Much is being made of the recently released revenue statistics from the Organisation for Economic Co-operation and Development (OECD) indicating that the United States has one of the lowest overall taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burdens at 26 percent of GDP, ranking the U.S. 31 st among the OECD’s 35 member nations. Only Turkey, Ireland, Chile, and Mexico had lower overall tax burdens than the U.S. in 2016.

Some news reports suggest that our ranking as a “low-tax” nation could undermine one of the key rationales for Congress’s efforts to overhaul the U.S. tax code. However, it would be misleading to interpret this ranking as an indication that the U.S. tax system does not need fixing. First, most of the difference between our tax burden and that of other nations is explained by the fact that the U.S. does not levy a value-added tax (VAT). If we subtract taxes on goods and services from the national totals, the U.S. tax burden would rank about average in the OECD.

What the headline figures gloss over is that the U.S. overrelies on taxes on personal and business income, which OECD economists have determined are the most harmful taxes for economic growth. Furthermore, the U.S. income tax system is very progressive and the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. is very narrow. We rely on a relatively small group of taxpayers to pay most of the taxes collected from both the individual and corporate tax systems.

The U.S. Overrelies on Harmful Income Taxes Compared to other OECD Nations

In a landmark 2008 study, Tax and Economic Growth, economists at the OECD determined that corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. es were the most harmful taxes for economic growth, followed by taxes on personal income. Taxes on consumption and property were determined to be less harmful because they are levied on less mobile factors in the economy than capital or labor.

