All Related Articles

Two Roads Diverge in the OECD’s Impact Assessment

The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions.

6 min read

Pillars, Blueprints, an Impact Assessment, and Construction Delays

The OECD released blueprints for proposals on changing international tax rules alongside an impact assessment based on the overall design of the proposals. While the blueprints cover proposals both for changing where large multinationals owe corporate tax and designing a global minimum tax, there are still many unanswered questions. In the meantime, other digital tax proposals are moving forward and have the potential to result in a harmful tax and trade war.

4 min read

Designing a Global Minimum Tax with Full Expensing

The design and implementation of a global minimum tax is not simple and straightforward. There are dozens of challenging issues that policymakers will need to consider. So, when it comes to the way the minimum tax treats new investment, it seems clear that incorporating full expensing into the design would have significant benefits.

6 min read

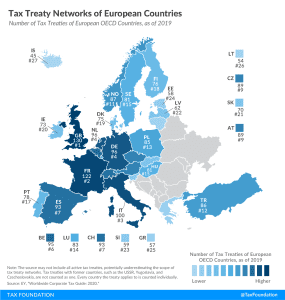

Tax Treaty Network of European Countries

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

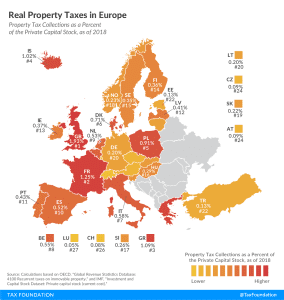

Proposals to Lure Foreigners to Greece Highlight Need to Reform Property Taxes

A more efficient property tax system in Greece is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

Real Property Taxes in Europe, 2020

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

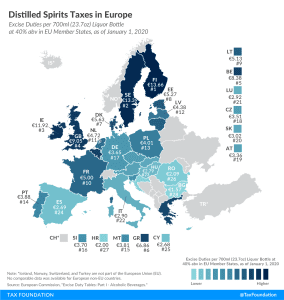

Distilled Spirits Taxes in Europe

2 min read

The New EU Budget is Light on Details of Tax Proposals

The European Council recently agreed on a new multiannual budget and a recovery program, which sets EU budget levels for 2021-2027 totals €1 trillion (US $1.2 trillion). The lack of details on the various tax proposals and the eventual need for revenue sources to finance new EU debt mean there is a lot of work left for policymakers in Brussels to do.

4 min read

Peruvian “Solidarity Tax” Unlikely to Offset Deficit Spending

While it is important that Peru find ways to offset its deficit spending, a temporary wealth tax may introduce more problems than it solves.

5 min read

Tax Policy Proposals for the German EU Presidency

While much of Germany’s EU presidency agenda is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic, there’s a pair of tax proposals that the country is planning to develop and move forward at the EU level: a financial transaction tax and a minimum effective tax.

5 min read