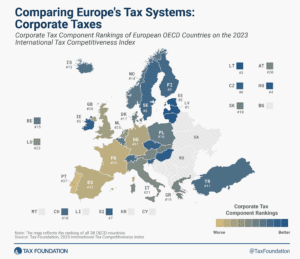

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

A harmonized EU tax base is a project in the making. Policymakers have a chance to put the Union on a path for increased investment and economic growth by focusing on the details of capital cost recovery.

3 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

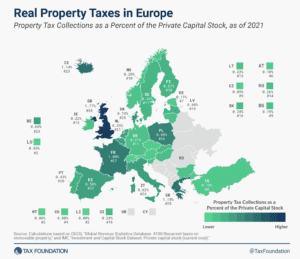

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

The global minimum tax agreement known as Pillar Two is intended to curb profit shifting. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations.

40 min read

Pillar Two implementation is underway in many jurisdictions, and many governments are aiming to get their proposals approved before the end of 2023. However, estimating Pillar Two’s impact on government revenue is proving difficult. As a result, only a few countries have publicly presented their findings.

7 min read

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

On 12 September, the European Commission released a proposal called “Business in Europe: Framework for Income Taxation” (BEFIT) and two associated proposals on transfer pricing and a Head of Office tax system.

6 min read

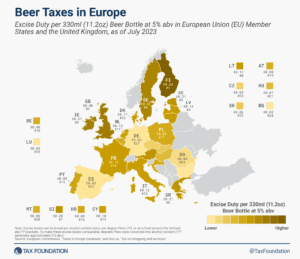

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

As Congress continues its work on the fiscal year 2024 appropriations process and associated tax provisions, it should consider an often-overlooked tax provision: the limitation on deductions companies take for interest payments.

7 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

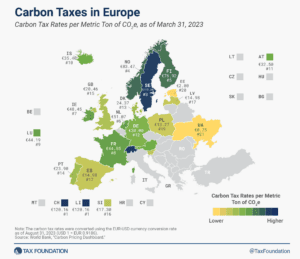

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

7 min read

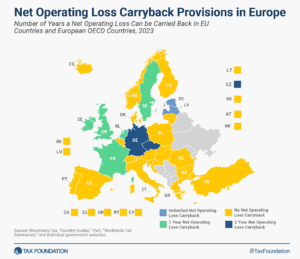

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read