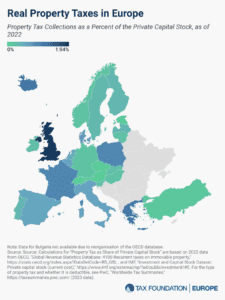

Real Property Taxes in Europe, 2024

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

Bob Stack, an international tax expert, explores the implications of the EU’s adoption of Pillar Two and the potential for streamlining overlapping policies. He also addresses the issues that the US faces in global tax policy with the upcoming elections.

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

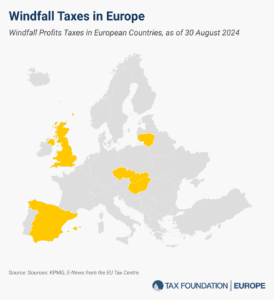

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

Pillar Two risks creating a more complex and unfair international tax system. It is inadvertently fostering new, opaque, and complex forms of competition, and policymakers should consider alternative approaches to creating a fairer international tax environment.

4 min read

How does living abroad impact the taxes an American has to pay? Unlike most countries that tax based on residency, the US employs citizenship-based taxation, meaning Americans are taxed on their global income regardless of where they reside.

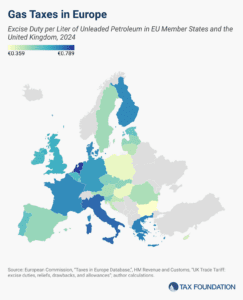

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

The global tax deal and Pillar Two are shaking up the tax landscape worldwide, introducing a web of complexity and confusion.

“No tax on tips” might be a catchy idea on the campaign trail. But it could create plenty of headaches, from figuring out tips on previously untipped services to an unexpectedly large loss of federal revenue.

6 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

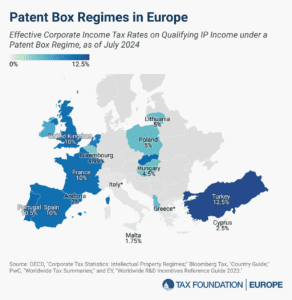

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Puerto Rico, a US territory with a limited ability to set its own tax policies, will be the first part of the US to be substantially affected by Pillar Two, the global tax agreement that seeks to establish a 15 percent minimum tax rate on corporate income.

17 min read

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

As Hungary takes over the six-month rotating presidency of the Council of the European Union in the aftermath of the European elections, the relationship between tax policy and Europe’s competitiveness will be closely linked.

6 min read

While neither full expiration nor a deficit-financed full extension of the TCJA would be appropriate, lawmakers should consider the incentive effects of whichever tax reform they pursue. Because taxes affect the economy, they also affect the sustainability of debt reduction.

3 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

Given the positive contribution of full expensing to economic growth and that the UK already incurred the peak-year costs due to the existing policy, it is imperative to maintain it permanently.

5 min read

The National Foreign Trade Council’s survey shows that the private sector recognizes the economic value of treaties as an instrument to increase tax certainty and decrease distortions.

3 min read