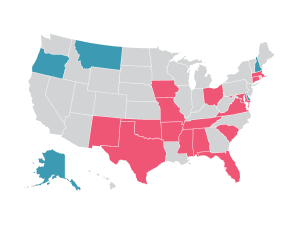

Sales Tax Holidays by State, 2020

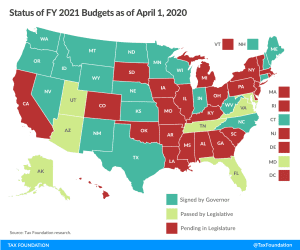

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read