A wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary.

How Does It Work?

Wealth taxes work by applying a tax rate to an individual’s net wealth, usually above a certain threshold. A person with $2.5 million in wealth and $500,000 in debt would have net wealth of $2 million. If it applies to all wealth above $1 million, then under a 5 percent wealth tax the individual would owe $50,000 in taxes.

If the individual’s wealth is not growing at a rate higher than the tax rate, the tax will ultimately reduce that individual’s wealth. This means that individuals with lower rates of return on their wealth will face higher effective tax rates.

| Source: Author’s calculations. | ||||

| Pretax return | Annual tax rate | Equivalent Income Tax Rate | Return after tax | |

|---|---|---|---|---|

| Scenario A | 2% | 5% | 250% | -3% |

| Scenario B | 5% | 5% | 100% | 0% |

| Scenario C | 10% | 5% | 50% | 5% |

What Countries Impose These Taxes?

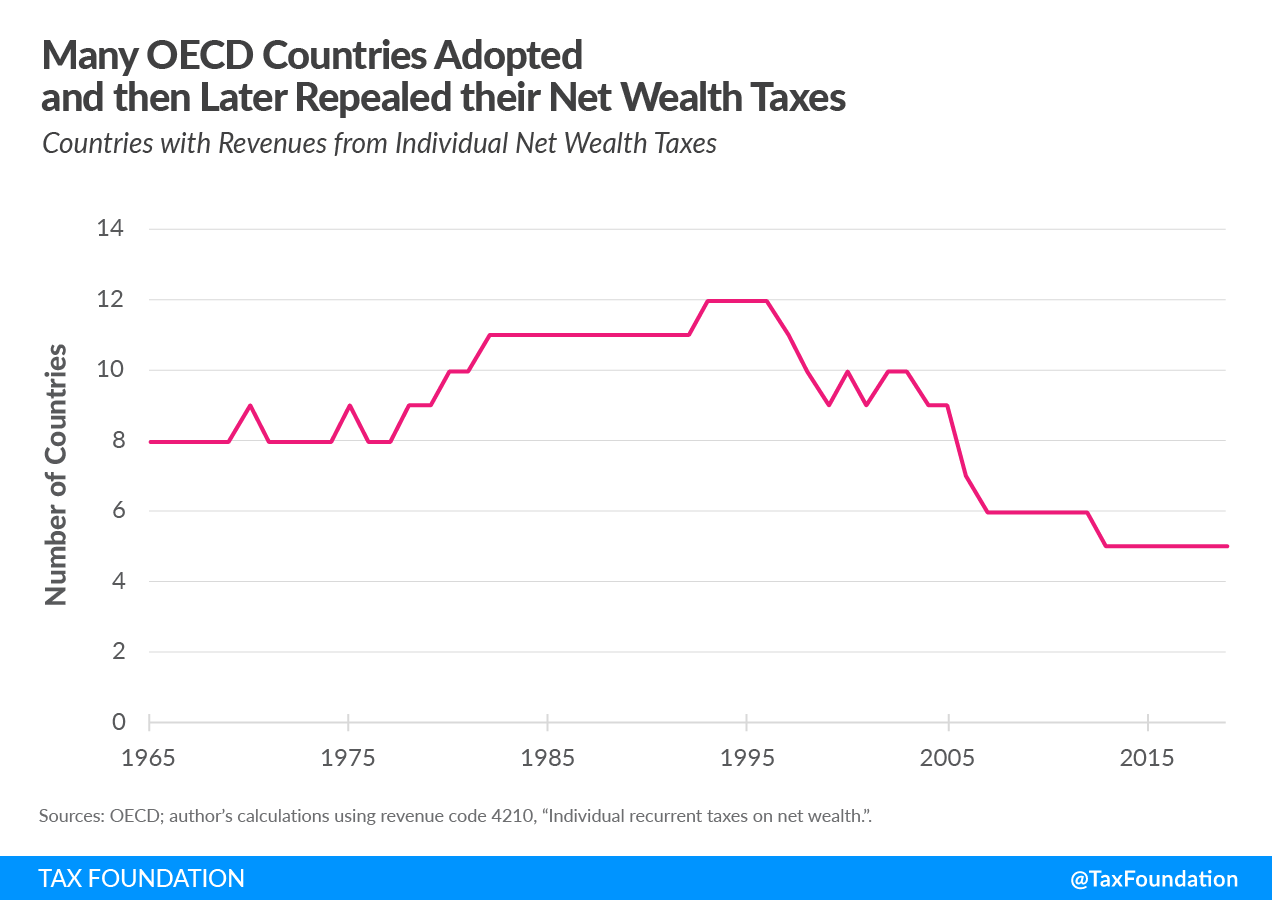

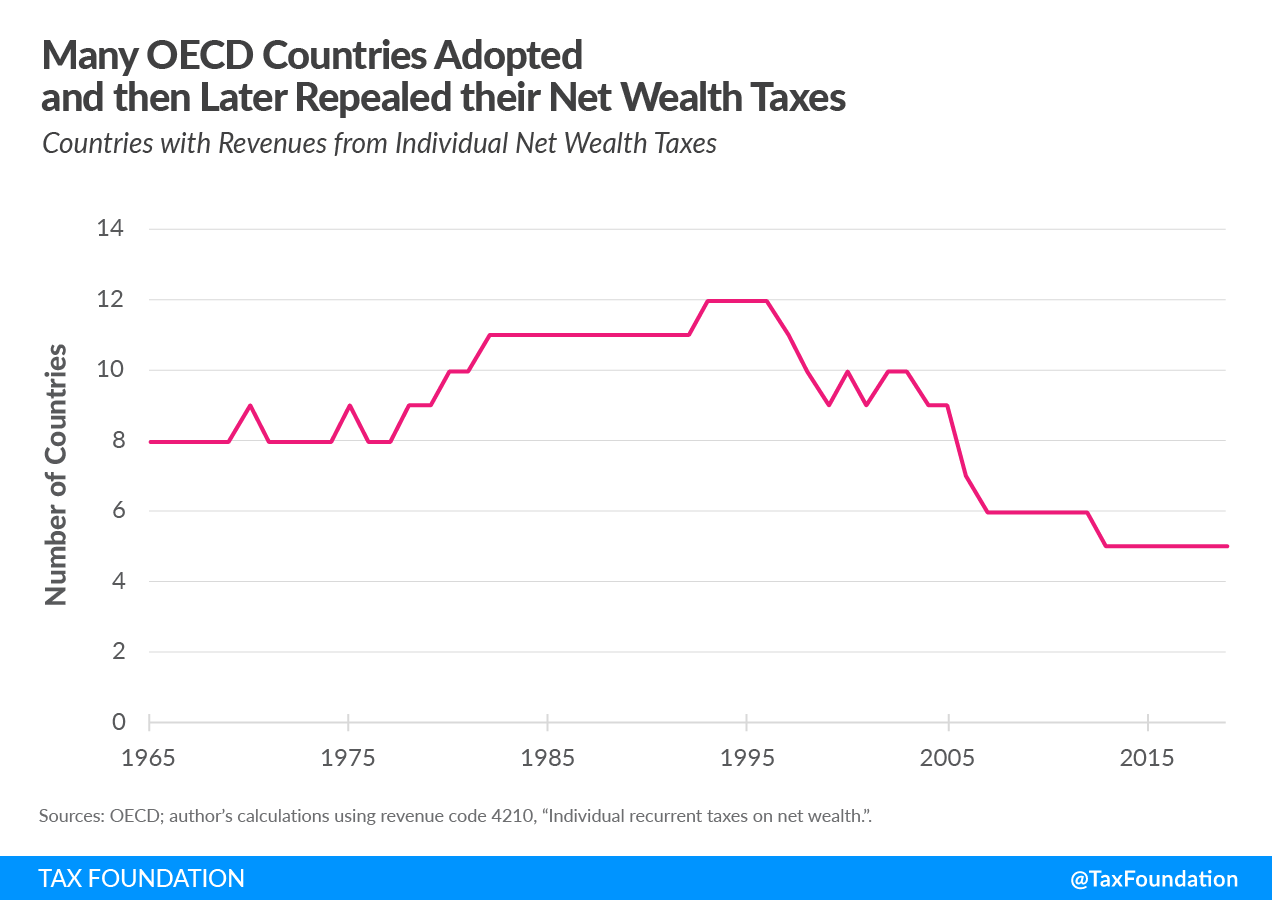

Comprehensive wealth taxes have never been implemented in the United States; however, several other countries around the world have implemented them. Many developed countries have repealed these taxes in recent years. Among OECD countries, there are just five countries that currently impose one. Even among these five countries there is variety in the way the countries define the tax rate and base.

| Country | Rate | Base |

|---|---|---|

| Colombia | 1 percent | Net wealth in excess of COP 5 billion (US $1.4 million). |

| France | Progressive from 0.5 percent to 1.5 percent | Net taxable wealth in real estate properties above €800,000 ($968,000) |

| Norway | 0.7 percent at the municipality level and 0.15 percent at the national level | Fair market value of assets minus debt. Tax applies to value of wealth above NOK 1.5 million ($180,000) for single/not married taxpayers and NOK 3 million ($360,000) for married couples. |

| Spain | Progressive from 0.2 percent to 3.75 percent depending on the region | May differ depending on the region, but generally value of assets minus value of liabilities. Regions have autonomy in setting the exemption amount. Madrid provides a full exemption. |

| Switzerland | Varies depending on the Canton | Gross assets minus debts. |

| Source: PwC, “Worldwide Tax Summaries.” | ||

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe