Katherine Loughead is a Senior Policy Analyst & Research Manager with the Center for State Tax Policy at the Tax Foundation, where she serves as a resource to policymakers in their efforts to modernize and improve the structure of their state tax codes.

Katherine has testified before legislators in seven states and has authored or coauthored tax reform options guides on Kansas, Kentucky, Nebraska, and Wisconsin. Her work has been cited in The New York Times, The Economist, USA TODAY, Forbes, the Associated Press, and numerous state media outlets across the country.

Prior to joining the Tax Foundation in 2018, Katherine worked for a US senator and a member of the US House of Representatives, where she advised on tax policy during the consideration of the historic Tax Cuts and Jobs Act. A graduate of the John Wesley Honors College at Indiana Wesleyan University, Katherine holds a degree in English and Business Administration, as well as a paralegal certificate from Georgetown University.

Originally from Belvidere, Illinois, Katherine now lives in Nashville, Tennessee, where in her spare time she enjoys rock climbing and taking flying trapeze classes.

Latest Work

State Tax Changes Effective July 1, 2020

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

CARES Act Conformity Would Promote Economic Recovery in Nebraska

Nebraska lawmakers may ultimately opt for a package that includes both property tax relief and the renewal of business incentives, but they should avoid doing so at the expense of decoupling from the CARES Act’s liquidity-enhancing provisions.

6 min read

States Should Conform to These Four CARES Act Provisions to Enhance Business Liquidity

As policymakers continue evaluating their evolving revenue and spending options, the importance of enacting policies that enhance business liquidity must remain at the forefront.

9 min read

In Some States, 2020 Estimated Tax Payments Are Due Before 2019 Tax Returns

To prevent confusion and to ensure taxpayers receive the full benefit of the extended federal deadline, states should consider extending first- and second-quarter estimated tax payment due dates to July 15 or later.

9 min read

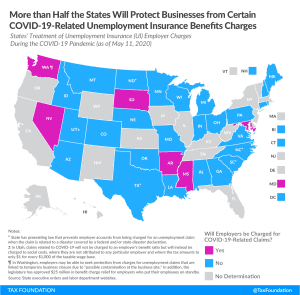

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read

April 24th Afternoon State Tax Update

Virginia enacted a biennial budget, which includes a new excise tax on “skill games.” Meanwhile, Arizona and Connecticut announced plans to convene in special sessions later this year while Oklahoma gets the green light to use rainy day fund money to close budget gaps.

4 min read

April 10th Afternoon State Tax Update

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

5 min read

April 2nd Evening State Tax Update

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

4 min read

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

March 27th Afternoon State Tax Update

Massachusetts, Ohio, and West Virginia have newly extended their income tax filing and payment deadlines to match the July 15 federal deadline.

3 min read

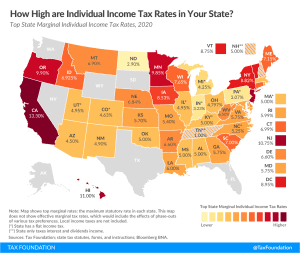

State Individual Income Tax Rates and Brackets, 2020

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

State Tax Changes as of January 1, 2020

This year was a significant one for state tax policy, and the wide range of changes taking effect January 1, 2020, reflects the scope and intensity of that activity. With states continuing to grapple with issues like the taxation of international income and collections obligations for remote sellers and marketplace facilitators, the coming year is unlikely to be any quieter.

23 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read