33 | 13.76 |

| Cyprus | 48.5 | 14.72 | 33.78 | 7.15 | 20.95 | -5.58 | 11.25 | 25.97 |

| Czech Republic | 41.9 | 6.03 | 35.87 | 9.11 | 18.68 | 2.02 | 6.05 | 12.09 |

| Denmark | 40.67 | 0.72 | 39.94 | 7.47 | 24.22 | 4.54 | 3.72 | 4.44 |

| Estonia | 36.33 | 2.42 | 33.91 | 6.81 | 16.33 | 2.42 | 8.35 | 10.77 |

| Finland | 51.22 | 9.45 | 41.77 | 10.37 | 22.45 | 2.84 | 6.12 | 15.57 |

| France | 54.02 | 12.87 | 41.15 | 9.58 | 22.81 | 2.81 | 5.95 | 18.82 |

| Germany | 46.93 | 8.62 | 38.31 | 6.88 | 22.1 | 2.34 | 6.99 | 15.61 |

| Greece | 56.3 | 14.34 | 41.96 | 9.64 | 19.56 | 2.37 | 10.39 | 24.73 |

| Hungary | 48.45 | 8.28 | 40.16 | 9.37 | 17.87 | 2.95 | 9.97 | 18.26 |

| Ireland | 51.94 | 14.67 | 37.27 | 12.33 | 23.84 | 0.63 | 0.47 | 15.14 |

| Italy | 55.7 | 14.45 | 41.25 | 11.43 | 19.67 | 1.23 | 8.92 | 23.37 |

| Latvia | 43.8 | 3.04 | 40.76 | 10.27 | 17.05 | 1.89 | 11.56 | 14.59 |

| Lithuania | 34.91 | 3.43 | 31.47 | 4.38 | 16.32 | 1.74 | 9.03 | 12.46 |

| Luxembourg | 38.05 | 14.12 | 23.93 | 7.81 | -2.52 | 1.22 | 17.42 | 31.54 |

| Malta* | 30.91 | 14.98 | 15.93 | 6.17 | 16.19 | 0.81 | -7.24 | 7.73 |

| Netherlands | 49.16 | 8.51 | 40.65 | 7.37 | 25.91 | 5.13 | 2.24 | 10.75 |

| Poland | 47.62 | 14.45 | 33.17 | 3.49 | 15.95 | 2.92 | 10.81 | 25.26 |

| Portugal | 53.01 | 14.31 | 38.7 | 8.66 | 20.53 | 2.9 | 6.61 | 20.93 |

| Romania | 34.51 | 12.42 | 22.09 | 7.9 | 13.23 | -0.09 | 1.04 | 13.46 |

| Slovakia | 44.92 | 2.91 | 42.01 | 10.56 | 18.39 | 1.97 | 11.09 | 14 |

| Slovenia | 49.85 | 11.07 | 38.78 | 7.85 | 19.62 | 2.5 | 8.81 | 19.88 |

| Spain | 60.3 | 13.44 | 46.86 | 9.81 | 21.34 | 2.44 | 13.26 | 26.7 |

| Sweden | 46.25 | 7.84 | 38.41 | 4.88 | 26.97 | 2.54 | 4.01 | 11.85 |

| EU-27 | 45.75 | 9.9 | 35.84 | 8.2 | 19.11 | 2.01 | 6.53 | 16.43 |

|

Note: * Although the Exemption Gap could become negative in periods when input VAT exceeds potential output VAT, like periods of increased investment or when losses are incurred, the negative value might be due to a measurement error that results from difficulties to decompose the components of the base, such as sectorial Gross Fixed Capital Formation and net adjustments, and inaccuracies in the underlying data and parameters. Source: Mikhail Bonch-Osmolovskiy, Agnieszka Pechcińska, Grzegorz Poniatowski, and Adam Śmietanka, “VAT gap in the EU: report 2022,” Publications Office of the European Union, 2022, https://data.europa.eu/doi/10.2778/109823. |

