Taxes: The Price We Pay for Government

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

Discover why there are better and worse ways for governments to raise a dollar of revenue. Compare the economic impact of the three basic tax types—taxes on what you earn, buy, and own—including three specific taxes within each category. Learn about the basics of “dynamic scoring,” one tool economists can use to compare the economic and revenue impact of different tax policies.

Identify some of the most common tax myths and tax policy misconceptions and learn how to separate fact from fiction. Discover why tax refunds shouldn’t be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among other useful facts. Improve your ability to counter misleading arguments about the tax code.

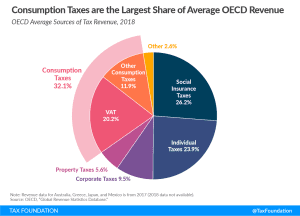

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

5 min read

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

Due to a quirk of some state tax codes, the recovery rebates in the CARES Act could increase your income tax liability in six states: Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon.

4 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

4 min read

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

As Congress and the White House consider ways to shore up the economy in the face of a public health crisis, President Trump has suggested suspending the entire payroll tax for the duration of the year. That would cost about $950 billion, according to our analysis.

6 min read

House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans.

3 min read

The CARES Act, now signed into law, is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

10 min read

Massachusetts, Ohio, and West Virginia have newly extended their income tax filing and payment deadlines to match the July 15 federal deadline.

3 min read

One of the most talked about government economic responses to the COVID-19 crisis is Germany’s Kurzarbeit: the German short-work subsidy scheme.

3 min read

To be eligible for federal funding, state expenditures must meet certain conditions. We break down the state aid coronavirus provisions in the latest federal bill.

5 min read

Countries around the world are implementing emergency tax measures to support their economies under the coronavirus (COVID-19) threat.

51 min read

Norway passed a large coronavirus tax relief package to address layoffs and bankruptcies, which includes a reduced VAT rate, the introduction of a loss carryback provision, and targeted postponements for wealth tax payments, among other provisions.

5 min read

The proposed Take Responsibility for Workers and Families Act can be contrasted with the Senate Republican CARES Act, although they share some similarities by providing individual taxpayers with a rebate and modifying business tax provisions to provide liquidity for struggling firms.

5 min read