Katherine Loughead is a Senior Policy Analyst & Research Manager with the Center for State Tax Policy at the Tax Foundation, where she serves as a resource to policymakers in their efforts to modernize and improve the structure of their state tax codes.

Ms. Loughead was one of the lead authors of Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform and Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform. Her work has been cited in The New York Times, USA TODAY, Forbes, the Associated Press, and numerous state media outlets across the country.

Prior to joining the Tax Foundation in April 2018, Ms. Loughead worked for a U.S. senator and a member of the U.S. House of Representatives, where she advised on tax policy during the consideration and enactment of the historic Tax Cuts and Jobs Act. A graduate of the John Wesley Honors College at Indiana Wesleyan University, Ms. Loughead holds a degree in English and Business Administration, as well as a paralegal certificate from Georgetown University.

Originally from Belvidere, Illinois, Katherine now lives in Washington, D.C., where in her spare time she can be found taking flying trapeze classes or reliving her gymnastics days at the local YMCA.

Latest Work

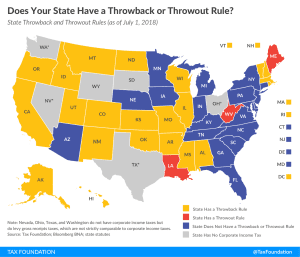

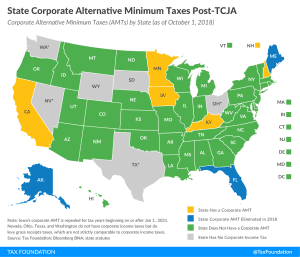

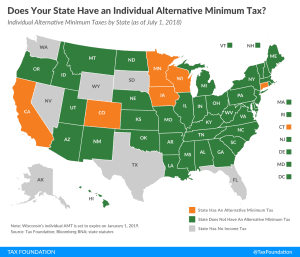

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

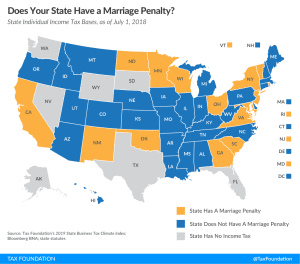

Does Your State Have a Marriage Penalty?

1 min read

Results of 2018 State and Local Tax Ballot Initiatives

Ballot initiatives are often an afterthought on Election Day, but in many states, voters went to the polls to weigh in on significant tax policy questions. Here are the most recent results we’ve compiled for tax-related ballot measures.

5 min read

Top State Tax Ballot Initiatives to Watch in 2018

Explore our list of the top state tax ballot measures to watch for throughout the country.

11 min read