Key Findings

-

Our estimates show that a carbon taxA carbon tax is levied on the carbon content of fossil fuels. The term can also refer to taxing other types of greenhouse gas emissions, such as methane. A carbon tax puts a price on those emissions to encourage consumers, businesses, and governments to produce less of them. levied on all energy-related carbon emissions at a rate of $50 per metric ton and an annual growth rate of 5 percent would generate $1.87 trillion in additional federal revenue over the next 10 years.

-

In isolation and ignoring environmental effects, a carbon taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. negatively impacts output and employment and makes the tax code less progressive.

-

Distributional and economic effects of a carbon tax critically depend on how the generated tax revenue is used, making revenue recycling an essential element of any carbon tax proposal.

-

A carbon tax paired with a lump-sum rebate would increase the tax code’s progressivity significantly, but impact employment and output negatively.

-

A carbon tax paired with a cut in the employee-side payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. increases progressivity, output, and employment.

-

A carbon tax paired with a cut in the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , permanent 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , and R&D expensing boosts output and pretax wages while decreasing progressivity and lowering employment.

Introduction

Over the past few years, lawmakers, businesses, and climate groups have expressed support for the United States to enact a carbon tax. In July 2019, Sen. Christopher Coons (D-DE), Rep. Francis Rooney (R-FL), and Rep. Dan Lipinski (D-IL) each introduced a carbon tax bill. These bills would introduce a border-adjusted tax on carbon emissions, with revenue being used for measures such as payroll tax cuts, investments in innovation and infrastructure, and carbon dividends.[1] Businesses in sectors such as energy, food, and transport have publicly called for federal climate action, including a price on carbon.[2]

Economists have long argued that a well-designed carbon tax is the most economically efficient way to reduce carbon emissions.[3] A carbon tax is considered a consumption-based tax. Generally, consumption-based taxes raise revenue with less distortionary effects than taxes on income, making them economically more efficient. As of August 2019, 25 national and three subnational jurisdictions around the world have implemented a carbon tax, and four are considering implementing one.[4]

The economic effects of a carbon tax vary significantly depending on how the generated tax revenues are used. For instance, using carbon tax revenues to reduce a more distorting type of tax can have a positive impact on the economy. Estimates show that in 2013, 44 percent of carbon tax revenues raised in countries around the world were used to lower other taxes, 28 percent went into general government funds, and 15 percent were used for environmental spending.[5]

In this paper, we discuss the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects. We estimate that a $50 carbon tax implemented in 2020 that grows at 5 percent each year would raise $1.87 trillion in additional federal revenue. A carbon tax would reduce after-tax wages and reduce the incentive to work, reducing GDP by 0.4 percent and full-time equivalent employment by 447,000 jobs. In isolation, a carbon tax would make the tax code less progressive.

We also estimate the economic and distributional effects of three carbon tax and revenue recycling proposals: (1) a carbon tax and rebate, (2) a carbon tax and payroll tax cut, and (3) a carbon tax and corporate tax cut. We find that each proposal faces different trade-offs and achieves different policy goals. Rebates make the tax code significantly more progressive but lead to lower output and fewer full-time equivalent jobs. Payroll tax cuts make the tax code slightly more progressive, boost output and employment. Cutting the corporate income tax rate and making full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. permanent results in a less progressive tax code and fewer jobs but leads to the highest growth in output and pretax wages.

Why a carbon tax?

Carbon emissions have been driving changes in global temperatures, imposing costs on economic, human, and natural systems.[6] The main purpose of a carbon tax is to price carbon emissions in order to reduce the amount of carbon in the atmosphere and mitigate the adverse effects of climate change. Under current policies, U.S. greenhouse gases are estimated to be 18 to 22 percent below 2005 levels by 2025, falling short of the 26 to 28 percent the United States committed to in the Paris Agreement.[7] Carbon pricing can significantly reduce carbon emissions and help meet climate goals.

The carbon tax is considered a Pigouvian taxA Pigouvian tax, named after 1920 British economist Arthur C. Pigou, is a tax on a market transaction that creates a negative externality, or an additional cost, borne by individuals not directly involved in the transaction. Examples include tobacco taxes, sugar taxes, and carbon taxes. . A Pigouvian tax is a tax on a market transaction that creates a negative externalityAn externality, in economic terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either the production or consumption of a good or service and can be positive or negative. , or an additional cost borne by individuals not directly involved in the transaction.[8] When individuals purchase goods that are created through a carbon-intensive production process, they create a negative externality. In the case of carbon emissions, carbon can build in the atmosphere and change the climate. This negative externality imposes a direct cost on those who were not part of the initial transaction of producing and purchasing the good.

A carbon tax internalizes these external costs on the environment by adding them to the price of the good. As a result, the full cost of the good, including the external costs to the environment, are paid for by the consumer and producer of the good. This disincentivizes both consumers and producers from using carbon-intensive goods, leading to lower carbon emissions.

In addition to pricing carbon emissions, a carbon tax would raise additional federal revenue. This additional federal revenue could be used to reduce the federal deficit, reform taxes, or create additional government programs. For example, many carbon tax proposals pair the enactment of a carbon tax with a new government program that would “rebate” the carbon tax back to Americans to offset the cost of the carbon tax on living standards. Other proposals would use part of the carbon tax revenue to reduce other taxes, such as income or payroll taxes.[9]

While not in the scope of this paper, a carbon tax would make current federal regulations that price carbon emissions redundant. If designed correctly, a carbon tax would provide the proper incentive to reduce carbon emissions and offset the negative externality. As such, there would no longer be a need for federal regulations meant to price carbon emissions.

Design Implications of a Carbon Tax

The revenue, economic, distributional, and environmental implications of a carbon tax will ultimately depend on the design of the tax. Policymakers must make design decisions regarding the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and tax rate, the point of taxation, and border adjustments, and take into account behavioral responses.

