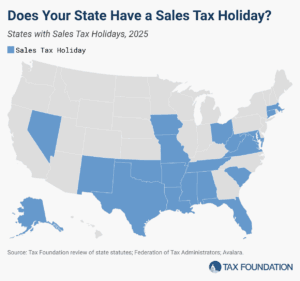

Sales Tax Holidays by State, 2025

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

16 min readKatherine Loughead is a Senior Policy Analyst & Research Manager with the Center for State Tax Policy at the Tax Foundation, where she serves as a resource to policymakers in their efforts to modernize and improve the structure of their state tax codes.

Katherine has testified before legislators in seven states and has authored or coauthored tax reform options guides on Kansas, Kentucky, Nebraska, and Wisconsin. Her work has been cited in The New York Times, The Economist, USA TODAY, Forbes, the Associated Press, and numerous state media outlets across the country.

Prior to joining the Tax Foundation in 2018, Katherine worked for a US senator and a member of the US House of Representatives, where she advised on tax policy during the consideration of the historic Tax Cuts and Jobs Act. A graduate of the John Wesley Honors College at Indiana Wesleyan University, Katherine holds a degree in English and Business Administration, as well as a paralegal certificate from Georgetown University.

Originally from Belvidere, Illinois, Katherine now lives in Nashville, Tennessee, where in her spare time she enjoys rock climbing and taking flying trapeze classes.

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

16 min read

With reports that Republican legislative leaders and Wisconsin Gov. Evers (D) have reached a budget deal for FY 2026 and 2027, it is worth examining two significant tax relief proposals included in the plan.

7 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

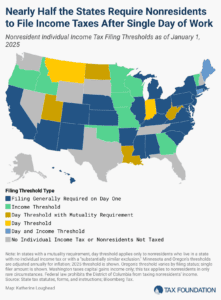

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

If adopted, these reforms would make Kansas’ tax code substantially more competitive while returning revenue growth to taxpayers in a fiscally responsible manner.

5 min read

As the property tax debate continues in Kansas, two new proposals have emerged that are much better structured, and would be more effective, than the assessment limits. However, policymakers should consider additional modifications.

7 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

From 2021-2024, within the span of 3.5 years, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

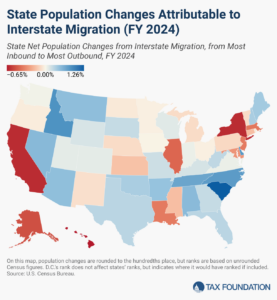

Americans were on the move in 2024, and many chose low-tax states over high-tax ones.

6 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

With a robust surplus and plenty saved for a rainy day, Kansas can afford substantial tax relief, but not all tax relief is created equal.

7 min read

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

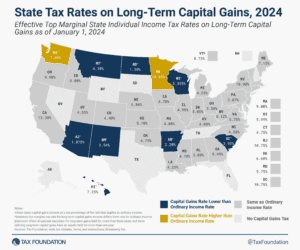

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

The “Bring Chicago Home” ballot measure would make Chicago’s tax structure substantially less neutral by raising taxes on some property transfers while decreasing taxes on others.

7 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?