||||||||

The Rate Gap

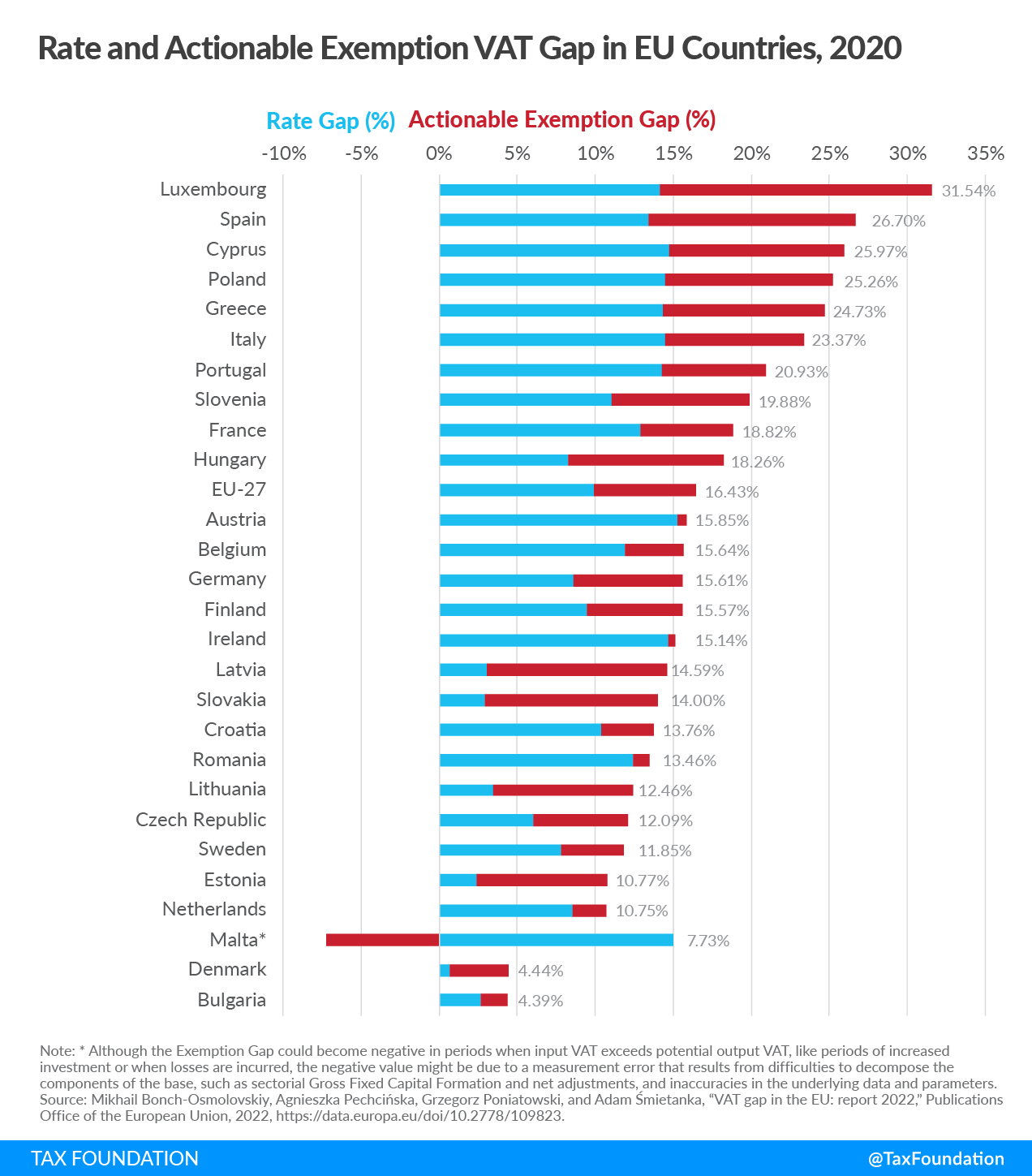

The Rate Gap represents the loss in VAT revenue due to reduced VAT rates. Therefore, it is smaller in countries that rely on reduced rates less, such as Denmark (0.72 percent), Estonia (2.42 percent), Bulgaria (2.64 percent), Slovakia (2.91 percent), and Latvia (3.04 percent). On the other hand, the Rate Gap in Austria (15.27 percent), Malta (14.98 percent), Cyprus (14.72 percent), Ireland (14.67 percent), Poland and Italy (both at 14.45 percent), Greece (14.34 percent), Portugal (14.31 percent) and Luxembourg (14.12 percent) show significant revenue forgone because of reduced rates.

The Actionable Exemption Gap

The Exemption Gap represents the loss in VAT revenue due to certain goods and services being exempt from VAT. There are some services—namely, imputed rents, the provision of public goods, and financial services—that are VAT-exempt because it would be difficult to levy a VAT on them. Subtracting the amount of lost VAT revenue caused by these services from the Exemption Gap leaves us with the Actionable Exemption Gap.

