One US Tax Policy OECD Countries Should Copy

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

7 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

7 min read

The European Commission proposed new budget options for 2028 to 2034. It is worth zooming in on one new proposal for revenues that would support EU-level spending. The “Corporate Resource for Europe,” or CORE, provides a good opportunity to think through how best to raise revenue for the EU budget.

5 min read

Sean Bray interviews Dr. Michele Chang, Director of the Masters in Transatlantic Affairs and Professor of European Political Governance at the College of Europe, about the future of the EU tax mix.

12 min read

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

4 min read

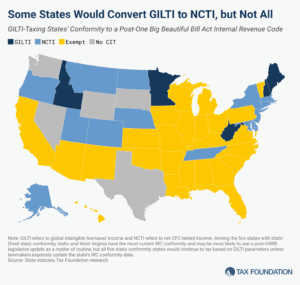

The One Big Beautiful Bill’s changes to the taxation of international income have surprising implications for state codes, yielding tax increases and a revised tax base that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

10 min read

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

Policymakers continue to debate international tax rules after the US gained agreement on a new approach at the G7 that could result in US anti-avoidance policies existing side-by-side with the global minimum tax.

4 min read

While well-designed excise taxes can make society better off, some of the health taxes proposed by the WHO use a pretty façade to cover for policies that fail to deliver their promised benefits.

5 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Dominika Langenmayr, Professor of Economics at Catholic University of Eichstätt-Ingolstadt, about the future of the EU tax mix.

15 min read

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

Between Russia’s war in Ukraine, President Trump’s uncertain policies towards Europe, and Poland’s attempt to increase domestic defense capabilities, raising revenue has become one of the most critical topics in the campaign.

7 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

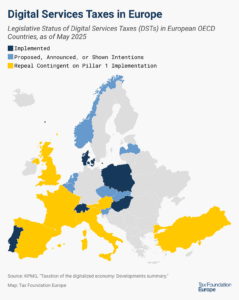

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read