Tax Base

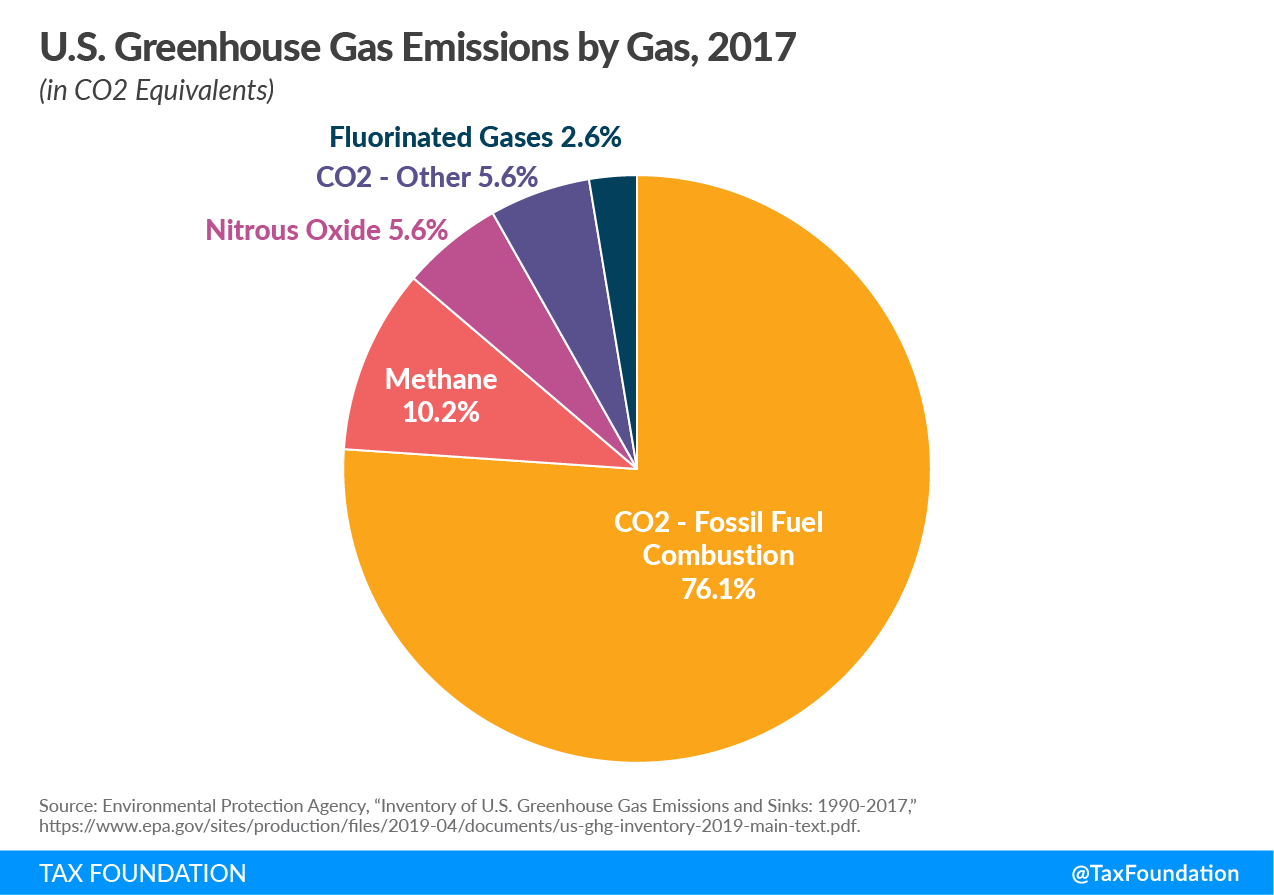

Carbon taxes can be levied on carbon emissions and on other types of greenhouse gases, such as methane, nitrous oxide, and fluorinated gases. Carbon emissions from fossil fuel combustion, or so-called energy-related carbon emissions, constitute more than three-fourths of all greenhouse gases, making them the main target of a carbon tax. Taxing greenhouse gases other than energy-related carbon emissions can be administratively more challenging because their source is not limited to fossil fuels.[10] However, some non-carbon emissions are easier to abate than carbon emissions, making their marginal abatement costs relatively lower.[11] Thus, broadening the tax base to greenhouse gases other than carbon emissions can minimize overall abatement costs.

According to the Environmental Protection Agency, energy-related carbon emissions accounted for 76.1 percent of all greenhouse gases emitted in 2017. Carbon emissions from industrial processes (other than fossil fuel combustion) made up 5.6 percent; methane emissions from energy production, agriculture, and landfills 10.2 percent; nitrous oxide from agriculture 5.6 percent; and fluorinated gases (HFCs, PFCs, SF6, and NF3, man-made industrial gases mainly used as refrigerants) the remaining 2.6 percent.[12] From now on, our analysis will focus on energy-related carbon emissions.

Combusting one unit of a certain type of fossil fuel always emits the same amount of carbon, establishing a correspondence between fossil fuels and carbon emissions. As a result, a carbon tax does not have to be levied when carbon is emitted but can instead be imposed on the carbon content of fossil fuels. It is thus not necessary to measure the amount of carbon each individual and business emits, simplifying the administration of a carbon tax drastically.

According to the U.S. Energy Information Agency (EIA), energy-related carbon emissions are estimated to amount to 5,217 million metric tons in 2019. Under current policies, these emissions are expected to decline slightly and total 4,977 million metric tons in 2025 and 4,920 million metric tons in 2029. Extrapolating these projections, energy-related carbon emissions will total 49,931 million metric tons over the next decade (2020-2029).[13]

Emissions from international bunker fuels used for international aviation and maritime transport are not counted in U.S. climate targets. However, the U.S. Energy Information Administration includes them in their projections for energy-related carbon emissions.[14] We exclude them from our tax base.