The highest Actionable Exemption Gaps are observed in Luxembourg (17.42 percent), Spain (13.26 percent), Latvia (11.56 percent), Cyprus (11.25 percent), Slovakia (11.09 percent), Poland (10.81 percent), and Greece (10.39 percent). Spain’s Exemption Gap is due to the application of different indirect taxes in the Canary Islands, Ceuta, and Melilla.

VAT Actionable Policy Gap

The Actionable Policy Gap (which equals the Actionable Exemption Gap plus the Rate Gap) is the amount of additional VAT revenue lawmakers could realistically raise by eliminating reduced rates and certain exemptions.

The average Actionable Policy Gap for the EU in 2020 was 16.43 percent—of which 9.9 percent was due to reduced rates (Rate Gap) and 6.53 percent to the actionable portion of the Exemption Gap. The highest Actionable Policy Gaps are observed in Luxembourg (31.54 percent), Spain (26.7 percent), Cyprus (25.97 percent), Poland (25.26), Greece (24.73 percent), Italy (23.37 percent), and Portugal (20.93 percent). The Actionable Policy Gap is smaller in Bulgaria (4.39 percent) and Denmark (4.44 percent).

In terms of foregone revenue, the largest Actionable Policy Gaps are in France (EUR 72 billion), Germany (EUR 68 billion), Italy (EUR 66 billion), and Spain (EUR 49 billion).

Overall, the EU’s Policy Gap is over EUR 864 billion (Table 2) which is nine times larger than the Compliance Gap (EUR 93 billion). The Actionable Policy Gap is just above EUR 310 billion—more than triple the Compliance Gap amount.

| Country | Policy GAP (million EUR) | Rate Gap (million EUR) | Actionable Exemption Gap (million EUR) | Total Actionable Policy Gap (million EUR) |

