Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

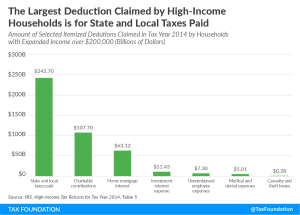

If the state and local tax deduction is necessary to prevent double taxation, why don’t states offer a deduction for federal and local taxes?

2 min read

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

According to the Taxes and Growth model, the House Tax Cuts and Jobs Act should increase after-tax income by 4.5 percent for those in the second-lowest quintile, and by 4.6 percent for those in the middle quintile.

3 min read

Repealing the state and local tax deduction will be an important part of pro-growth tax reform. Eliminating the deduction would free up $1.8 trillion to use for lowering rates across the board. Special interest groups will want you to think this deduction protects you against double taxation. Don’t fall for it.

2 min read

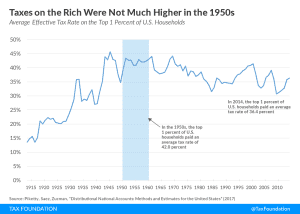

The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards. In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent.

4 min read