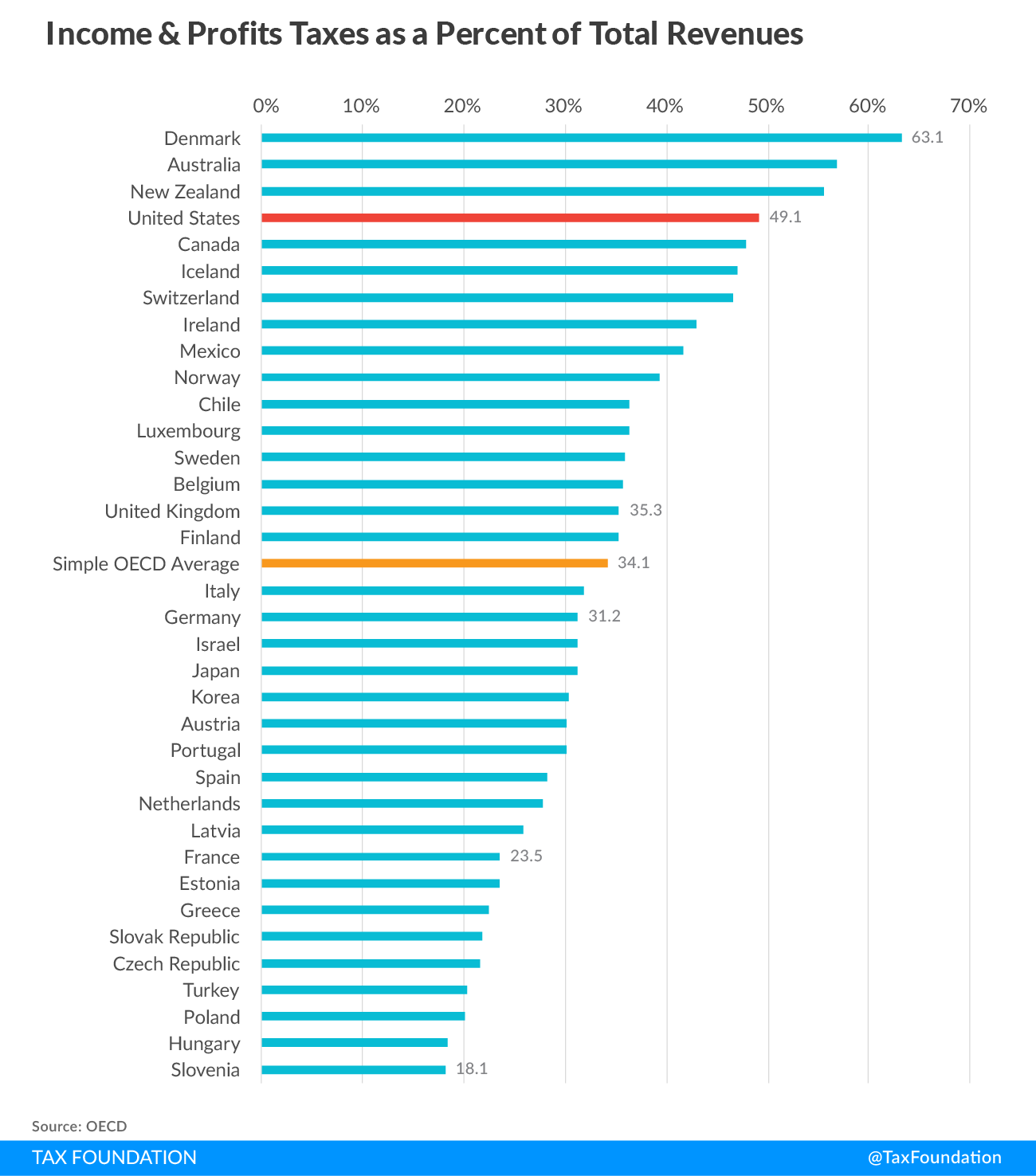

Yet the U.S. relies more heavily on these economically harmful taxes than nearly any other developed nation. According to the OECD’s new publication, 49.1 percent of all tax revenue collected in the U.S. by all levels of government are generated by taxes on personal income and business profits. As the nearby chart shows, the simple average among OECD nations is 34.1 percent of total tax collections. Only Denmark, Australia, and New Zealand rely more on personal income and business profits taxes than does the U.S.

U.S. Income Taxes Are Very Progressive

In their 2008 study, OECD economists also found “evidence of a negative relationship between the progressivity of personal income taxes and growth.” Yet the U.S. income tax system is very progressive. True, our top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s may not be as high as the rates imposed on high-income taxpayers in other countries, but the share of the tax burden borne by high-income taxpayers in the U.S. is the highest in the OECD.

Another OECD study found that the top 10 percent of taxpayers in the U.S. pay a larger share of the income tax burden than do the top 10 percent in any OECD country, while our poor pay the lowest share of income taxes compared to the poor in any other country. Indeed, in 2015, some 51 million taxpayers—or 34 percent of all filers—paid no income taxes because of the credits and deductions available to them.