|---|---|---|---|---|

| 1 | 2 | 3 | 4 | |

| Austria | 27,101.73 | 8,878.86 | 337.25 | 9,216.10 |

| Belgium | 38,584.67 | 8,638.14 | 2,724.39 | 11,362.53 |

| Bulgaria | 2,856.32 | 234.18 | 155.23 | 389.42 |

| Croatia | 4,152.92 | 1,139.68 | 364.21 | 1,503.89 |

| Cyprus | 1,796.75 | 545.32 | 416.77 | 962.09 |

| Czech Republic | 13,115.61 | 1,887.52 | 1,893.78 | 3,781.30 |

| Denmark | 22,320.11 | 395.14 | 2,041.57 | 2,436.72 |

| Estonia | 1,434.76 | 95.57 | 329.76 | 425.33 |

| Finland | 23,422.76 | 4,321.46 | 2,798.66 | 7,120.12 |

| France | 206,186.57 | 49,122.94 | 22,710.29 | 71,833.23 |

| Germany | 205,723.03 | 37,786.76 | 30,641.47 | 68,428.22 |

| Greece | 20,745.57 | 5,284.04 | 3,828.53 | 9,112.58 |

| Hungary | 13,298.01 | 2,272.60 | 2,736.45 | 5,009.05 |

| Ireland | 16,850.17 | 4,759.18 | 152.48 | 4,911.66 |

| Italy | 158,281.19 | 41,062.18 | 25,347.72 | 66,409.90 |

| Latvia | 2,077.65 | 144.20 | 548.35 | 692.55 |

| Lithuania | 2,642.19 | 259.60 | 683.44 | 943.05 |

| Luxembourg | 2,438.21 | 904.80 | 1,116.26 | 2,021.05 |

| Malta* | 500.72 | 242.66 | -117.28 | 125.38 |

| Netherlands | 58,679.57 | 10,157.92 | 2,673.76 | 12,831.68 |

| Poland | 42,888.31 | 13,014.20 | 9,735.88 | 22,750.08 |

| Portugal | 20,602.41 | 5,561.60 | 2,568.99 | 8,130.59 |

| Romania | 10,954.56 | 3,942.50 | 330.13 | 4,272.63 |

| Slovakia | 6,460.06 | 418.49 | 1,594.88 | 2,013.38 |

| Slovenia | 3,736.20 | 829.68 | 660.30 | 1,489.98 |

| Spain | 110,541.37 | 24,638.08 | 24,308.10 | 48,946.18 |

| Sweden | 38,631.07 | 6,548.49 | 3,349.42 | 9,897.91 |

| EU-27 | 863,724.31 | 186,904.28 | 123,281.31 | 310,185.58 |

|

Note: * Although the Exemption Gap could become negative in periods when input VAT exceeds potential output VAT, like periods of increased investment or when losses are incurred, the negative value might be due to a measurement error that results from difficulties to decompose the components of the base, such as sectorial Gross Fixed Capital Formation and net adjustments, and inaccuracies in the underlying data and parameters. Source: Mikhail Bonch-Osmolovskiy, Agnieszka Pechcińska, Grzegorz Poniatowski, and Adam Śmietanka, “VAT gap in the EU: report 2022,” Publications Office of the European Union, 2022, https://data.europa.eu/doi/10.2778/109823 and author’s calculations. |

||||

Broadening the VAT Base and Pro-Growth Reform

Reforms that reduce the Actionable Policy Gap can provide revenue to shift the tax mix in a more efficient and pro-growth direction.

A 2021 report finds that a reduction of an income tax financed through the elimination of reduced VAT rates positively impacts long-term growth. Simply increasing the VAT standard rate has a negative impact. Additionally, the paper concludes that cutting the standard VAT rate while eliminating the reduced VAT rates has a higher impact on long-term growth than cutting income taxes.[18]

Therefore, while cutting income taxes will still spur long-term growth, a VAT tax reform that eliminates VAT reduced rates and cuts the standard VAT rate would allow for a more rapid economic recovery. Policymakers should focus on simplifying VAT rules and broadening their tax bases by eliminating reduced rates and unnecessary tax exemptions. Additionally, governments should not shy away from a revenue-neutral reform by lowering standard VAT rates because consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible. revenues are likely to rebound and grow at a faster rate than other tax revenues (like they did after the financial crisis of 2007-2008), even as incomes remain suppressed.[19]

Closing the Policy Gap

Given the importance of VAT revenues both for individual EU countries and for the EU as a whole, policymakers should consider reforms that reduce the difference between the expected revenue and the amount actually collected. Closing the VAT Gaps, especially the VAT Actionable Policy Gap, would provide governments the opportunity to shift their tax mix away from economically harmful individual and corporate taxes towards a more efficient, pro-growth VAT system that provides stable revenue even in poor economic conditions.[20] European countries could increase their tax revenue by broadening the VAT base through the elimination of exemptions and reduced rates. This would allow policymakers to either increase VAT revenues, reduce the top statutory VAT rate, or reduce labor income taxation.

Increase VAT Revenues

Closing the VAT Actionable Policy gap would increase EU countries’ VAT revenues by one-third (33.3 percent). VAT revenues will see the biggest increase in Spain and Greece (70.5 percent), Italy (66.6 percent), Poland (54.4 percent), Luxembourg (54.2 percent), and Cyprus (53.9 percent). Bulgaria and Denmark will benefit the least from broadening the VAT tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. as their revenues would increase by less than 10 percent.

Reduce the General VAT Rate

When closing the VAT Policy and Compliance Gaps, countries should also consider a revenue-neutral reform instead of increasing VAT revenues.