Point of Taxation

There are different points in the supply chain at which a carbon tax can be levied. Various aspects, such as the scope of the tax base and administrative efficiency, determine the optimal point of taxation. Generally, carbon taxes can be levied at the point of fuel production (upstream), at the point of fuel consumption (downstream), or at different points in between (midstream).

Ideally, a carbon tax is levied at a point where the greatest share of emissions is included in the tax base and a minimum number of entities is subject to the tax. A broad tax base minimizes the economic costs by including potentially less costly abatement opportunities, while levying the tax on a small number of tax filers minimizes the administrative burden.

A paper by Metcalf and Weisbach (2009) suggests levying the carbon tax on fossil fuels when they enter the economy. In other words, when coal is extracted, oil is refined, and natural gas is processed. According to their estimates, collecting the tax upstream for coal and slightly downstream for oil and natural gas could cover approximately 80 percent of all U.S. emissions and collect the tax at fewer than 3000 points.[15] However, there are also arguments for imposing the tax at the point of consumption, such as making it more visible to consumers.

Border Adjustment

Most carbon tax proposals also enact a border adjustment. A border adjustment addresses two concerns with the carbon tax: competitiveness and “leakage.” If the United States were to enact a tax on all carbon-intensive goods produced in the United States, it could create an incentive for companies to shift their production overseas to avoid the tax. Businesses would have an incentive to import goods to avoid the tax. This would particularly apply to emission-intensive and trade-exposed (EITE) sectors.

In addition, a carbon tax can create what is called “leakage.” If companies shift production overseas into jurisdictions without a carbon tax, the tax will fail to price the emissions that were previously emitted in the United States. Without a border adjustment, between 5 percent and 19 percent of domestic emission reduction resulting from a carbon tax is estimated to be offset by increases in emissions abroad. Under a border adjustment, such leakage would be reduced to between 2 percent and 12 percent, making the border adjustment an effective tool.[16]

A border adjustment shifts the base of the carbon tax from all carbon-intensive goods produced in the United States to all carbon intensive goods consumed in the United States. In effect, this eliminates the competitive pressures that may encourage companies to shift production overseas. This is because the price level for a carbon-intensive good consumed in the United States is the same, regardless of where it was produced.

Mechanically, a border adjustment works by applying the carbon tax to all carbon-intensive goods produced in foreign countries and imported to the United States. A border adjustment also provides a credit for any goods produced in the United States subject to the carbon tax but exported to foreign countries.

While a border adjustment for a carbon tax is conceptually appealing, there are potential administrative challenges. A comprehensive border adjustment would require information about the carbon content of each good imported to and exported from the United States. Since this would be challenging, policy proposals for border adjustments are usually limited to EITE industries, such as chemicals, ferrous metals, and paper.[17]

Taking into account imports and exports of carbon-embedded goods, the United States consumed 7.7 percent more CO2 than it produced in 2016 (latest data available),[18] making the United States a net importer of CO2.[19]

Sample Carbon Tax Proposal

To illustrate the revenue, economic, and distributional impacts of a carbon tax, we model a sample carbon tax enacted by the federal government. This proposal would enact a carbon tax in 2020 equal to $50 per metric ton of carbon and growing annually at 5 percent. The carbon tax would apply to a broad tax base, covering all energy-related carbon emissions in the United States and would be border-adjusted. Finally, the tax would exempt international bunker fuels used for international aviation and maritime transport.[20]

Revenue Implications of a Carbon Tax

We estimate that a $50 per metric ton carbon tax would raise federal revenue by $1.87 trillion between 2020 and 2029.

The carbon tax itself would collect $2.6 trillion in receipts over this time. However, the imposition of the carbon tax would reduce income and payroll tax revenue. This is typically called the “excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. offset.” The income and payroll tax offset can occur for one of two reasons, or a combination of both. If the excise tax is passed back to the factors of production and borne entirely by the producer, the tax reduces some combination of business profits and labor compensation. Alternatively, the tax could be passed forward in the form of higher prices. Higher prices reduce the amount of income available to consumers for purchasing other goods and services. The industries affected by the decline in consumption see lower revenue, resulting in lower profits and labor compensation.[21]

The size of the income and payroll tax offset depends on the tax rates and tax structures and varies by modeling assumptions. The Joint Committee on Taxation has historically estimated an income and payroll tax offset of around 25 percent. This means that for every dollar of excise tax revenue, income and payroll tax falls, offsetting $0.25 of the excise tax revenue. Under current law, the Joint Committee on Taxation estimates the income and payroll tax offset to be around 22 percent until 2026, when it rises to approximately 24 percent once the Tax Cuts and Jobs Act (TCJA) expires.[22] The Tax Foundation model estimates a slightly higher income and payroll tax offset, ranging between 26 percent and 30 percent over the next decade. In the past, estimates of the Joint Committee on Taxation have ranged between 25 percent and 35 percent.[23]

Our estimate also considers for the shift away from carbon-intensive goods. A carbon tax distorts the relative prices of goods in the U.S. economy away from carbon-intensive goods. This would encourage investment to shift towards less carbon-intensive production processes and reduce taxable carbon emissions, shrinking the tax base.

There is a degree of uncertainty in predicting the speed of technological change, changes in the energy mix, and consumer demand of carbon-intensive goods under current law and under a carbon tax. We assume in our analysis that carbon emissions would decrease incrementally to 80 percent of the baseline in the first five years of a carbon tax, and to 75 percent in the following five years.[24]

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2020-2029 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Source: Tax Foundation General Equilibrium Model, April 2019 |

|||||||||||

|

Gross Revenue |

$251 | $249 | $250 | $249 | $247 | $255 | $264 | $271 | $281 | $290 | $2,607 |

|

Net Revenue (After Excise Tax Offset) |

$181 | $180 | $180 | $179 | $178 | $184 | $190 | $195 | $202 | $209 | $1,877 |

Economic Effects of a Carbon Tax

According to the Tax Foundation General Equilibrium Model, we estimate that a $50 per ton carbon tax enacted in isolation would reduce long-run output (Gross Domestic Product) by 0.4 percent. A carbon tax would reduce after-tax wages and reduce the incentive to work. As a result, hours worked would decline by 421,000 full time equivalent jobs.