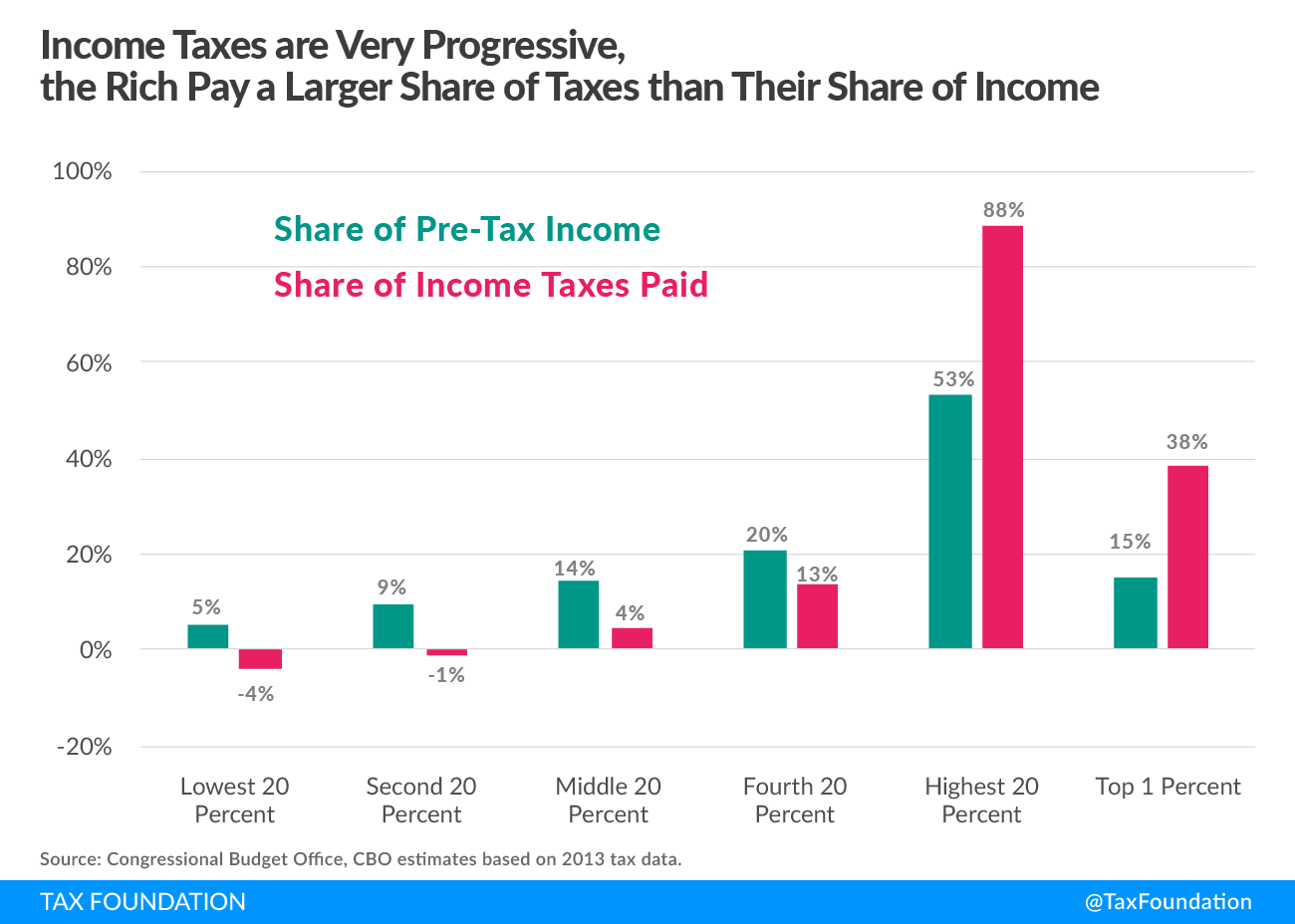

The chart below, based on Congressional Budget Office data, illustrates how progressive the income tax system is today. The top 20 percent of households—which starts at $117,000 for a two-person household—earn more than 50 percent of the nation’s income, but they pay nearly 90 cents of every $1 of federal income taxes collected. The ratio is even more extreme for the top 1 percent of households. The top 1 percent of households—which starts at $500,000 for a two-person household—earn 15 percent of the nation’s income, but pay 38 percent of federal income taxes. That’s a burden twice their share of income.

By contrast, the bottom 80 percent of households collectively earn 47 percent of the nation’s income but pay just 12 percent of federal income taxes. Isolating middle-income households, we can see that they earn 14 percent of the nation’s income but pay just 4 percent of income taxes. The bottom 40 percent of households actually receive more tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. s and refunds from the IRS than they owe in income taxes. Thus, their “income tax burden” is actually negative, as is illustrated in the chart.

