Tax Freedom Day 2018 is April 19th

Tax Freedom Day is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. In 2018, Tax Freedom Day falls on April 19th, 109 days into the year.

5 min readErica York is Vice President of Federal Tax Policy with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Tax Freedom Day is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. In 2018, Tax Freedom Day falls on April 19th, 109 days into the year.

5 min read

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

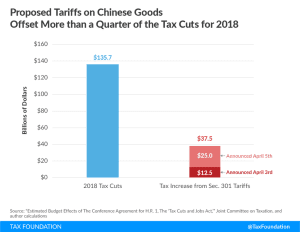

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read

President Trump’s new tariffs on steel and aluminum will have negative consequences for downstream manufacturing companies, consumers, and other sectors in the economy.

4 min read

Taxpayers reported $10.4 trillion of total income on their 2015 tax returns. This report breaks down the sources of this income: wages and salaries, business income, investment income, and retirement income.

9 min read

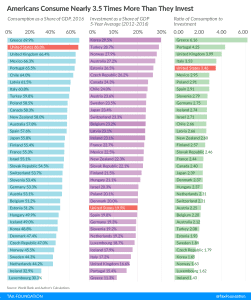

Recent data show that Americans stand out for consuming much more than they invest, and this is due in part to the tax code’s bias against savings.

3 min read

Tariffs on washing machines and solar cells, though designed to help U.S. manufacturing and protect consumers, will likely raise prices and distort markets.

3 min read