Tax Foundation Response to OECD Consultation on Amount A of Pillar One

Pillar One Amount A is meant to reallocate taxable profits of large multinationals, mitigate double taxation of profits, and avoid a harmful tax and trade war.

Pillar One Amount A is meant to reallocate taxable profits of large multinationals, mitigate double taxation of profits, and avoid a harmful tax and trade war.

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

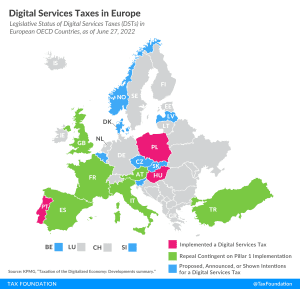

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

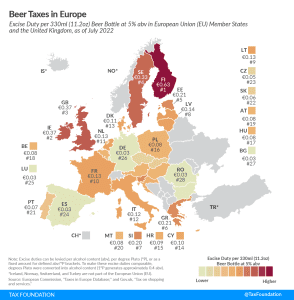

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

While the global minimum tax gets much attention in the media, there is another significant piece to the deal.

6 min read

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

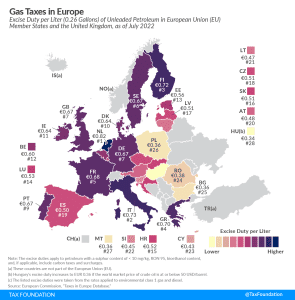

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

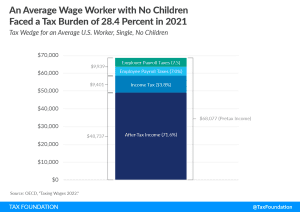

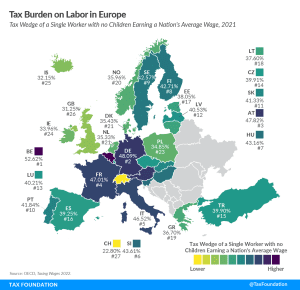

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

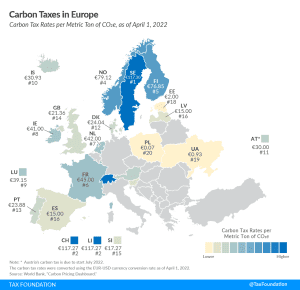

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read

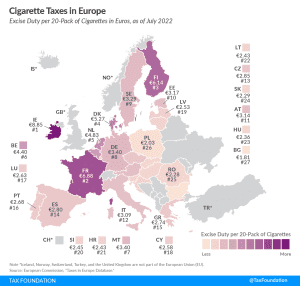

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read