Sources of U.S. Tax Revenue by Tax Type, 2023

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

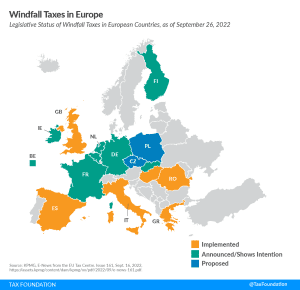

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

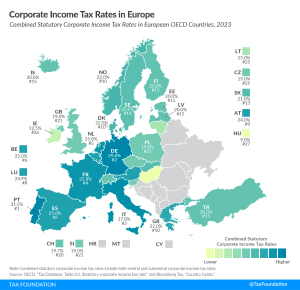

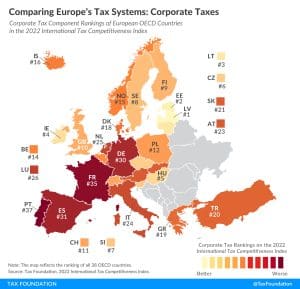

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

President Biden’s State of the Union Address outlined three tax proposals, including raising the tax on stock buybacks, imposing a billionaire minimum tax, and expanding the child tax credit.

6 min read

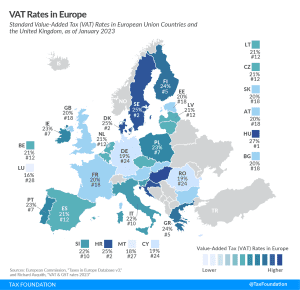

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

The process leading to the global minimum tax has been messy, and the mess will likely continue for years to come. New revenues are hardly a salve for the setback they represent.

7 min read

Before EU policymakers rush to implement massive reforms, they should remember the goals of the Single Market, its international limitations, and the role of tax policy.

4 min read

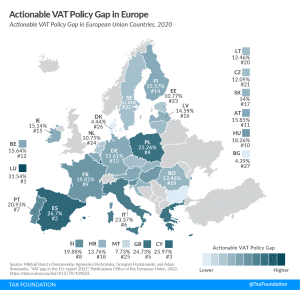

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

The EU’s unilateral approach with carbon taxes, faster track on the global minimum tax, and threat of renewed efforts on DSTs means that U.S. policymakers face some hard choices. Policymakers on both sides of the Atlantic should keep in mind pro-growth tax and trade principles that promote a rules-based international order and increase opportunity.

7 min read

As it stands, Pillar One would usher in the end of many digital services taxes (though perhaps not all) at the cost of increased complexity (in an already complex and uncertain system).

4 min read

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

While there is disagreement about the amount of interest that should be deductible, it’s clear that the limit based on EBIT makes the U.S. an outlier compared to other countries across the OECD while raising the cost of new investment.

7 min read

Europe is facing difficult times. Governments are balancing the need for more resources with the need to maintain peace and prosperity domestically. To properly strike this balance, EU policymakers must incorporate “Fiscal Fairness” into the debate.

2 min read

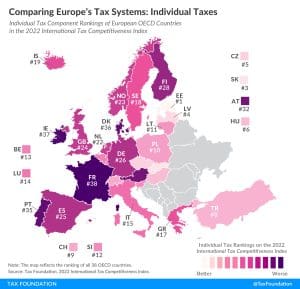

France’s individual income tax system is the least competitive among OECD countries. France’s top marginal tax rate of 45.9 percent is applied at 14.7 times the average national income. Additionally, a 9.7 surtax is applied to those at the upper end of the income distribution. Capital gains and dividends are both taxed at comparably high top rates of 34 percent.

2 min read

the Inflation Reduction Act gives us a glimpse into a future where the U.S. and EU opt for protectionist tax and trade policies rather than implementing principled tax policies and reducing trade barriers between allies.

5 min read

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read