All Related Articles

Caitlin Clark Pays Income Taxes on NIL. It’s Time to Tax the NCAA, too.

If student athletes are taxed on their earnings, it’s time the NCAA should be taxed on theirs.

Summary of the Latest Federal Income Tax Data, 2024 Update

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

Taxes and Migration: New Evidence from Academic Research

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Evaluating the Proposed Tax Changes in Illinois Governor’s FY 2025 Budget

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

Vermont Lawmakers Consider Harmful Taxes on the Wealthy

Vermont lawmakers are considering the adoption of two new taxes on high earners, which proponents have branded “wealth taxes.”

4 min read

Why Your Tax Refund Is Nothing to Celebrate

Don’t be fooled by tax myths and misconceptions this tax filing season.

3 min read

Virginia Considers Expanding Its Sales Tax Base to B2B Digital Services

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

Sustainably Reforming Social Security and Medicare Will Need More than Just Tax Hikes

Creative options including changes in Social Security benefits growth for higher earners and reforms to how Medicare compensates for health services should be on the table, along with broad-based and well-structured tax reforms.

6 min read

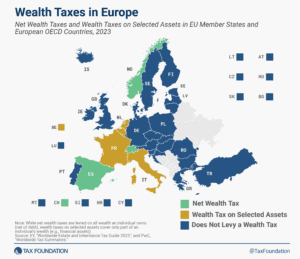

Wealth Taxes in Europe, 2024

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD and Select EU Countries

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

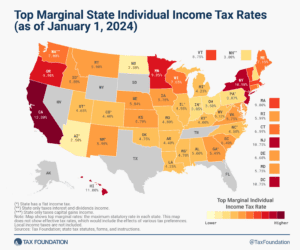

State Individual Income Tax Rates and Brackets, 2024

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

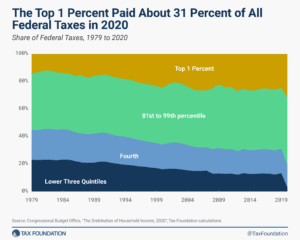

New CBO Report Shows Pandemic Response Sharply Reduced Inequality, Increased Progressivity in 2020

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution.

4 min read

How Are Remote and Hybrid Workers Taxed?

Working from home is great. The tax complications? Not so much.

4 min read

Major Takeaways from CBO’s Updated Long-Term Outlook

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Canada’s Tax-Free Savings Accounts Are a Huge Success. U.S. Lawmakers Should Take Note

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

5 min read

Latest SALT Deduction Cap Proposal Increases Budget Deficit, Creates New Tax Cliffs, and is Regressive

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

Maryland Considers Raising Local Income Taxes

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read