IRS Extends Tax Filing Deadline to May 17

Since February 12th, the Internal Revenue Service (IRS) has been processing federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. returns for the 2020 tax year, complicated for taxpayers and the IRS by the coronavirus pandemic and multiple pandemic-related relief packages passed last year. That’s why on Wednesday, the IRS announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes and give the IRS opportunity to clear its backlog of tax returns and correspondence.

Because of tax policy changes introduced through the CARES Act (passed in March 2020), the coronavirus relief package in the Consolidated Appropriations Act, 2021 (passed in December), and the American Rescue Plan Act (ARPA, signed just a week ago), the tax filing season has several unique features to keep in mind:

- the adjustment of economic impact payments on individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. returns;

- a tax exclusion for the first $10,200 in unemployment insurance (UI) benefits; and

- changes to individual tax refunds.

With these changes, outlined below, the IRS is urging taxpayers to file their returns electronically to expedite the processing of tax returns.

Economic Impact Payments

The IRS and Treasury Department sent two rounds of economic impact payments to individuals in 2020 as part of broader coronavirus relief packages. The payments, sometimes called stimulus payments, were sent through direct deposit, paper check, or prepaid debit cards. Technically, the payments are tax credits advanced to individuals based on their 2018 or 2019 adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. (AGI). For the filing season now underway, the IRS updated the 2020 Form 1040 to finalize payments in case individuals are eligible for an additional amount.

Individuals may receive an additional payment (in the form of a refundable tax credit on their 2020 individual income tax return) in one of two ways. First, filers who did not receive either of the payments due to processing delays or errors may claim it on their return. Second, filers likely will benefit by using 2020 AGI when calculating any credit they are owed. If a filer received a partial payment (or no payment at all) because of a 2018 or 2019 AGI above the phaseout threshold, using a lower 2020 AGI would make them eligible for an additional payment.

Filers who did not receive a payment for an eligible dependent may also receive the credit on their tax return. (Additionally, filers who originally were not eligible for a CARES Act payment because they lacked a Social Security number may be eligible if they are part of an eligible mixed-status family.)

Adjustments are only made in the taxpayers’ favor, so taxpayers will not see any increase in their tax liability related to the payments. Because the payments are tax credits, they are not taxable income.

Adjustments for the latest round of $1,400 economic impact payments through the ARPA will be made in the 2022 tax filing season.

Unemployment Insurance Benefits

Lawmakers responded to the unprecedented increase in unemployment in 2020 with large increases in the payment of unemployment insurance (UI) benefits. The UI benefits helped support American incomes through the year and are considered taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. .

To avoid an unexpected tax bill when filing their taxes, taxpayers would have needed to correctly withhold taxes from their UI benefits. For federal income taxes, a taxpayer can opt into a 10 percent withholding rate, but it is not required. Taxpayers may additionally remit quarterly estimated taxes throughout the year. Many taxpayers likely have not properly withheld or saved tax owed on UI benefits, which may create an unexpected tax liability when they file for the 2020 tax year.

To provide tax relief for unemployed workers, the ARPA excluded the first $10,200 in unemployment benefits for filers earning less than $150,000 per year. The IRS will provide guidance on this exclusion for filers who have already filed their tax return and received unemployment benefits; they may not need to submit an amended return if the IRS automatically calculates the proper tax owed and sends out a tax refund if necessary.

According to the U.S. Department of Labor, about $6.4 billion in unemployment insurance benefits were paid in the fourth quarter of 2019. By the second quarter of 2020, this jumped to $64.2 billion, and the third quarter of 2020 saw $48.7 billion in UI benefits paid. The higher UI benefit payments follow the rise in unemployment from 3.5 percent in February 2020 to a peak of 14.8 percent in April 2020. The unemployment rate remains elevated, at about 6.7 percent in December.

Refundable Tax Credits

The December coronavirus relief package included an adjustment to the way the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (EITC) and the Child Tax Credit (CTC) are calculated for the 2020 tax year. Normally, both credit amounts are calculated based on earned income and phase in over time for lower-income earners. The phase-in with earned income means that an economic downturn can lower the value of credits for people who may have lost their incomes due to the pandemic.

Filers can use 2019 earnings in lieu of 2020 to determine credit eligibility for tax filing. The “lookback” provision will raise the total amount of refundable credits provided to lower-income earners. It will be important for filers to compare earned income for both tax years to see what is best for their tax situation. The Joint Committee on Taxation (JCT) estimates that the lookback will reduce federal revenue by about $4.1 billion in 2021.

Tax Refunds

Many filers are concerned about tax refunds heading into tax season. The combination of unique economic and tax policy circumstances may affect refunds both for individual taxpayers and in the aggregate.

