The Biden administration has put forward significant plans for changing tax policy, including taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. changes that would impact workers. While the administration is trying to narrowly target tax hikes to individuals who earn more than $400,000 and provide tax relief to families, it is helpful to understand what the tax burden looks like for workers outside of those potential policy changes.

Workers in the United States generally face two major taxes on income: individual income tax and payroll tax (levied on both the employee and the employer). Slightly more than half of the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. burden is paid by employers, but workers ultimately bear this burden through lower take-home pay.

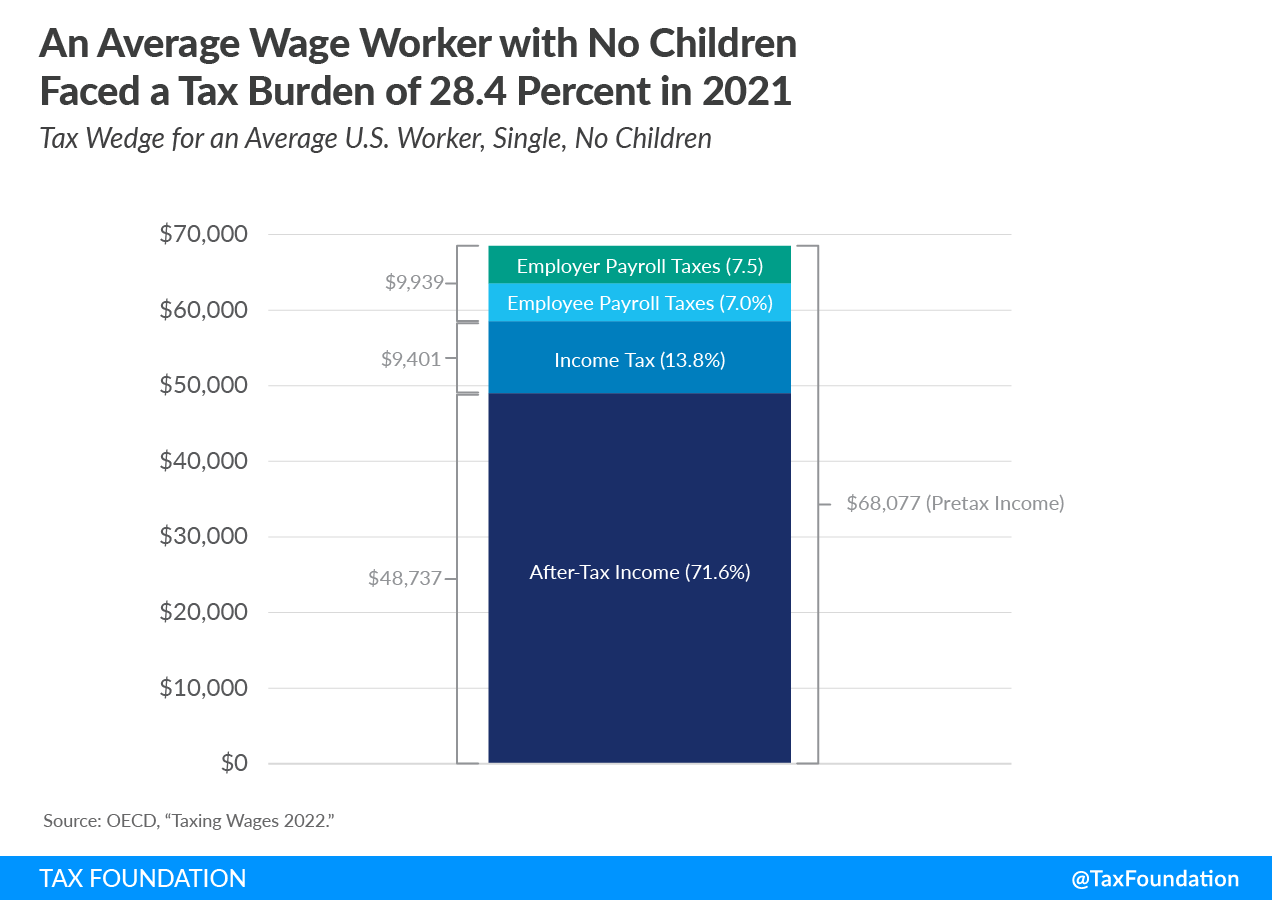

In 2021, the Organisation for Economic Co-operation and Development (OECD) reported that the overall tax burden on an average income single worker in the U.S. with $68,000 in pretax income was $19,340, amounting to a 28.4 percent tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. . This is 6 percentage points lower than the average tax burden on labor for single workers among OECD countries.

The tax burden that the worker faces includes the income tax share of 13.8 percent of pretax income, employee payroll taxes of 7.1 percent, and employer payroll taxes of 7.5 percent. Payroll taxes fund federal programs such as Social Security, Medicare, and Unemployment Insurance (UI).

The tax wedge on labor income is the difference between total labor costs to the employer and the net take-home pay of the employee. To calculate a country’s tax wedge, the OECD adds the income tax payment, employee payroll tax payment, and employer-side payroll tax payment of a worker making the country’s average wage. The OECD divides this amount by the total labor cost of this average worker, or what the worker would have earned in the absence of these three taxes.