A carbon tax is a broad-based excise tax that increases the price of goods and services in the economy. Excise taxes are a type of consumption-based tax and impact the economy by reducing real after-tax wages. As an excise tax, it would not distort the choice between current and future consumption and does not have a direct impact on the incentive to save or invest. An individual would face roughly the same tax burden, in present value, if they choose to consume today compared to if they invested their income and consumed it later.[25]

However, a carbon tax would ultimately distort investment decisions in the economy across different types of projects. A carbon tax, by design, would reduce the demand for goods produced in more carbon-intensive production processes.

This estimate only includes the direct effect of the new tax on the U.S. economy. This estimate does not account for the potential economic benefits from mitigating climate change. Nor does our modeling include the effect of repealing current federal regulations with respect to carbon emissions.

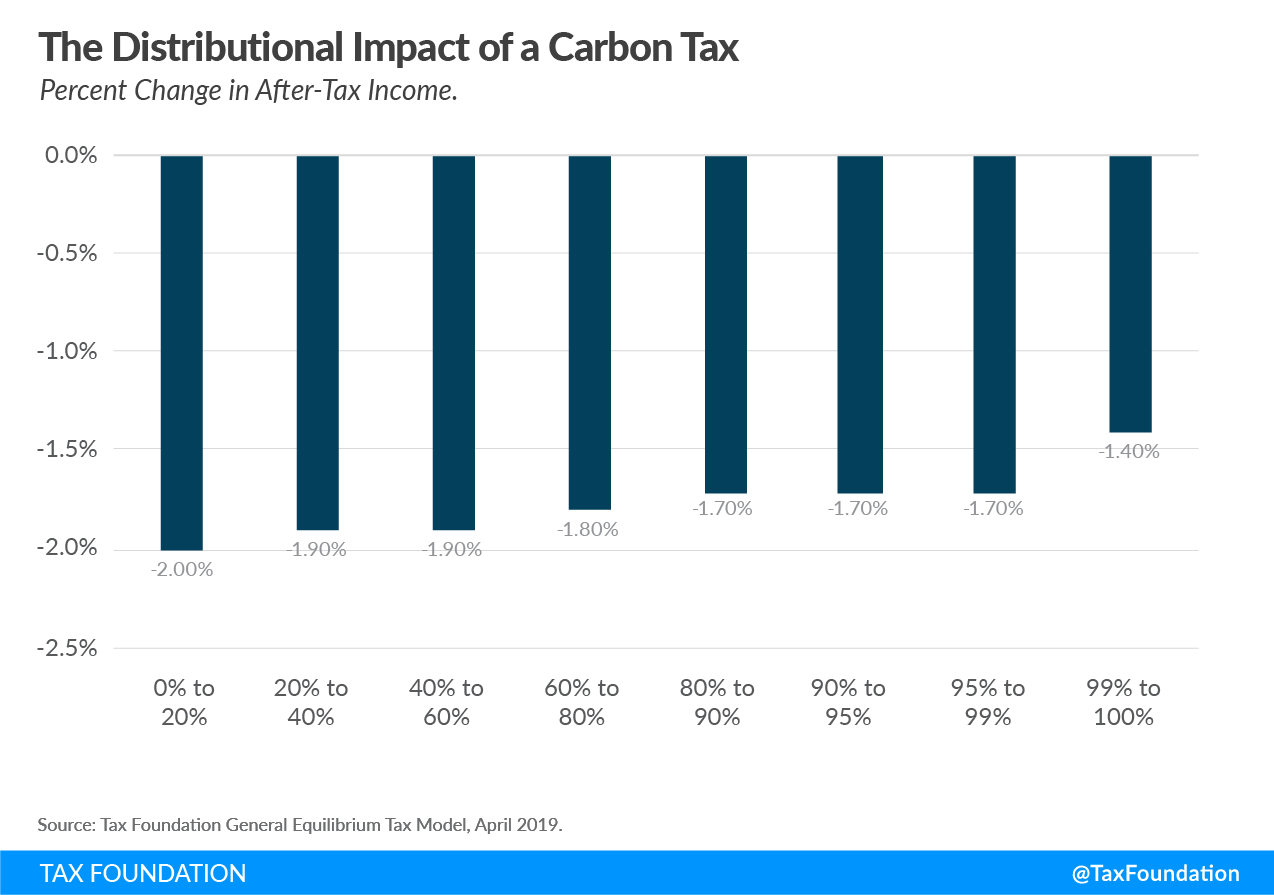

Distributional Effects of a Carbon Tax

If enacted in isolation, a carbon tax would make the federal tax code less progressive. We estimate that a $50 per metric ton carbon tax would reduce the after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. of taxpayers in the bottom quintile by nearly 2 percent. Middle-income taxpayers (40%-60% income quintile) would see a slightly smaller reduction in after-tax income or 1.9 percent. Taxpayers in the top 1 percent would see the smallest reduction in after-tax income of about 1.4 percent.

By raising the prices of goods and services, a carbon tax reduces real incomes earned by taxpayers. As a consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or income taxes where all savings are tax-deductible. , however, a carbon tax would not burden saving, but any capital income in excess of the initial saving (in present value) would face the tax. Specifically, a carbon tax would reduce the returns to wages and the super-normal return to capital.[26]

Uses of Carbon Tax Revenues

Ultimately, the revenue, distributional, and economic impacts of a carbon tax will depend on how the revenue is used. In this section, we model three possible uses: (1) a per-person, lump-sum dividend, (2) a cut in the employee-side payroll tax, and (3) a corporate tax reform.

Carbon Tax and Lump-Sum Dividend

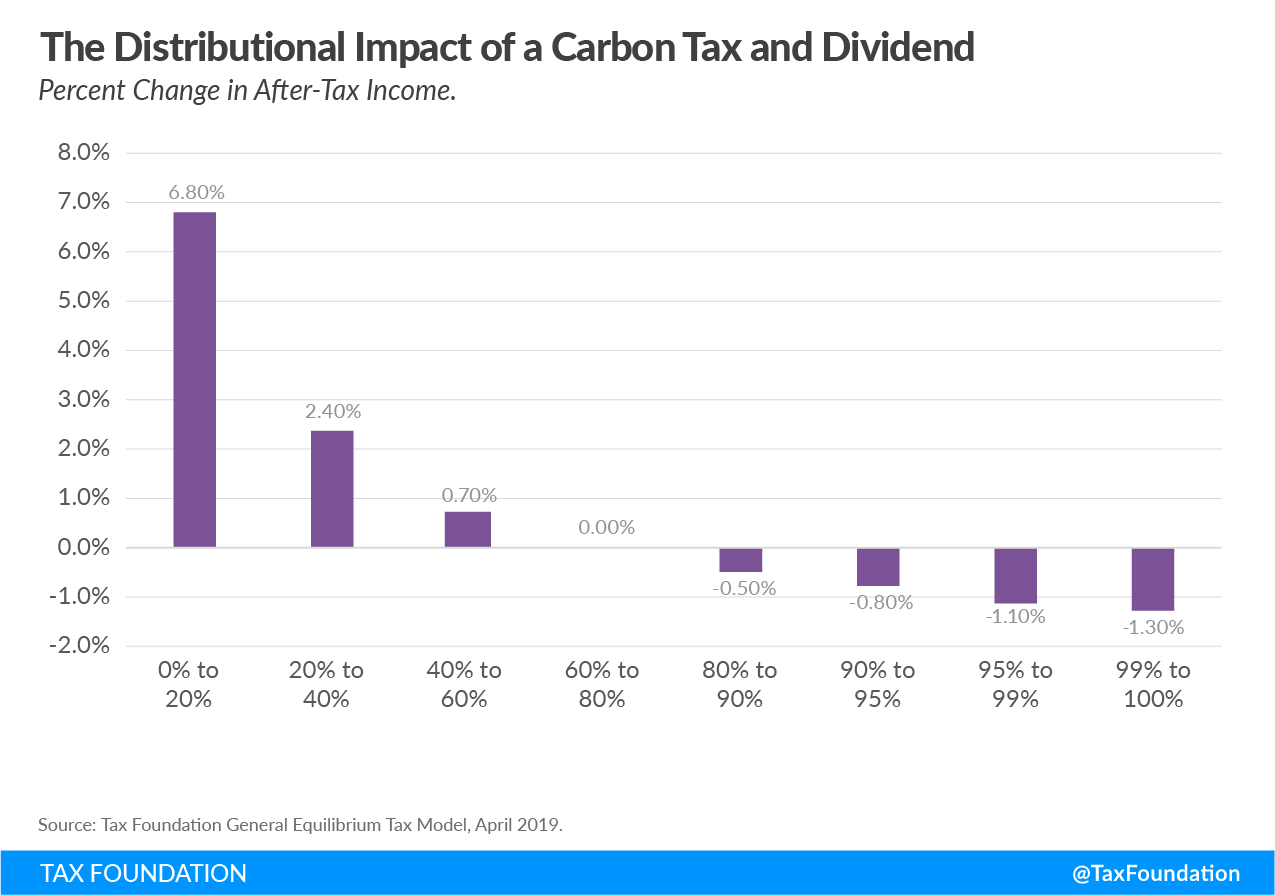

The first proposal would enact a $50 per metric ton carbon tax and rebate the additional federal revenue to each household as a lump-sum payment or “dividend.” We estimate that a carbon tax of this size would be able to fund a dividend of $1,057 per individual (each tax filer) and a dividend equal to half that for each dependent.

We estimate that in the long run the carbon tax and dividend proposal would have roughly the same economic impact as a carbon tax in isolation. GDP would be 0.4 percent lower and hours worked would decline by 421,000 full time equivalent jobs. This is because the lump-sum dividend would not alter taxpayers’ incentives to work, save, or invest. As a result, taxpayers would simply face the increased marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on work from the carbon tax.

In contrast to a carbon tax in isolation, a carbon tax and dividend would be progressive. After-tax income would increase for taxpayers in the bottom three quintiles. Those in the bottom quintile (0% to 20%) would see a 6.8 percent increase in after-tax income. Taxpayers in the top 20 percent would face a net tax increase as their expected carbon tax burden would be larger than the rebate. Taxpayers in the top 1 percent would see a 1.3 percent decline in after-tax income.

Carbon Tax and Payroll Tax Cut

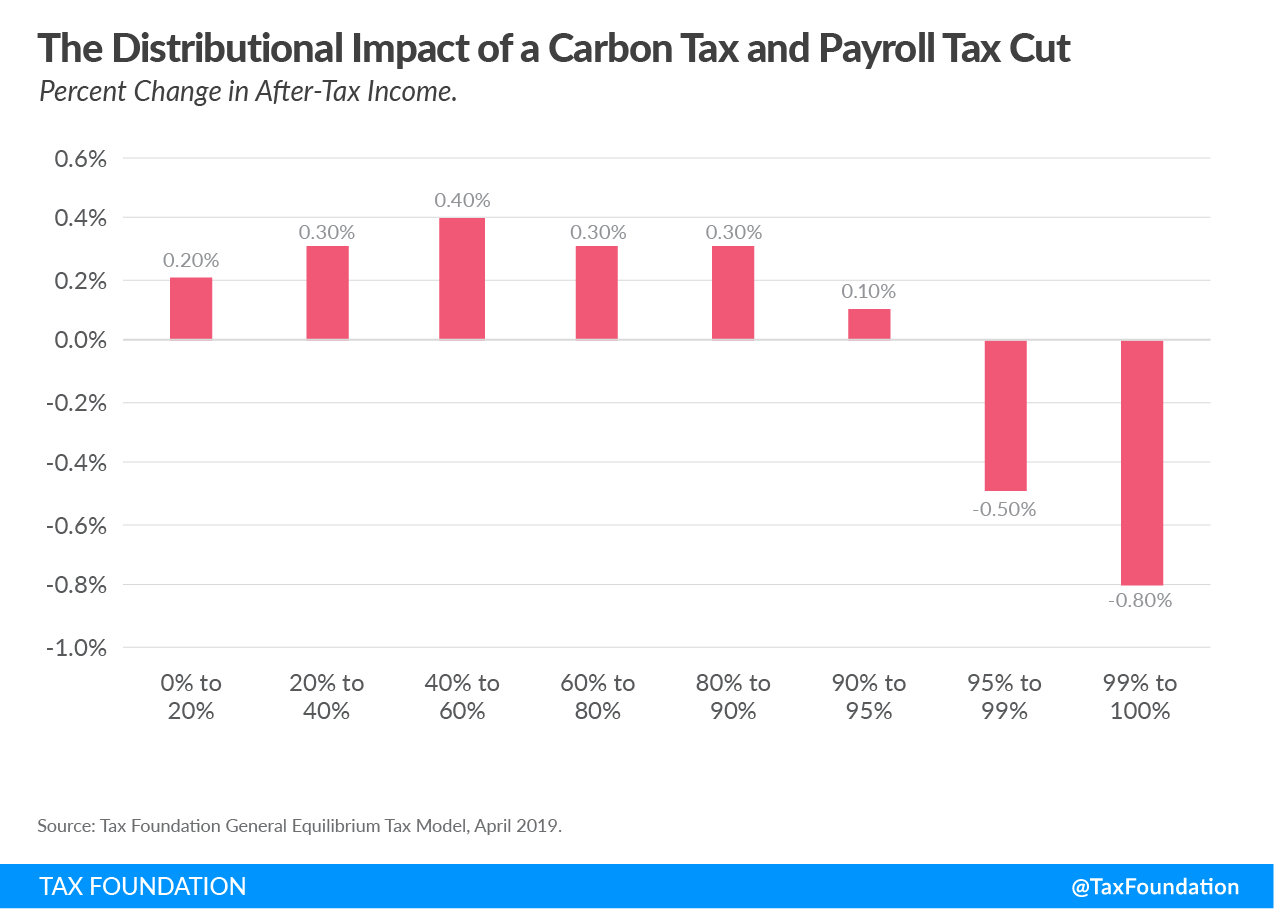

This proposal would use the revenue from a $50 per metric ton carbon tax to reduce the employee-side of the Old Age, Survivors, and Disability Insurance (OASDI) payroll tax. We estimate that the net revenue from a carbon tax of this size could reduce the payroll tax by 2.24 percentage points from the current 6.2 percent to 3.96 percent.

We estimate that using carbon tax revenue to reduce the employee-side of the OASDI payroll tax by 2.24 percentage points would increase the long-run size of the economy. On net, this swap would reduce the marginal effective tax rate on labor income, resulting in an increase in hours worked equal to 102,000 full time equivalent jobs.

A carbon tax paired with a cut to the employee-side OASDI payroll tax would make the tax code slightly more progressive on net. We estimate that taxpayers in the bottom four quintiles (0-20%, 20%-40%, 40%-60%, and 60%-80%) would see a slight increase in after-tax incomes, between 0.2 percent and 0.4 percent. High-income taxpayers would face an additional burden on both their labor income and capital income. Under current law, the OADSI payroll tax only applies to the first $138,000 and completely exempts capital income. The carbon tax would apply to labor income above that cap and to super-normal returns to capital income. As a result, taxpayers in the top 5 percent and top 1 percent see reductions in after-tax income of 0.5 and 0.8 percent respectively.

