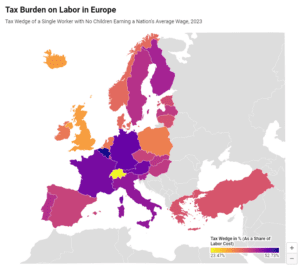

Tax Burden on Labor in Europe, 2024

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

The recent push to increase taxes on the wealthy has gained significant traction across Europe. This report highlights the obstacles and complex interplay between tax policy and economic behavior, suggesting that simply raising tax rates on the wealthy might not yield the intended social benefits.

42 min read

Improving the country’s fiscal situation won’t be comfortable, but economic growth can help cushion the blow.

3 min read

European Union Member States are in the process of implementing the global minimum tax in line with a directive unanimously agreed to at the end of 2022.

3 min read

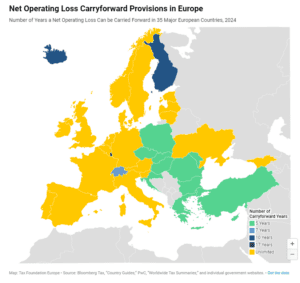

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

On Europe Day, our experts explore how the decisions made in the upcoming elections will shape the trajectory of the continent for years to come.

4 min read

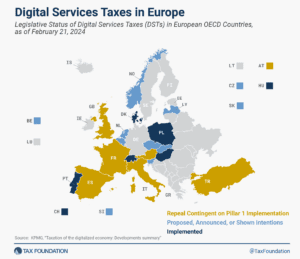

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

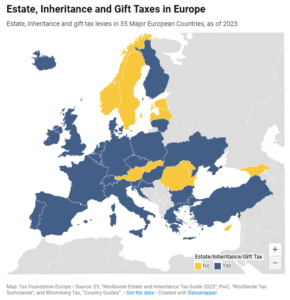

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

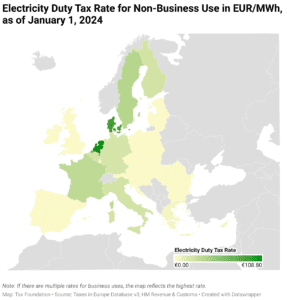

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

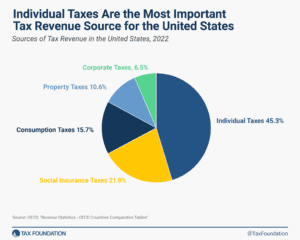

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

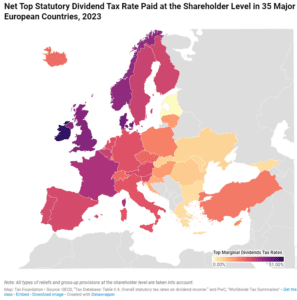

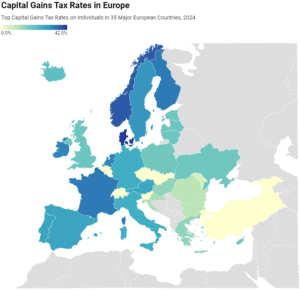

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

Pillar Two, the international global minimum tax agreement, has a considerable chance of failing and may ultimately allow the same problems it was designed to address.

6 min read