Tax Foundation Response to OECD Public Consultation Document: Reports on the Pillar One and Pillar Two Blueprints

The Tax Foundation response to the OECD public consultation document on the reports on the OECD Pillar 1 and OECD Pillar 2 blueprints.

The Tax Foundation response to the OECD public consultation document on the reports on the OECD Pillar 1 and OECD Pillar 2 blueprints.

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

At the end of 2020, 33 temporary tax provisions are scheduled to expire at the federal level. These provisions generally fall under four categories: cost recovery, energy, individual, and other business provisions.

20 min read

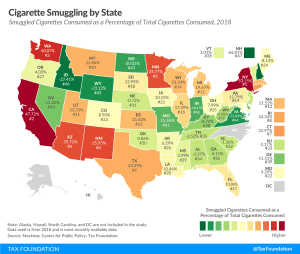

Excessive tax rates on cigarettes in some states induce substantial black and gray market movement of tobacco products into high-tax states from low-tax states or foreign sources. New York has the highest inbound smuggling activity, with an estimated 53.2 percent of cigarettes consumed in the state deriving from smuggled sources.

13 min read

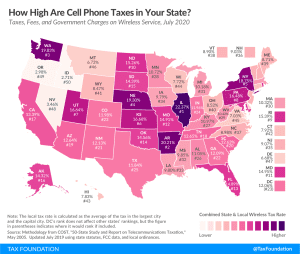

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

What has President Joe Biden proposed in terms of tax policy changes? Our experts provide the details and analyze the potential economic, revenue, and distributional impacts.

23 min read

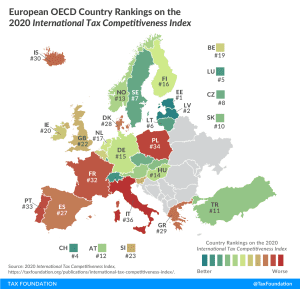

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

A competitive tax code has never been more important, and these tax policy improvements can both strengthen the short-term economic recovery and promote long-term economic growth in Nebraska.

26 min read

Heading into Election Day, the Illinois legislature and Governor J.B. Pritzker (D) are trying to convince voters to scrap a key constitutional feature of Illinois’ tax system: a provision in the state constitution that prohibits a graduated-rate income tax.

18 min read

Making the Tax Cuts and Jobs Act’s individual provisions permanent combined with a carbon tax can be a revenue-neutral trade and increase the long-run size of the economy by 1 percent, making it a sustainable pro-growth option.

23 min read

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read

Implemented in 1991, Sweden’s carbon tax was one of the first in the world. Since then, Sweden’s carbon emissions have been declining, while there has been steady economic growth. Today, Sweden levies the highest carbon tax rate in the world and its carbon tax revenues have been decreasing slightly over the last decade.

21 min read

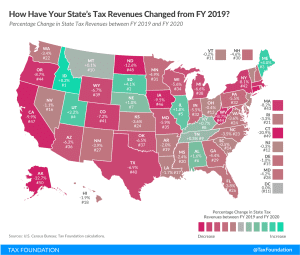

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

The highway trust fund is on track to run out of money by 2021, states are struggling to cover their transportation spending, and increased fuel economy, plus inflation, is chipping away at gas tax revenue year. How can Congress and state governments ensure they have the revenue necessary to fund our highways? One solution is the vehicle miles traveled (VMT) tax.

35 min read

States can tax your income where you live and where you work—but a growing number of states may also seek to tax your income even if you neither live nor work there, an aggressive posture that becomes increasingly consequential as more Americans work remotely both during and potentially after the COVID-19 pandemic.

15 min read

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read

The LIHTC has subsidized over 3 million housing units since it was established in 1986, the largest source of affordable housing financing.

24 min read

The Tax Reform Act of 1986 extended depreciation schedules for both commercial and noncommercial of real estate, reducing the attractiveness of those investments.

21 min read