Personal income taxes in the U.S. are progressive. This means that as individuals earn more, they pay more income taxes. Currently, seven income tax brackets range from 10 percent to 37 percent.

However, various provisions in the tax code, including benefits for families with children and work incentives, provide tax reductions for workers. While the tax burden was 28.4 percent for a single worker making the average wage in 2021, that burden was just 8.5 percent for a family with one income earner and two children.

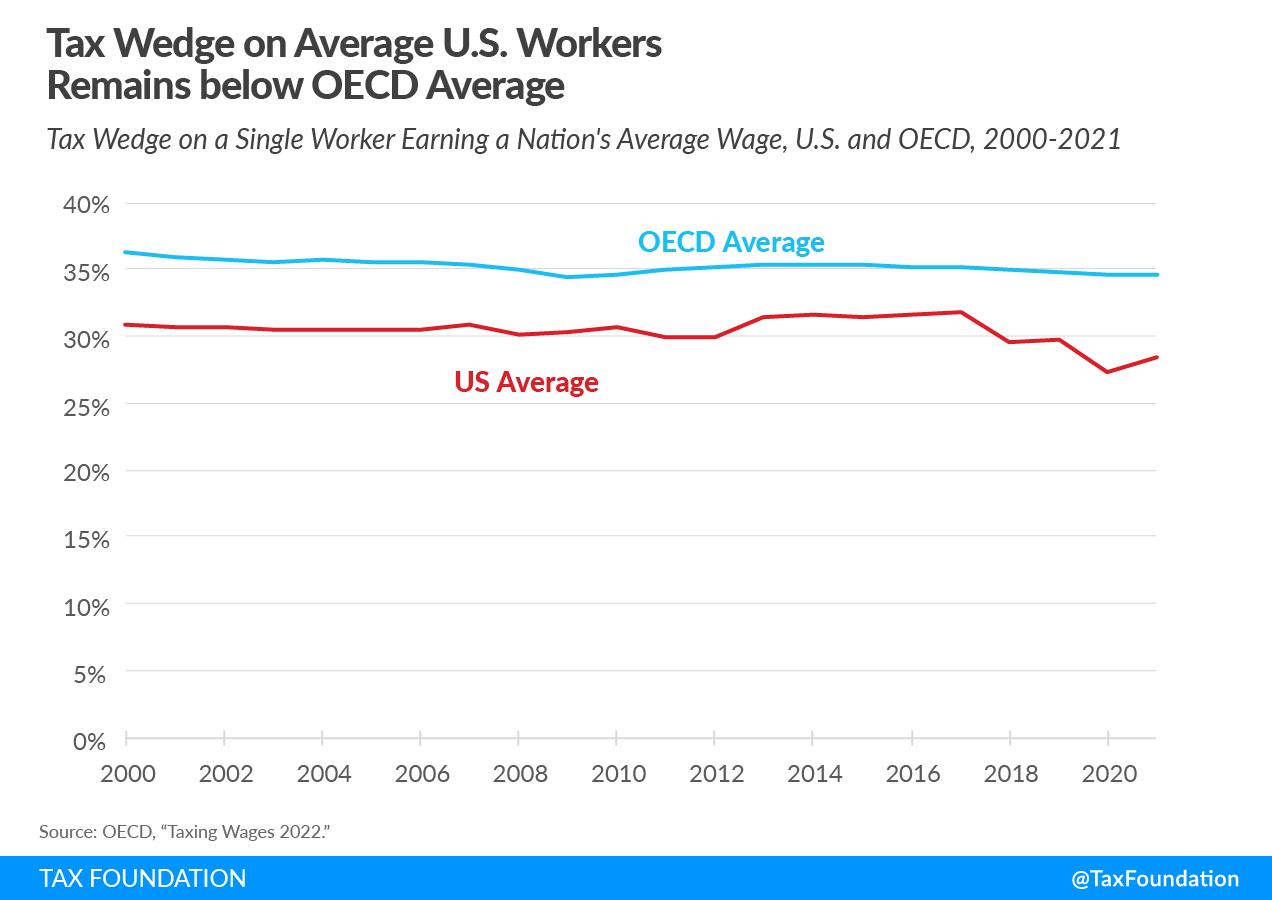

The U.S. tax burden on single workers making the average wage has consistently remained below the OECD average, with the difference expanding a bit in the years since the 2017 Tax Cuts and Jobs Act (TCJA). That difference was largest in 2020 when the U.S. tax burden on workers earning the average wage shrank to 27.2 percent before rebounding a bit in 2021.

The 2020 low point was partially a result of the economic impact payments which provided direct payments to millions of taxpayers in the United States. There were two rounds of these payments in 2020 and a third round in 2021. Overall, $867 billion in direct payments were provided to taxpayers.

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes. Individual income taxes and payroll taxes together make up the tax burden on labor in the U.S., which increased slightly in 2021 but remains below the levels faced by workers prior to the TCJA.

To make the taxation of labor more efficient, policymakers in the U.S. and abroad should understand how the tax wedge is generated, and taxpayers should understand how their tax burden funds government services. This will be particularly important as policymakers explore ways to encourage a robust economic recovery.

Share this article