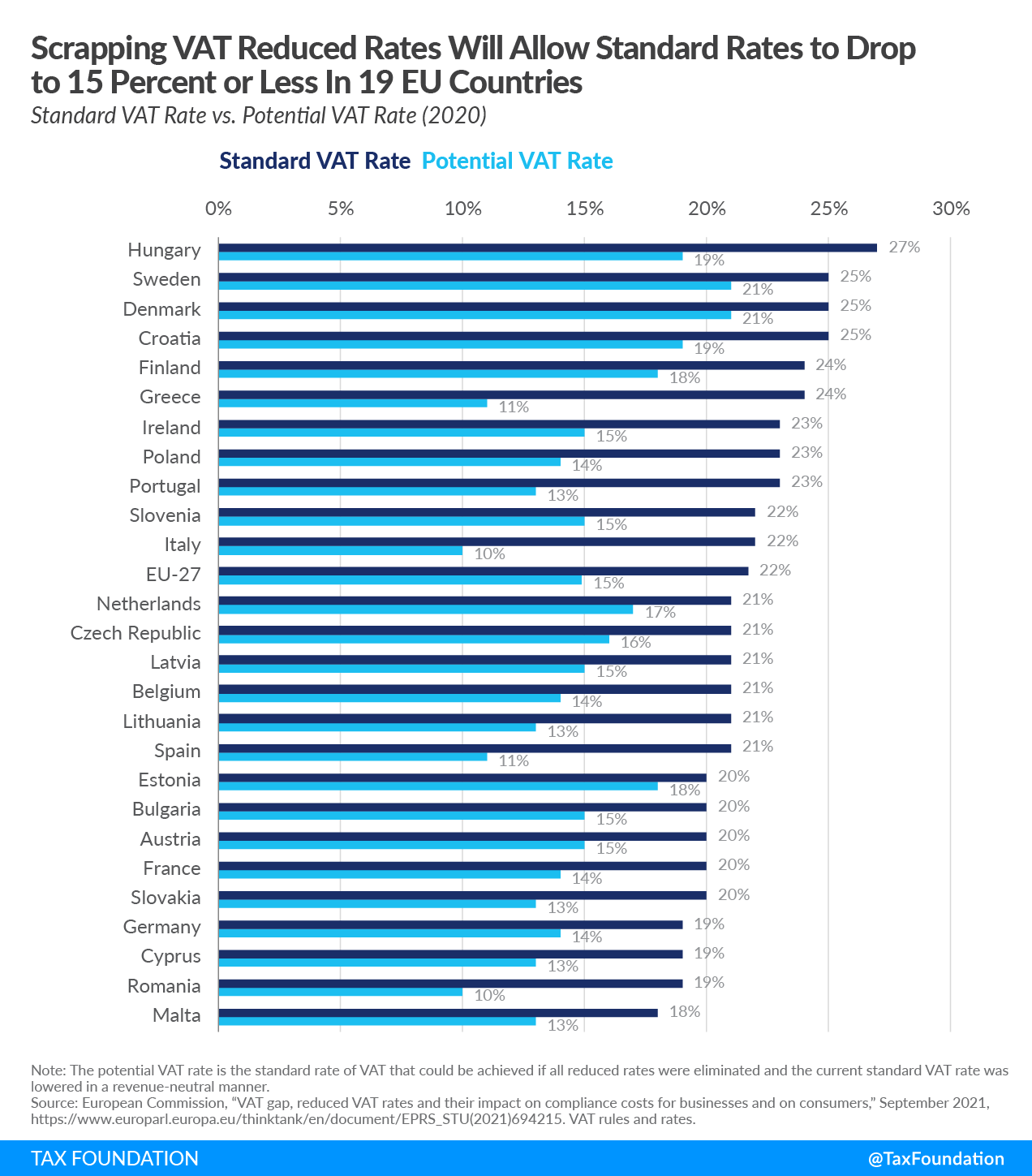

A report by the European Parliamentary Research Service estimated that by replacing the different reduced tax rates with the standard VAT rate applied to the whole tax base, under a revenue-neutral system, the average VAT rate in the EU could be reduced by 7 percentage points.[21]

The potential VAT rate reduction ranges from 2 percentage points in Estonia and 4 percentage points in Sweden, up to 10 percentage points in Portugal and Spain, 12 in Italy, and 13 in Greece. This would translate to potential VAT rates that range from 10 percent in Romania and Italy and 11 percent in Spain to 21 percent in Sweden and Denmark and 18 percent in Hungary and Croatia.

The benefits of implementing a single VAT tax rate are twofold: the reduction of compliance costs by simplifying the tax return process for businesses[22] and a more neutral tax code for consumption decisions.

The main political justification for reduced VAT rates and VAT-exempted goods/services is to promote equity because lower-income households tend to spend a larger share of income on food and public transport.[23] Some policymakers also want to encourage the consumption of “merit goods” (e.g., books), promote local services (e.g., tourism), and correct externalities (e.g., clean power).

However, in absolute terms, higher-income households tend to benefit more than lower-income households from VAT reduced rates because they tend to consume more (and more expensive) goods at those reduced rates. Evidence shows that reduced VAT rates and VAT exemptions are not necessarily effective in achieving redistributive policy goals and can even be regressive in some instances.[24] Instead of reduced rates, governments can implement compensation measures for poorer households, such as targeted tax credits or direct transfers to low-income earners.

Cut Labor Taxes

Apart from increasing tax revenue and reducing the VAT tax rate, policymakers could reduce labor taxes. The EUROMOD tax-benefit microsimulation model was used to design a revenue-neutral tax reform that would cut income taxes for low-income workers.[25] For each EU country, different income tax reforms were evaluated to match the forgone revenue from reducing the income tax with the additional tax revenue collected by closing the VAT Actionable Policy Gap. Table 3 summarizes the income tax reforms that EU countries could implement by closing the VAT Gap. Closing the VAT Actionable Policy Gap would provide enough revenue for Cyprus, Croatia, France, Greece, and Ireland to eliminate their income taxes altogether. Furthermore, Luxembourg could reduce the number of income tax brackets from 22 to four, and Spain could abolish the central income tax as well as the first regional income tax bracket.

Other countries could completely eliminate income tax for low and average-income earners or cut the flat income tax rate. Even Bulgaria and Denmark, the countries with the smallest Actionable Policy Gap, could cut income taxes for low-income earners.

Source: Author’s calculations using EUROMOD through the EUROMOD-JRC Interface. For more information visit https://euromod-web.jrc.ec.europa.eu/.

| Country | Income Tax Reforms |

|---|---|

| Austria | Cut the 1st tax bracket from 20% to 0% and the 2nd tax bracket from 35% to 25% |

| Belgium | Cut the 1st tax bracket from 25% to 10.7% |

| Bulgaria | Add a 0% tax bracket up to BGN 2,200 (EUR 1,125) |

| Croatia | Abolish income tax, surtax, and dividend tax |

| Cyprus | Abolish income tax, contribution to the government pension plan, special contribution for defense, and property tax |

| Czech Republic | Cut the first tax bracket from 15% to 9.5% |

| Denmark | Add a 0% central government tax bracket for taxable income below DKK 35,000 (EUR 4,706) |

| Estonia | Cut the income tax rate from 20% to 15% |

| Finland | Cut the first three tax brackets to 0% and the 4th tax bracket from 31.25% to 17.25% |

| France | Abolish income tax and the residual wealth tax |

| Germany | Cut income tax for the 1st tax bracket from 14% to 0% up to EUR 22,000 (currently EUR 14,753) |

| Greece | Abolish income tax |

| Hungary | Cut income tax from 16% to 4% and eliminate the lump tax for low-income self-employed workers |

| Ireland | Abolish income tax |

| Italy | Cut the 1st income tax bracket from 23% to 0% up to EUR 12,000 (currently EUR 15,000) |

| Latvia | Cut the 1st income tax bracket from 20% to 11% up to EUR 20,004 |

| Lithuania | Cut the general income tax rate from 20% to 15% |

| Luxembourg | Cut the first 18 tax brackets to 0% up to an annual income of EUR 45,897 |

| Malta | Cut the 1st tax bracket from 15% to 4% for all workers |

| Netherlands | Cut the income tax rate from 9.45% down to 0% for income below EUR 31,000 (currently EUR 20,384) |

| Poland | Add a 0% tax bracket up to PLN 30,000 (EUR 6,463). Currently, there is a 17% tax bracket from PLN 0 up to PLN 85,528 (EUR 18,426) |

| Portugal | Cut the first two tax brackets to 0% and the 3rd from 28.5% to 5% |

| Romania | Cut the flat income tax rate from 10% to 2% |

| Slovakia | Add a 0% tax bracket for taxable income below EUR 6,000 (before: 19% up to EUR 37,982) |

| Slovenia | Cut 1st income tax bracket from 16% to 0% and 2nd from 26% to 16% |

| Spain | Abolish the central income tax and set a 0% income tax for the first regional income tax bracket |

| Sweden | Cut the income tax from 20% to 17% and municipal tax from 20.72% to 17% |

Policy Implications of Closing the VAT GAP

Positively Impact the EU’s Own Resources

In addition to being an important source of revenue for EU countries, VAT revenue is also one of the EU’s own resources. However, the share of VAT-based resources accounted for only 7.49 percent of the EU’s total revenue in 2021, down from 60 percent in 1988.[26] This decline is due to own resources policy reforms that reduced both the VAT base and the VAT rate.[27] Since the VAT revenue collected by each Member State determines the VAT base for own resources, closing the VAT Actionable Policy Gap, and especially the Actionable Exemption Gap, would not only positively impact EU countries’ VAT revenues but could also contribute to the EU’s sources of revenue.[28] Closing the VAT system’s gaps would reinforce the VAT as an important and stable revenue source for the EU budget.

