Congress has less than two years to prevent taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. hikes on the vast majority of Americans from taking place. That’s because the Tax Cuts and Jobs Act (TCJA) of 2017, a tax reform law that simplified individual income taxes and reduced tax rates across the income spectrum, is set to expire. If Congress does nothing, most Americans will face higher taxes, worse incentives for work and investment, and a more complicated tax system starting in 2026.

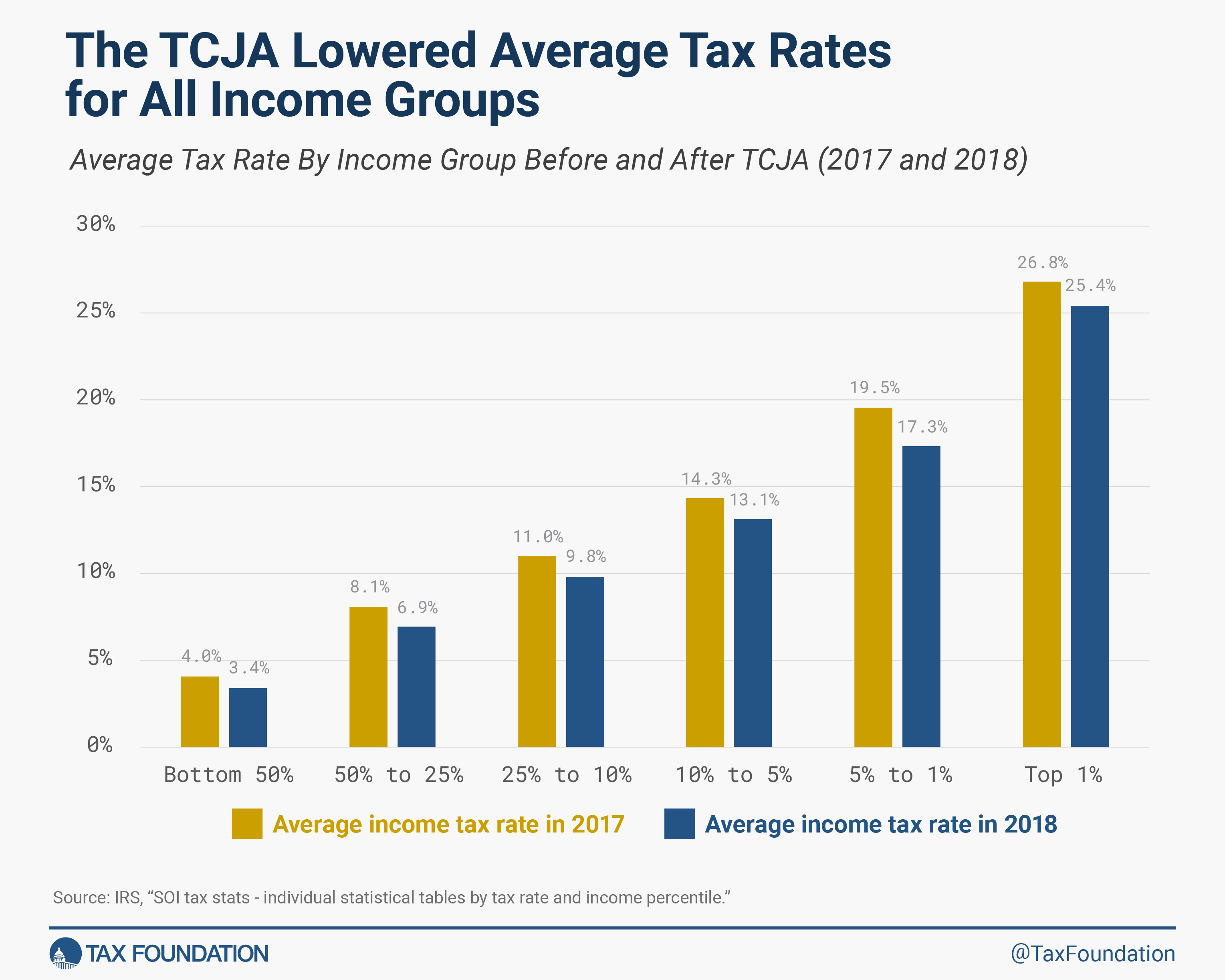

The TCJA reduced average tax rates for taxpayers at all income levels because it lowered marginal tax rates, widened tax brackets, doubled the child tax credit and zeroed out personal and dependent exemptions, nearly doubled the standard deduction, and limited several itemized deductions and the alternative minimum tax, among other changes. Although not every change the TCJA made was a tax cut—for instance, placing a $10,000 cap on itemized deductions for state and local taxes paid increased taxable income for higher-income taxpayers living in high-tax states—the net effect of all changes taken together was to reduce average tax burdens.

In 2017, the year before the new tax changes took effect, the bottom half of taxpayers paid an average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. of 4.0 percent. After the TCJA took effect in 2018, the average tax rate for the bottom half dropped to 3.4 percent. Likewise, the average tax rate paid by the top 1 percent of taxpayers decreased from 26.8 percent in 2017 to 25.4 percent in 2018. Average rates declined across all income groups and have remained below their 2017 levels since. Further, we estimate making the individual provisions of the TCJA permanent would reduce taxes for about 62 percent of filers, leave taxes unchanged for about 29 percent, and increase taxes for just under 9 percent of filers in 2026.

Our tax calculator tool helps demonstrate how the expiration or extension of the TCJA could affect taxpayers in different scenarios in 2026. The calculator allows users to compare how different sample taxpayers fare or to input a custom taxpayer.

The tax calculator compares tax liability under two scenarios for tax year 2026. First, the calculator shows a taxpayer’s liability if Congress extends the TCJA. Next, the calculator shows a taxpayer’s liability if Congress does nothing and allows the TCJA to expire. The difference between the two illustrates the tax increase (or, in rare cases, decrease) a taxpayer would see if the TCJA expires.

2026 Tax Calculator

Share this tool: taxfoundation.org/calculator

About the Tax Calculator

The calculator includes most aspects of the federal individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code except provisions related to business and self-employed income.

The Tax Foundation’s tax calculator is intended as an illustrative tool for the estimation of the TCJA’s impact on example taxpayers. It does not fully represent all potential tax scenarios and liabilities and should not be used for tax preparation purposes. The tax calculator is for educational use only.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe