Senator Elizabeth Warren’s (D-MA) campaign proposals include at least a dozen taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increases, many of which would apply to the same income. This violates a fundamental principle of sound tax policy: each dollar should be taxed only once. Despite the senator’s claims that she is asking the wealthy to pitch in just two cents, her proposed taxes would instead lead to an extremely high effective tax rate on capital income for some—potentially even reaching over 100 percent.

To illustrate the multiple layers of tax on the same pool of income that the senator’s proposal would create, consider the following example, which contains several simplifying assumptions that are noted below. It is also important to remember the potential for interactions among the various taxes Sen. Warren proposes, which may lower the revenue generated from each tax.

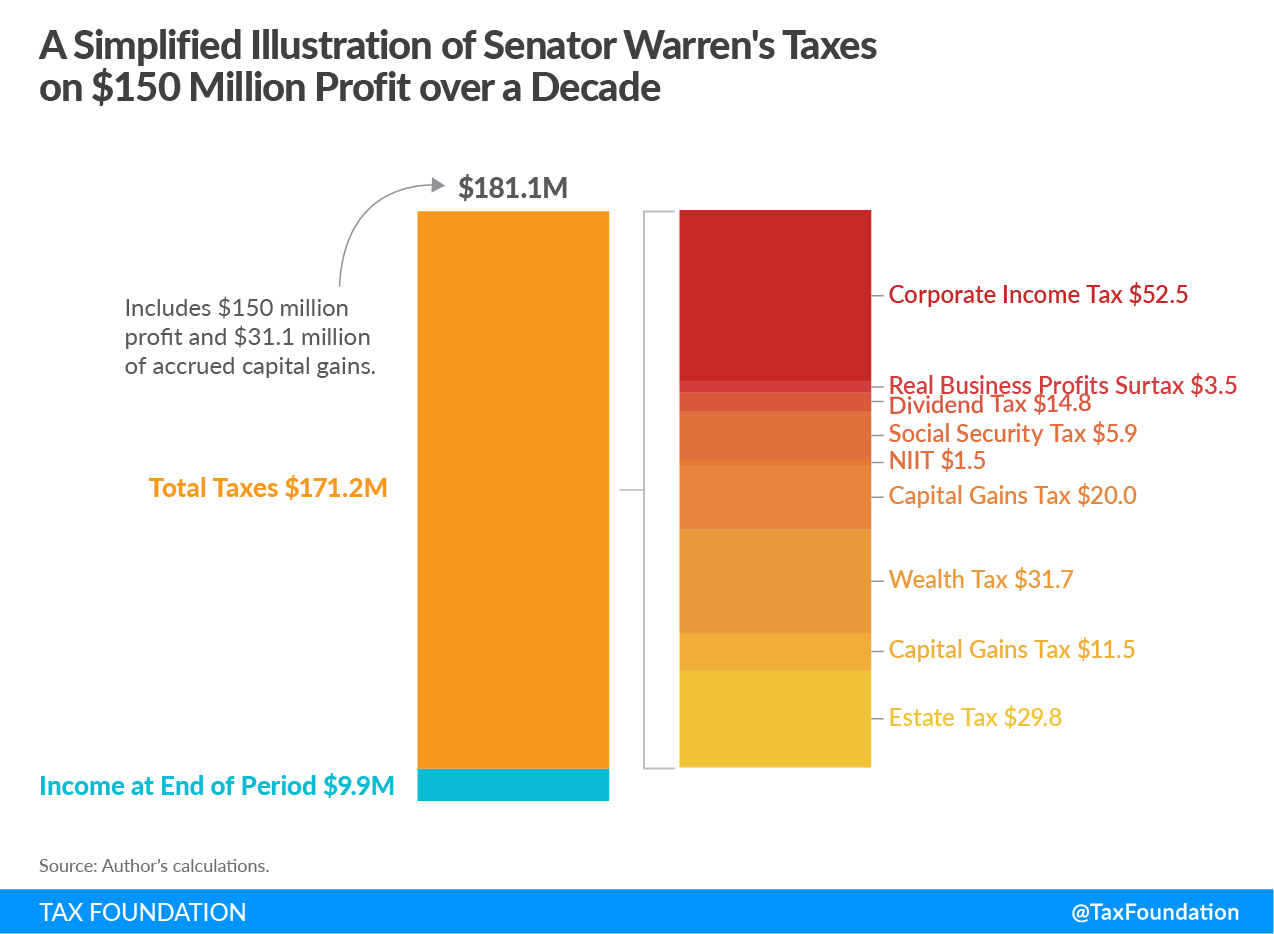

Imagine a billionaire businesswoman who makes $150 million in corporate profits from a business where she is the only shareholder. First, she would face two separate taxes: the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. of 35 percent assessed on the corporation for $52.5 million and the Real Business Profits Surtax of 7 percent for $3.5 million. The surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. would apply to a different tax base than the corporate income tax, but for this example, the 7 percent rate was applied to $50 million. The businesswoman would be left with $94 million in after-tax income after corporate taxes are remitted.

| Source: Author’s calculations. | |||

| $150 million corporate profit at beginning of period | |||

|---|---|---|---|

| Corporate Income Tax | $150 * 35% | $52.5 | |

| Real Business Profits Surtax | $50 * 7% | $3.5 | |

| Corporate Taxes Paid | $56 million | ||

| Remaining Income | $94 million | ||

Now suppose that the business distributes a $40 million dividend from its after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. . Under Warren’s plan, dividends would be taxed as ordinary income (at 37 percent, $14.8 million), face a new Social Security tax (14.8 percent, $5.9 million), and the Net Investment Income tax under current law (3.8 percent, $1.5 million). These taxes would reduce the dividend from $40 million to $17.8 million after taxes. This example assumes the current top income tax rate of 37 percent applies and subjects the full amount of the dividend to each tax.

After entity level taxes and dividend distributions, the business would be left with $54 million in retained earnings, which would increase the value of the company and the equity price. For the owner, this unrealized capital gain would be taxed under Sen. Warren’s proposed mark-to-market taxation of capital gains at ordinary income tax rates, which means that the billionaire pays taxes on the capital gains each year whether or not they sell the asset. If we assume a 1-to-1 increase in the gain from the retained earnings, that $54 million would be taxed as ordinary income, which would result in a $20 million tax at the current top 37 percent income tax rate.

|

Source: Author’s calculations. |

|||||

| $40 million dividend | |||||

|---|---|---|---|---|---|

| Dividend Tax | $40 * 37% | $14.8 | |||

| Social Security Tax | $40 * 14.8% | $5.9 | |||

| NIIT | $40 * 3.8% | $1.5 | |||

| $54 million capital gain | |||||

| Capital Gains Tax | $54 * 37% | $20 | |||

| Corporate + Shareholder Taxes Paid | $98.2 million | ||||

| Remaining Income | $51.8 million | ||||

So far in this simplified illustration, the business’s $150 million in profit has faced $98.2 million in taxes at the entity and shareholder levels, reducing the profit to $51.8 million for an effective tax rate of 65 percent.

However, Sen. Warren has plans to tax total net wealth on an annual basis too. Each year, net wealth above $50 million would be subject to a tax of 2 percent, rising to 6 percent for net wealth above $1 billion. In this example, the billionaire businesswoman’s $51.8 million increase in net wealth would be taxed at 6 percent, for a tax of $3.1 million. This brings the total taxes paid on the $150 million profit to $101.3 million, for an effective tax rate of 68 percent and after-tax income of $48.7 million.

Let’s assume over the next 10 years that the $48.7 million in income grows at an annual rate of 7 percent. Over this decade, the billionaire businesswoman would owe capital gains taxes (at the current top 37 percent rate) on her yearly gains and wealth tax (at the 6 percent rate) on her net wealth each year for a tax bill of $11.5 million and $28.6 million, respectively. Her net wealth at the end of 10 years would be $39.7 million.

If we suppose that this billionaire passes away after 10 years, under Sen. Warren’s plan, her estate would be subject to an estate tax levy with a top rate of 75 percent, leaving $9.9 million of the original $150 million in profit plus a decade of growth.

| Source: Author’s calculations. | |||

| $51.8 million in net wealth | |||

|---|---|---|---|

| Wealth Tax | Net wealth * 6% | $3.1 | |

| $48.7 million + 7% annual growth for ten years | |||

| Wealth Tax | Net wealth at end of year * 6% | $28.6 | |

| Capital Gains Tax | Annual increase in wealth * 37% | $11.5 | |

| Corporate + Shareholder + Wealth Taxes Paid | $141.4 | ||

| Remaining Income | $39.7 | ||

| Estate Tax | $39.7 * 75% | $29.8 | |

| Total Taxes Paid | $171.2 million | ||

| Remaining Income | $9.9 million | ||

After all layers of federal taxes, the effective tax rate in this simplified illustration exceeds 94 percent. Senator Warren also proposes repealing the Tax Cuts and Jobs Act (TCJA), which would change other provisions, such as the Pease limitation on itemized deductions, and increase individual income tax rates. Including TCJA repeal as well as state and local taxes in the calculation would push rates even higher.

|

Source: Author’s calculations. |

|

| Total Income | $181.1 million |

| Total Taxes Paid | $171.2 million |

| Effective Tax Rate | 94.52% |

As Harvard economist Lawrence Summers has pointed out, doing a rough calculation of Sen. Warren’s proposals yields taxes on the rich in excess of their current after-tax income. And The Wall Street Journal’s Richard Rubin figures her proposals would push federal tax rates above 100 percent on some billionaires and multimillionaires.

However, it is not likely that any billionaire would actually face effective tax rates this high, because such a system would lead the wealthy to spend down their wealth, hire tax attorneys and accountants, or find other avenues of tax avoidance. In other words, Sen. Warren’s tax increases would likely push effective tax rates above the revenue maximizing rate, which is counterproductive for raising stable revenues to support long-term spending programs.

Taken together, these proposed tax changes would significantly raise marginal and effective tax rates and increase the cost of capital, all of which would lead to a reduced level of output and less revenue than anticipated. It should go without saying: these changes would move the U.S. tax system far from an ideal tax code which emphasizes low tax rates and a broad tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .

Share this article