All Related Articles

New Details on the Austrian Tax Reform Plan

14 min read

Anti-Base Erosion Provisions and Territorial Tax Systems in OECD Countries

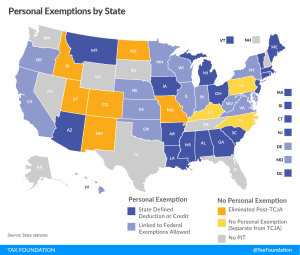

The U.S. decision to adopt a territorial tax system is certainly an improvement over having a worldwide system. However, in moving to a territorial system some of the new features created with the TCJA increased the complexity of the system.

38 min read

An Analysis of Senator Warren’s ‘Real Corporate Profits Tax’

Sen. Elizabeth Warren introduced a 7 percent surtax on corporate profits called the “Real Corporate Profits Tax.” We estimate that this tax would reduce the incentive to invest in the United States, and result in a 1.9 percent smaller economy, a 3.3 percent smaller capital stock, and 1.5 percent lower wages. The surtax would raise $872 billion between 2020 and 2029 on a conventional basis and $476 billion on a dynamic basis. The tax would make the tax code more progressive, but it would fall on taxpayers in every income group.

9 min read

An Overview of Capital Gains Taxes

Capital gains taxes create a burden on saving because they are an additional layer of taxes on a given dollar of income. The capital gains tax rate cannot be directly compared to individual income tax rates, because the additional layers of tax that apply to capital gains income must also be part of the discussion.

14 min read

The Alternative Minimum Tax Still Burdens Taxpayers with Compliance Costs

Although Congress intended the AMT to be a tax on wealthy taxpayers, for much of its history it has subjected middle-income taxpayers in high-tax states to heavy compliance burdens. TCJA reforms that have increased the AMT’s exemption and exemption phaseout threshold will shield some taxpayers from the AMT through 2025, but the number of taxpayers impacted will increase in 2026 when the TCJA’s individual income tax reforms expire.

14 min read

Tax Policy and Entrepreneurship: A Framework for Analysis

A key element of America’s dynamism problem is a drop in entrepreneurship. Removing tax barriers for entrepreneurs would improve America’s dynamism while making America’s tax code more neutral, efficient, and simple for all taxpayers.

25 min read

Capital Cost Recovery across the OECD, 2019

Capital cost recovery, though often overlooked, can have a significant impact on investment decisions—with far-reaching economic consequences.

24 min readReforming Rental Car Excise Taxes

The growing number of options that travelers have for rental cars, including peer-to-peer car-sharing arrangements, is an opportunity for policymakers to revisit the policy rationale for these discriminatory taxes.

26 min read

Tax Treatment of Worker Training

15 min read

Testimony: Temporary Policy in the Federal Tax Code

Tax policy can increase the size of the economy by having a positive impact on the incentives to work and invest. However, when tax policy is temporary or retroactive, these positive effects are muted, and policies do not effectively incentivize the intended activity.

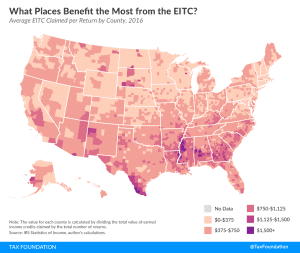

Analysis of the Cost-of-Living Refund Act of 2019

We estimate that a new proposal to expand the EITC would reduce federal revenue by $1.8 trillion and decrease long-run GDP by 0.29 percent, while boosting labor force participation for low-income tax filers by 822,788 full-time equivalent jobs.

10 min read

The Case for Universal Savings Accounts

21 min read

Evaluating Education Tax Provisions

Research shows that the current menu of education-related tax benefits is not effectively promoting affordability or the decision to attend college. Lawmakers wishing to provide education assistance should reconsider whether the tax code is the best tool to achieve that goal.

21 min read

Wisconsin Tax Options: A Guide to Fair, Simple, Pro-Growth Reform

Despite tax cuts in recent years, Wisconsin’s overall tax structure lags behind competitor states in simplicity, tax rates, and business climate for residents and investment. Explore our new comprehensive guide to see how the Badger State can achieve meaningful tax reform.

11 min read

Amortizing Research and Development Expenses Under the Tax Cuts and Jobs Act

Expensing, or the immediate write-off of R&D costs, is a valuable component of the current tax system. The TCJA’s change to amortization in 2022, requiring firms to write off their business costs over time rather than immediately, would raise the cost of investment, discourage R&D, and reduce economic output.

12 min read