All Related Articles

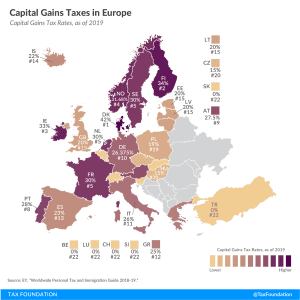

Capital Gains Taxes in Europe, 2019

2 min read

The Italian DST Marches On

3 min read

The ABCs of the OECD Secretariat’s Unified Approach on Pillar 1

If there is double taxation due to digital services taxes or because a country is unwilling to conform to the structure of the Secretariat’s proposal, the impact would be a net negative for many businesses.

8 min read

Next Steps from the OECD on BEPS 2.0

The continuation of this work is important, but the OECD and policymakers around the world should carefully consider whether these proposals will lead to more certainty, or if they will undermine that goal by simply be a step toward more unilateralism. The impact on cross-border investment will also be a critical issue to consider, and the ongoing impact assessment by the OECD is an important part of the work.

6 min read

OECD Tackling Harmful Tax Practices

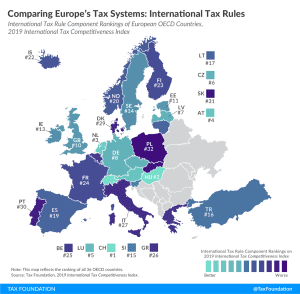

Countries around the world often design their tax policies to become attractive targets for foreign investment. These policies can be anything from a system with special preferences for certain industries to a well-designed tax system based on principles of sound tax policy. Systems that are rife with special preferences and complexities can create distortions in local jurisdictions and across the global economy.

3 min read

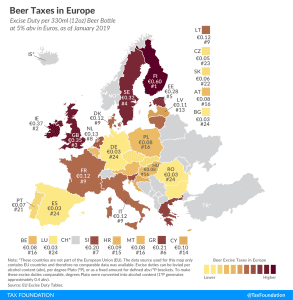

Beer Taxes in Europe, 2019

2 min read

The Italian DST Remix

6 min read

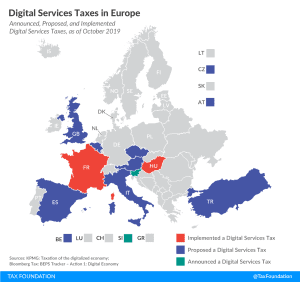

Digital Services Taxes in Europe, 2019

4 min read

Summary and Analysis of the OECD’s Work Program for BEPS 2.0

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read

Tax Burden on Labor in Europe, 2019

2 min read

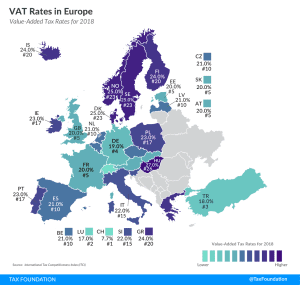

Reliance on Consumption Taxes in Europe

2 min read