All Related Articles

Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications

In our new report, we explore the design implications of a carbon tax and provide estimates for revenue, economic, and distributional effects of three potential carbon tax and revenue recycling proposals. Each proposal faces different trade-offs and achieves different policy goals.

23 min read

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

The Home Mortgage Interest Deduction

20 min read

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

States Should Continue to Reform Taxes on Tangible Personal Property

Tangible personal property taxes increase the complexity of state and local tax codes, discriminate against taxpayers based on their capital structure, and change economic behavior by incentivizing taxpayers to modify their property ownership to avoid the tax.

32 min readLocal Income Taxes in 2019

13 min read

Sales Tax Holidays by State, 2019

If a state must offer a “holiday” from its tax system, it is an implicit recognition that the state’s tax system is uncompetitive.

44 min read

Tax Reforms in Georgia 2004-2012

9 min read

State Tax Changes as of July 1, 2019

15 min read

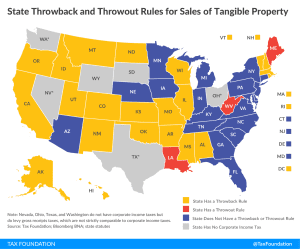

State Throwback and Throwout Rules: A Primer

38 min read

The “Cadillac” Tax and the Income Tax Exclusion for Employer-Sponsored Insurance

The Cadillac tax offers one way that policymakers can work to rein in our tax code’s subsidization of the health-care industry, which has increased the price of health-care services.

18 min read

Summary and Analysis of the OECD’s Work Program for BEPS 2.0

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read

Switzerland Referendum Approves Tax Reform

15 min read

Modernizing Utah’s Sales Tax: A Guide for Policymakers

By almost any measure, Utah is, and deserves to be, the envy of its peers. Utah leads the country in job growth, and the state’s economy has grown at twice the rate of the nation at large. Utah’s income tax reforms adopted in 2007 established a model for other states to follow. But today, some of these gains are being undone—not by conscious policy choices, but by their absence.

6 min read