Contribute Towards EU Recovery Funds and Public Debt Additional Costs

Additional VAT revenue will also help EU countries reimburse and support the additional costs of increasing the public debt by 10.4 percent, on average, over the last few years.[29] Increased VAT revenues would also play a role in addressing the consequences of the COVID-19 pandemic and high energy prices by contributing towards EU recovery funds.

Digital VAT Would Allow for Abolishing Digital Services Taxes

The VAT has been changing in recent years to account for the digitalization of the economy. Changes to the VAT that incorporate online goods and services have resulted in higher revenues for many countries. The EU raised an additional EUR 14.8 billion in VAT revenues in the first four years after implementing measures to include cross-border trade in digital goods and services in the VAT.[30] Additionally, in 2021, the EU agreed to eliminate a VAT exemption for goods imported into the EU valued at less than EUR 22 by non-EU companies. According to preliminary results, the EU is currently collecting around EUR 1.38 billion annually in extra revenues for parcels valued at less than EUR 22.[31]

The expansion of the VAT to include digital services and products can achieve a neutral broadening of the tax base. Because the purpose of consumption taxes is to tax where consumption occurs, broadening tax bases to digital consumption is simply an extension of that principle. This would allow Member States to eliminate their Digital Services Taxes (DST). Abolishing DSTs would also eliminate the distortions that taxes on gross revenues create.

Conclusion

While the VAT system is an important source of revenue for individual EU countries and the EU as a whole, the EU Actionable Policy Gap, just above EUR 310 billion, shows the significant revenue forgone because of reduced rates and exemptions. Since VAT revenues are such a significant and stable contributor to overall government revenues, policymakers should pay particular attention to how efficiently those revenues are raised. Governments should ensure that VAT policies apply to broad bases and that reduced rates and exemptions are either minimized or ideally eliminated.

Policymakers should consider the capacity of the VAT system to raise revenue in a weak economic situation, and the burden the tax would place on economic recovery. Closing the VAT Actionable Policy Gap would provide governments the opportunity to simplify consumption and income taxes while supporting long-term growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Eurostat, “Main National Accounts Tax Aggregates,” December 19, 2022, https://ec.europa.eu/eurostat/databrowser/bookmark/89c8df5c-12d5-4604-a983-dcd60d5ed185?lang=en.

[2] The EU budget is funded partially through revenues it raises directly, own resources, and partially through contributions from Member States.

[3] European Commission, EU spending and revenue: data 2000-2021, https://ec.europa.eu/info/strategy/eu-budget/long-term-eu-budget/2021-2027/spending-and-revenue_en.

[4] Santiago Acosta-Ormaechea and Atsuyoshi Morozumi, “The value-added tax and growth: design matters,” International Tax Public Finance 28, 2021, https://doi.org/10.1007/s10797-021-09681-2.

[5] European Commission, Directorate-General for Economic and Financial Affairs, “European Economic Forecast,” Publications Office, November 2022.

[6] Ali Agha and Jonathan Haughton, “Designing VAT systems: Some efficiency considerations,” The Review of Economics and Statistics, 1996; Zídková H, “Determinants of VAT gap in EU,” Prague Economic Papers 23:4 (2014); Jan Pavel and Hana Zídková, “What Causes the VAT Gap?,” Ekonomicky casopis 64:9 (2016).

[7] Kent Mathews, “VAT Evasion and VAT Avoidance: Is there a European Laffer Curve for VAT?,” International Review of Applied Economics 17:1 (2003): 105-114.

[8] Edward Christie and Mario Holzner, “What explains tax evasion? An empirical assessment based on European data,” WIIW Working Paper 40 (2006).

[9] Mikhail Bonch-Osmolovskiy, Agnieszka Pechcińska, Grzegorz Poniatowski, and Adam Śmietanka, “VAT gap in the EU: report 2022,” Publications Office of the European Union, 2022, https://data.europa.eu/doi/10.2778/109823.

[10] Shaun Courtney, “EU’s Fight to Close VAT Gap Turns to E-Invoicing Push (Podcast),” Bloomberg Tax, Jan. 21, 2022, https://news.bloombergtax.com/daily-tax-report-international/eus-fight-to-close-vat-gap-turns-to-e-invoicing-push-podcast.

[11] “VAT rules and rates,” European Union, December 2022, https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates/index_en.htm.

[12] Council Directive (EU) 2022/542 of 5 April 2022

[13] “VAT rules and rates,” European Union, December 2022, https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates/index_en.htm.