Carbon Tax and a Corporate Tax Cut

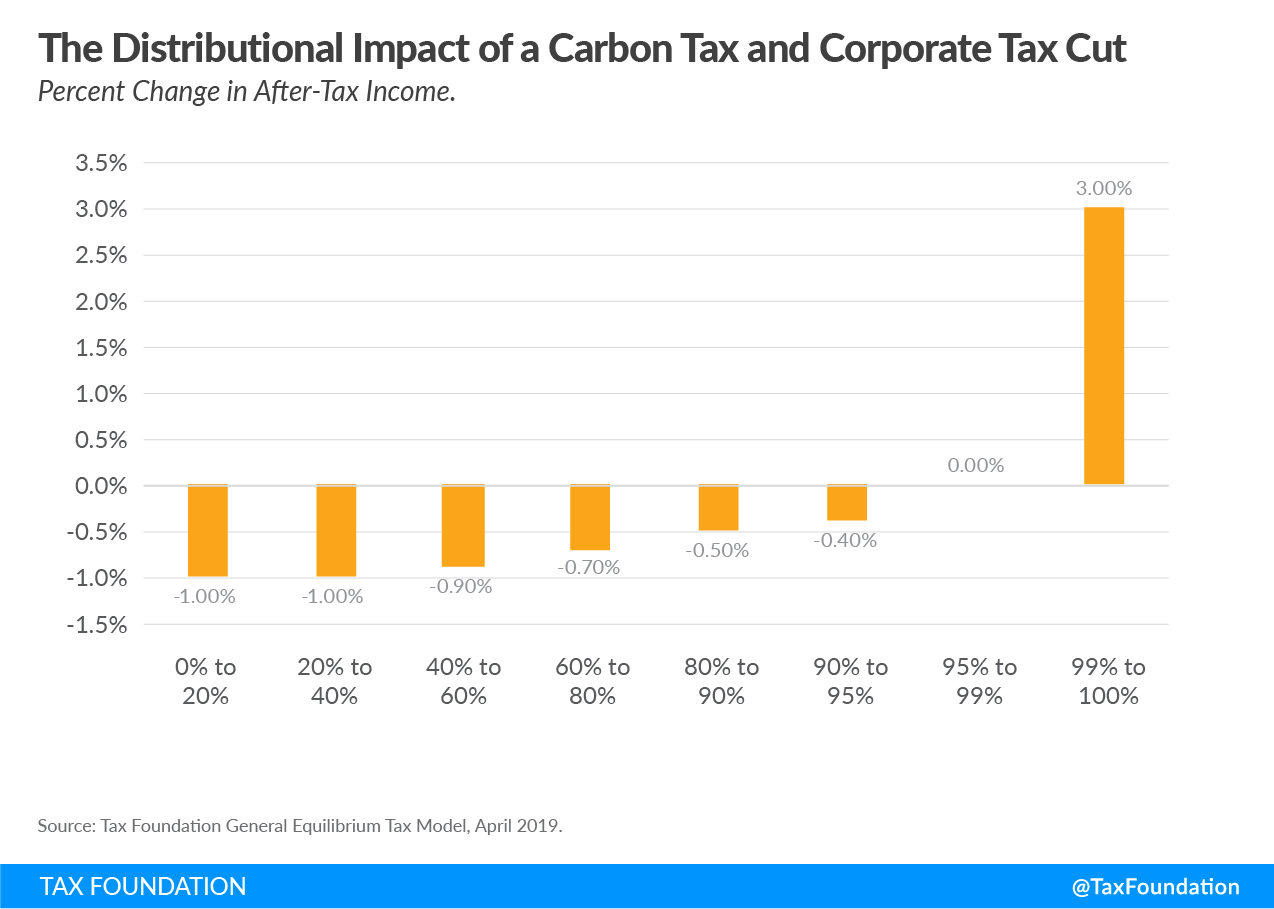

This proposal would use carbon tax revenue to reduce corporate income taxes through both a reduction in the rate and acceleration of cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. , or the speed at which companies can write off their investments. We estimate that a $50 per metric ton carbon tax would raise enough revenue to reduce the corporate income tax rate to 11 percent, make 100 percent bonus depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. permanent, and cancel the amortization of research and development costs scheduled to occur in 2021.

This swap would raise the effective marginal tax rate on labor earnings, but also reduce the cost of capital, leading to a larger capital stock. The larger capital stock would boost labor productivity and lead to 0.5 percent higher wages. However, the higher marginal effective tax rate on labor would slightly reduce hours worked, leading to 198,000 fewer full-time equivalent jobs. On net, we estimate that this swap would boost output (GDP) by 0.8 percent.

While this swap would provide the largest boost to output, it would make the tax code less progressive overall. The carbon tax would place an additional burden on taxpayers of all income levels. At the same time, the corporate tax cut would primarily boost after-tax income for taxpayers in the top 10 percent of income earners. On net, the bottom 95 percent of taxpayers would see reductions in after-tax income between 0.4 percent and 1 percent, and taxpayers in the top 1 percent would see a 3 percent increase in after-tax income.

| Carbon Tax | Carbon Tax and Dividend | Carbon Tax and OASDI Payroll Tax Cut (2.24%) | Carbon Tax and 11% Corporate Tax + Permanent 100% Bonus Depreciation and R&D Expensing | |

|---|---|---|---|---|

|

Source: Tax Foundation General Equilibrium Model, April 2019 |

||||

|

GDP |

-0.4% | -0.4% | 0.1% | 0.8% |

|

Wages |

0.0% | 0.0% | 0.0% | 0.5% |

|

FTE Jobs |

-421,000 | -421,000 | 102,000 | -198,000 |

|

0% to 20% |

-2.0% | 6.8% | 0.2% | -1.0% |

|

20% to 40% |

-1.9% | 2.4% | 0.3% | -1.0% |

|

40% to 60% |

-1.9% | 0.7% | 0.4% | -0.9% |

|

60% to 80% |

-1.8% | 0.0% | 0.3% | -0.7% |

|

80% to 90% |

-1.7% | -0.5% | 0.3% | -0.5% |

|

90% to 95% |

-1.7% | -0.8% | 0.1% | -0.4% |

|

95% to 99% |

-1.7% | -1.1% | -0.5% | 0.0% |

|

99% to 100% |

-1.4% | -1.3% | -0.8% | 3.0% |

|

TOTAL |

-1.7% | 0.0% | 0.0% | 0.0% |

Conclusion

There are many policy choices lawmakers face when designing a carbon tax, one being revenue recycling and its implications. Our analysis shows how economic and distributional effects of a carbon tax critically depend on how the generated tax revenue is used.

Assuming a broad-based carbon tax levied at a rate of $50 per metric ton and an annual growth rate of 5 percent, we estimate that the tax would generate $1.87 trillion in additional federal revenue over the next 10 years. In isolation, a carbon tax would negatively impact output and employment and make the tax code less progressive.

When pairing a carbon tax with different revenue recycling methods, these economic and distributional effects change significantly. While a lump-sum rebate would certainly increase the tax code’s progressivity, the effects on employment and output would be adverse. Using the revenue to reduce the payroll tax increases progressivity, output, and employment. Recycling the revenue by reducing the corporate income tax and making bonus depreciation and R&D expensing permanent boosts output and pretax wages while lessening progressivity and lowering employment.