Largest Firms Pay the Lion’s Share of Corporate Income Taxes

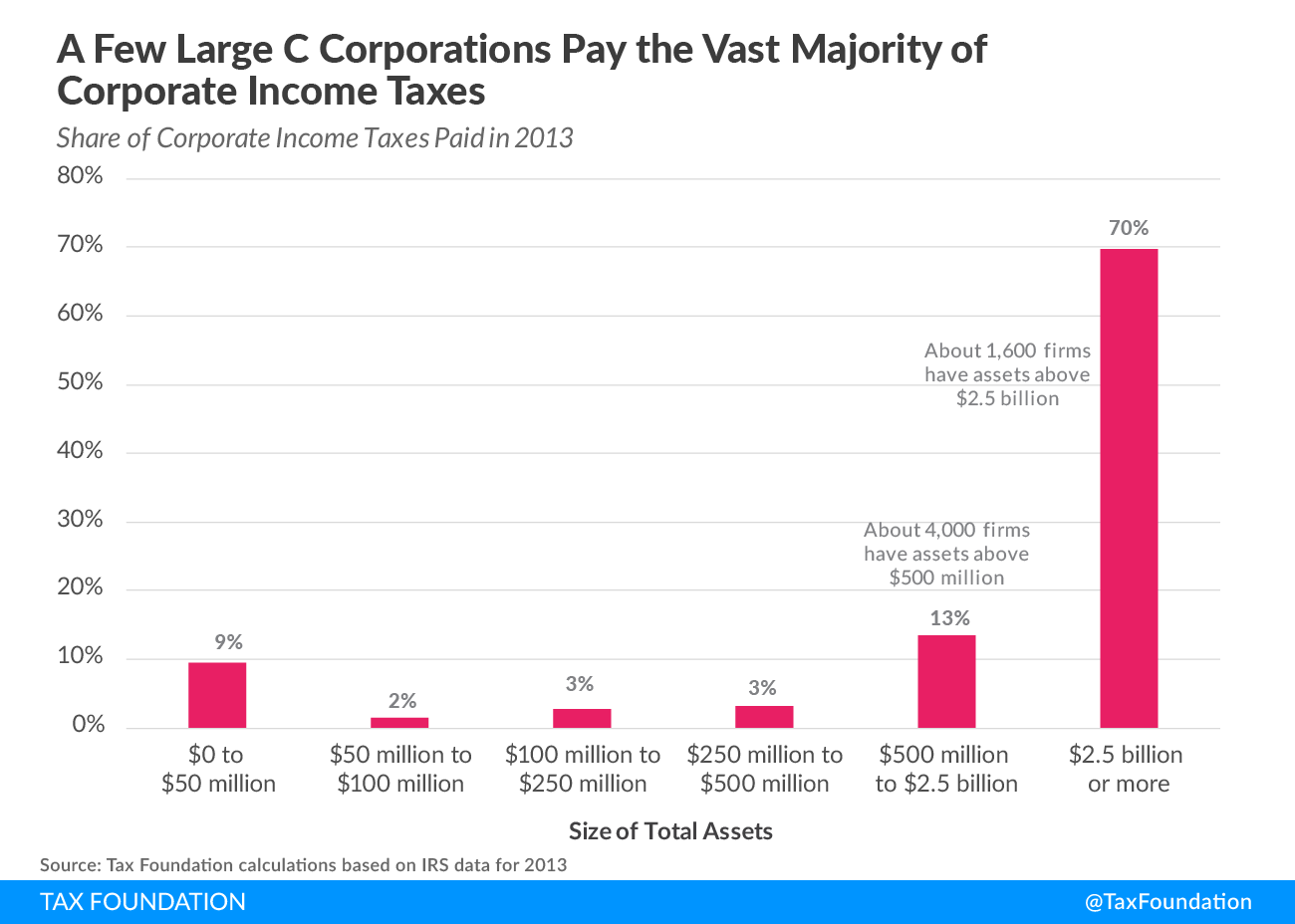

Despite the frequent rhetoric about corporations not paying their fair share of taxes, when it comes to which taxpayers shoulder the greatest tax burden, the corporate income tax is even more progressive than the personal income tax. In 2013, the most recent data available, there were about 1.6 million C corporations. (Interestingly, this was the fewest number of C corporations since 1974). The vast majority of these firms are small or mid-sized; only about 1,600, or 0.01 percent, had more than $2.5 billion in assets and only about 4,000, or 0.25 percent, had assets above $500 million.

Yet, as the nearby chart illustrates, 70 percent of the $293 billion in corporate income taxes paid in 2013 was paid by the 1,600 largest firms, those with more than $2.5 billion in assets. Adding the share paid by firms with more than $500 million in assets means that 83 percent of all corporate income taxes were paid by the top 0.25 percent of corporations. In other words, the remaining 99.75 percent of U.S. corporations paid just 17 percent of all corporate income taxes.

Conclusion

How a country raises tax revenues is often much more telling than how much its tax system actually raises. The OECD’s latest revenue statistics showing the U.S. to be a “low-tax” nation is a good example of how a single statistic can be misleading.

Pundits who cite the OECD’s headline finding should look deeper in the report. They would find that the U.S. is overly reliant on what OECD economists have determined are the two most harmful taxes for economic growth, corporate and personal income taxes. IRS data further shows that our income tax system is highly progressive and attempts to collect the majority of tax revenues from a shrinking number of taxpayers. This is neither equitable nor economically intelligent.

Share