[14] OECD, “Consumption Tax Trends 2022: VAT/GST and Excise Rates, Trends and Policy Issues,” OECD Publishing, 2022, https://doi.org/10.1787/6525a942-en.

[15] András Kaszap, Tim Meeusen, Wannes Verschueren, et al., “Study on tax compliance costs for SMEs: final report,” Publications Office, 2018, https://data.europa.eu/doi/10.2826/02329.

[16] Skatteverket, “Compliance costs of value added tax in Sweden,” Report 2006/3b, 2006, http://www.skatteverket.se/download/18.906b37c10bd295ff4880002550/rapport200603B.

[17] European Commission, “VAT gap, reduced VAT rates and their impact on compliance costs for businesses and on consumers,” September 2021.

[18] Santiago Acosta-Ormaechea and Atsuyoshi Morozumi, “The value-added tax and growth: design matters,” International Tax Public Finance 28 (2021), https://doi.org/10.1007/s10797-021-09681-2.

[19] Daniel Bunn, “Tax Policy and Economic Downturns,” Tax Foundation, March 2020, https://taxfoundation.org/government-revenue-most-hit-recession/.

[20] Åsa Johansson et al., “Taxation and Economic Growth,” OECD Economics Department Working Papers 620 (2008), https://doi.org/10.1787/241216205486.

[21] European Commission, “VAT gap, reduced VAT rates and their impact on compliance costs for businesses and on consumers,” September 2021, https://www.europarl.europa.eu/thinktank/en/document/EPRS_STU(2021)694215.

[22] Alan Tait, “Value Added Tax International Practice and Problems,” International Monetary Fund (1988): 42-44.

[23] OECD/KIPF, “The Distributional Effects of Consumption Taxes in OECD Countries”, OECD Tax Policy Studies, 2014, https://doi.org/10.1787/9789264224520-en.

[24] OECD, “Consumption Tax Trends 2022: VAT/GST and Excise Rates, Trends and Policy Issues,” OECD Publishing, 2022, https://doi.org/10.1787/6525a942-en and Cristina Enache, “Contrary to Popular Belief, Value-Added Taxes Found to Be Slightly Progressive,” Tax Foundation, August 2020, https://taxfoundation.org/value-added-tax-vat-progressive/

[25] Author’s calculations using EUROMOD through the EUROMOD-JRC Interface. For further information visit https://euromod-web.jrc.ec.europa.eu/.

[26] European Commission, “EU spending and revenue: data 2000-2021,” https://commission.europa.eu/document/download/db7394f7-b867-4d1e-a961-f2c874eed22d_en?filename=eu_budget_spending_and_revenue_2000-2021.xlsx and European Commission, Directorate-General for Budget, “EU budget 2008: financial report,” Publications Office, 2009, https://data.europa.eu/doi/10.2761/10839.

[27] The national VAT base to which the call rate is applied cannot exceed 50 percent of the gross national income. Currently the call rate is 0.3 percent.

[28] Until recently the VAT resource base for a member country for a given year was the total net VAT revenue collected during that year divided by the rate at which the VAT rate was levied during the year. If more than one VAT rate was applied, the harmonized VAT base was calculated by dividing the VAT revenue by the weighted average rate. However, from 2021, each Member State will apply the weighted average VAT rate of 2016, throughout the 2021-27 period. See: European Commission, “The Value Added Tax (VAT)-based own resource in 2021-2027,” December 2022, https://commission.europa.eu/strategy-and-policy/eu-budget/long-term-eu-budget/2021-2027/revenue/own-resources/value-added-tax_en.

[29] Eurostat, “Euro area government deficit at 5.1% and EU at 4.6% of GDP,” Euro Indicators, October 21, 2022, https://ec.europa.eu/eurostat/documents/2995521/11563047/2-22042021-AP-EN.pdf.

[30] “OECD Secretary-General Tax Report to G20 Finance Ministers and Central Bank Governors,” OECD, July 2020, http://www.oecd.org/tax/oecd-secretary-general-tax-report-g20-finance-ministers-july-2020.pdf.

[31] “New VAT rules for online purchases brought €1.9 billion in revenues for Member States in their first six months alone,” European Commission, March 2022, https://taxation-customs.ec.europa.eu/news/new-vat-rules-online-purchases-brought-eu19-billion-revenues-member-states-their-first-six-months-2022-03-15_en.

Share this article