Notes

[1]Jason Ye, “Carbon Pricing Proposals in the 116th Congress,” Center for Climate and Energy Solutions, September 2019, https://www.c2es.org/document/carbon-pricing-proposals-in-the-116th-congress/.

[2] LEAD on Carbon Pricing, “Participating Companies,” May 2019, https://www.leadoncarbonpricing.com/participating-companies/.

[3] International Monetary Fund, “Fiscal Policies for Paris Climate Strategies—From Principle To Practice,” May 1, 2019, https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/05/01/Fiscal-Policies-for-Paris-Climate-Strategies-from-Principle-to-Practice-46826.

[4] World Bank, “Carbon Pricing Dashboard,” Aug. 1, 2019, https://carbonpricingdashboard.worldbank.org/.

[5] Jeremy Carl and David Fedor, “Tracking global carbon revenues: A survey of carbon taxes versus cap-and-trade in the real world,” Energy Policy 96 (September 2016).

[6] Intergovernmental Panel on Climate Change, “Special Report: Global Warming of 1.5°C: Summary for Policymakers,” October 2018, https://www.ipcc.ch/sr15/chapter/spm/.

[7] John Larsen, Shashank Mohan, Peter Marsters, and Whitney Herndon, “Energy and Environmental Implications of a Carbon Tax in the United States,” Columbia SIPA Center on Global Energy Policy, July 17, 2018, https://energypolicy.columbia.edu/research/report/energy-and-environmental-implications-carbon-tax-united-states.

[8] Arthur Cecil Pigou, The Economics of Welfare (London: Macmillan, 1920).

[9] Ye, “Carbon Pricing Proposals in the 116th Congress.”

[10] John Horowitz, Julie-Anne Cronin, Hannah Hawkins, Laura Konda, and Alex Yuskavage, “Methodology for Analyzing a Carbon Tax,” Office of Tax Analysis, The Department of the Treasury, January 2017, https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-115.pdf.

[11] Environmental Protection Agency, “Global Non-CO2 Greenhouse Gas Emission Projections & Mitigation, 2015-2050,” September 2019, https://www.epa.gov/global-mitigation-non-co2-greenhouse-gases.

[12] Environmental Protection Agency, “Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2017,” April 11, 2019, https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks-1990-2017.

[13] U.S. Energy Information Administration, “Annual Energy Outlook 2019: Energy-Related Carbon Dioxide Emissions by Sector and Source,” Jan. 24, 2019, https://www.eia.gov/outlooks/aeo/data/browser/#/?id=17-AEO2019&cases=ref2019&sourcekey=0. EPA and EIA data differs slightly due to differences in methodology. For example, EIA includes international bunker fuels, while EPA does not.

[14] U.S. Energy Information Administration, “Annual Energy Outlook 2019: Energy-Related Carbon Dioxide Emissions by Sector and Source.”

[15] Gilbert E. Metcalf and David A. Weisbach, “The Design of a Carbon Tax,” The Law School, The University of Chicago, January 2009, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1324854.

[16] Christoph Böhringer, Edward J. Balistreri, and Thomas F. Rutherford, “The Role of Border Carbon Adjustment in Unilateral Climate Policy: Insights from a Model-Comparison Study,” The Harvard Project on Climate Agreements, October 2012, https://www.belfercenter.org/sites/default/files/files/publication/bohringer_dp54_v3-final.pdf.

[17] Sam Kortum and David Weisbach, “Border Adjustments for Carbon Emissions: Basic Concepts and Design,” Resources for the Future, March 2016, https://media.rff.org/archive/files/document/file/RFF-DP-16-09.pdf.

[18] Between 2006 and 2016, this measure fluctuated between 6 percent and 8 percent.

[19] Global Carbon Project, “Global Carbon Budget 2018,” https://www.icos-cp.eu/GCP/2018.

[20] U.S. emissions from international bunker fuels increased from 100 million metric tons in 2013 to 120 million metric tons in 2017, an annual increase of approximately 5 million metric tons. See Environmental Protection Agency, “Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990-2017.” We assume this trend will continue and thus increase the annual amount of international bunker fuel emissions subtracted from the tax base by 5 million metric tons.

[21] Joint Committee on Taxation, “The Income and Payroll Tax Offset to Changes in Excise Tax Revenues,” Dec. 23, 2011, https://www.jct.gov/publications.html?func=startdown&id=4378.

[22] Joint Committee on Taxation, “New Income and Payroll Tax Offsets to Changes in Excise Tax Revenues for 2018-2028,” March 27, 2018, https://www.jct.gov/publications.html?func=startdown&id=5066.

[23] Joint Committee on Taxation, “The Income and Payroll Tax Offset to Changes in Excise Tax Revenues.”

[24] This assumption is based on the results of the Stanford Energy Modeling Forum exercise 32 (EMF 32), which used 11 different models to estimate the emission, energy, and economic effects of a carbon tax. See Alexander R. Barron, Allen A. Fawcett, Marc A.C. Hafstead, James R. McFarland, and Adele C. Morris, “Policy Insights from the EMF 32 Study on U.S. Carbon Tax Scenarios,” Climate Change Economics 9:1 (March 2018).

[25] Although we modeled the carbon tax as not impacting the normal return to investment, others have stated that the carbon tax could interact with other tax policies and distort investment incentives. See Joseph Rosenberg, Eric Toder, and Chenxi Lu, “Distributional Implications of a Carbon Tax,” Urban-Brookings Tax Policy Center, July 2018, https://www.taxpolicycenter.org/sites/default/files/publication/155473/distributional_implications_of_a_carbon_tax_5.pdf.

[26] A consumption tax would also burden transfer payments that are not adjusted for inflation. However, the current version of the Tax Foundation model does not include transfer payments in its definition of income.

Share this article