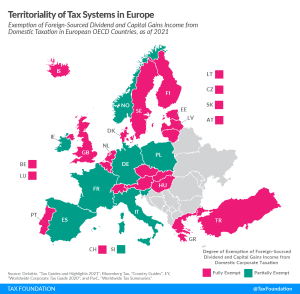

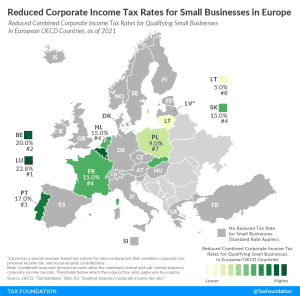

Territoriality of Tax Systems in Europe

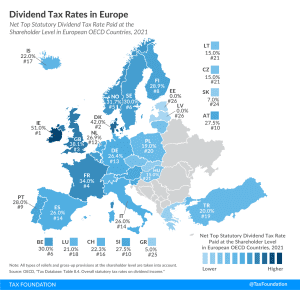

19 European OECD countries employ a fully territorial tax system, exempting all foreign-sourced dividend and capital gains income from domestic taxation. No European OECD country operates a worldwide tax system.

3 min read