Analyzing the Kansas Senate’s Proposed Tax Changes

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min readKatherine Loughead is a Senior Policy Analyst & Research Manager with the Center for State Tax Policy at the Tax Foundation, where she serves as a resource to policymakers in their efforts to modernize and improve the structure of their state tax codes.

Ms. Loughead was one of the lead authors of Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform and Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform. Her work has been cited in The New York Times, USA TODAY, Forbes, the Associated Press, and numerous state media outlets across the country.

Prior to joining the Tax Foundation in April 2018, Ms. Loughead worked for a U.S. senator and a member of the U.S. House of Representatives, where she advised on tax policy during the consideration and enactment of the historic Tax Cuts and Jobs Act. A graduate of the John Wesley Honors College at Indiana Wesleyan University, Ms. Loughead holds a degree in English and Business Administration, as well as a paralegal certificate from Georgetown University.

Originally from Belvidere, Illinois, Katherine now lives in Washington, D.C., where in her spare time she can be found taking flying trapeze classes or reliving her gymnastics days at the local YMCA.

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

Done responsibly, reducing income tax rates while consolidating brackets would return excess tax collections to taxpayers and promote long-term economic growth in Nebraska.

3 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

With increases to the standard deduction, a flat tax could provide a net tax cut to taxpayers of all income levels, providing both short-term and long-term relief to taxpayers across the income spectrum. It would also simplify the tax code in ways that encourage greater investment and economic growth, particularly by ensuring that the marginal rate on small business investment is competitive with peer states.

4 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

1 min read

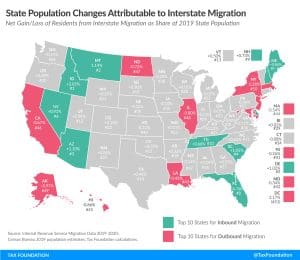

IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

12 min read

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

While Wisconsin has long been one of the highest-tax states in the nation, that distinction is increasingly detrimental as businesses and individuals enjoy increased economic and geographic mobility.

6 min read

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

As Kentucky policymakers make final decisions on tax relief this year, they should make the most of this opportunity to return excess tax collections in a manner that would also enhance the Bluegrass State’s prospects for long-term economic growth.

5 min read

If Nebraska is to create a competitive environment and attract in-state investment, comprehensive tax modernization must be a priority.

9 min read

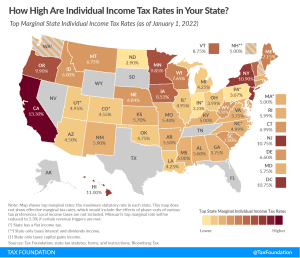

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

Tax relief can take many different forms, but not all tax cuts have the same effects. Ultimately, maintaining broad tax bases while reducing tax rates is a more neutral and less complex approach than further narrowing an already-narrow sales tax base.

4 min read

With the adoption of its new budget in mid-November, North Carolina has reinforced its position as a leader in pro-growth tax reform, becoming the 12th state to enact income tax rate reductions in 2021 alone.

6 min read