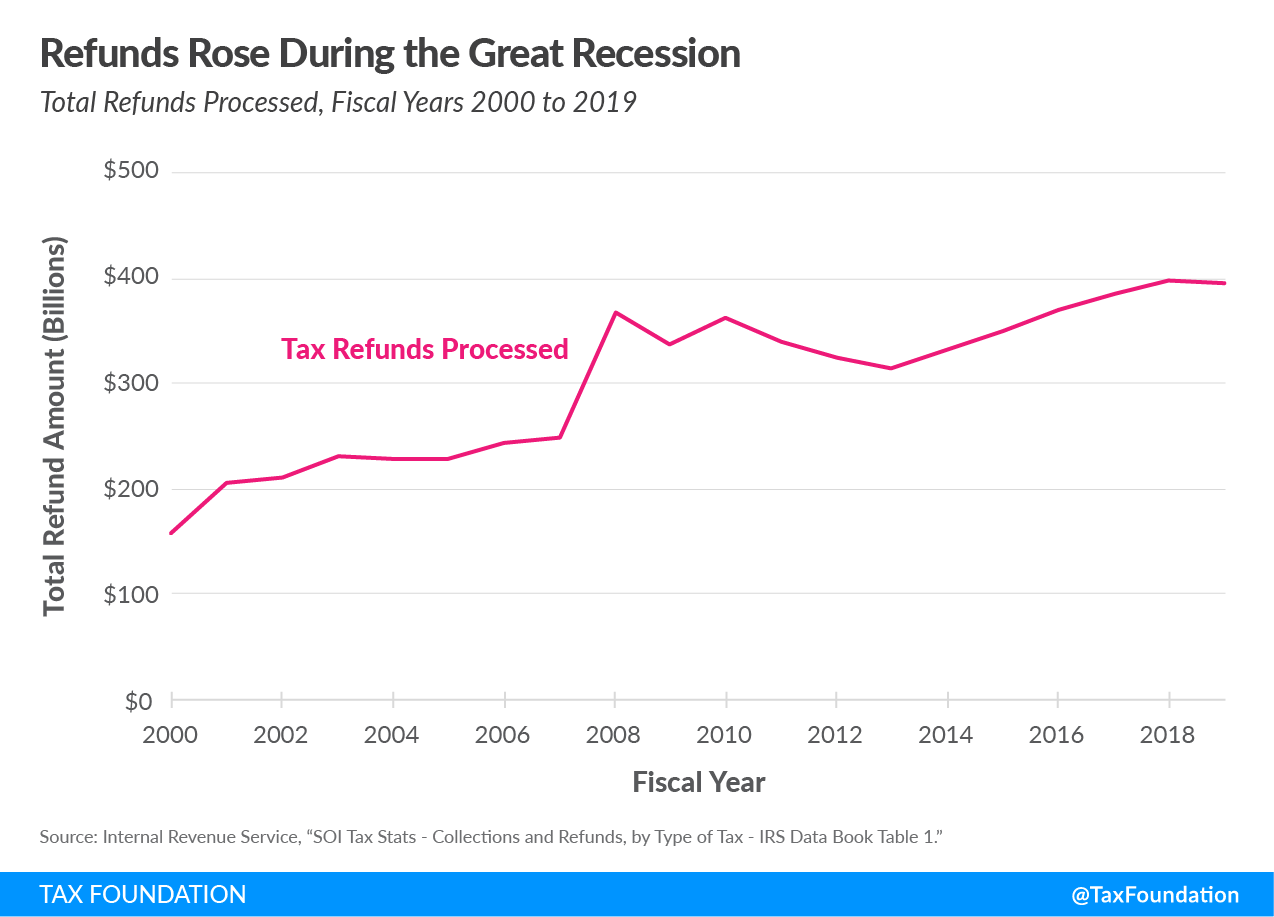

Economic recessions tend to impact refunds because taxpayers have lower incomes and tax policy tends to provide stimulus that flows into refund amounts. During the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. , for example, total refunds rose above trend from about $250 billion in 2007 to $335 billion in 2009 before remaining flat for the next several years (see the following Figure). The share of returns with a tax refundA tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. The U.S. Treasury estimates that nearly three-fourths of taxpayers are over-withheld, resulting in a tax refund for millions. Overpaying taxes can be viewed as an interest-free loan to the government. On the other hand, approximately one-fifth of taxpayers underwithhold; this can occur if a person works multiple jobs and does not appropriately adjust their W-4 to account for additional income, or if spousal income is not appropriately accounted for on W-4s. , however, remained stable at between 75 percent and 80 percent of returns filed in those years. The average tax refund also rose, from about $2,200 in 2007 to about $2,600 in 2009, before dropping to about $2,200 in 2016.

Where tax refunds will end up for the 2020 tax year is uncertain, though the trends tend to point toward higher refund levels compared to recent tax seasons. Many taxpayers have yet to claim their economic impact payment. Up to nine million individuals eligible for a payment had not received one as of mid-September 2020. Additionally, individuals who have not received a second-round stimulus payment must indicate it on their tax return to receive this credit. Filers will have to watch that they do not double claim these payments if the second-round payment arrives after filing a return, which may require an amendment to the tax return.

The payments will tend to increase refunds, all else equal, though it’s unclear how many people who typically do not file a tax return will do so this year to claim a payment.

The lookback adjustment for tax credits may also help sustain refund levels for lower-income taxpayers. The estimated $4 billion cost of the adjustment is about 1 percent of 2019 tax refunds processed, though the revenue loss is unlikely to translate to a direct dollar-for-dollar increase in tax refunds.

The increase in unemployment insurance claims means some filers may have additional tax owed if they have not properly withheld tax over the tax year. The same problem, however, was not so large during the Great Recession to offset the other trends pushing tax refunds up overall. The recent exclusion of the first $10,200 in unemployment benefits for those earning less than $150,000 will limit unexpected tax bills and makes it more likely that refunds will be higher than prior years.

While tax refunds are an area of focus for taxpayers, it’s important to remember that tax refunds are not an accurate way of looking at tax liability or evaluating how tax changes impact taxpayers’ after-tax incomes.

The 2021 tax season is a messy one for taxpayers, the IRS, and state tax authorities because of the tax changes made over the past year and the logistical challenges due to the ongoing pandemic. The IRS should provide flexibility for individuals and businesses seeking to comply with and understand their tax obligations for the year while looking forward to ways that would simplify tax compliance and the filing process.

Related Resources

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe