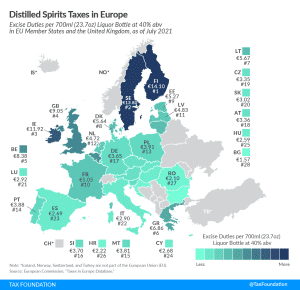

Distilled Spirits Taxes in Europe, 2021

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

The highest excise duties are applied in Finland, Sweden, and Ireland, where the rates for a standard-size bottle of liquor are €14.10 ($16.08), €13.80 ($15.73), and €11.92 ($13.59), respectively.

3 min read

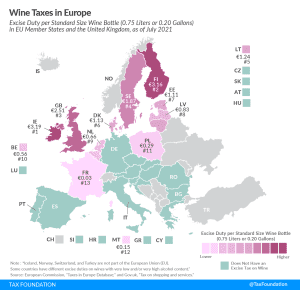

As one might expect, southern European countries that are well-known for their wines—such as France, Greece, Portugal, and Spain—either don’t tax it or do so at a very low rate. But travel north and you’ll see countries that tend to levy taxes on wine—and often hefty taxes.

3 min read

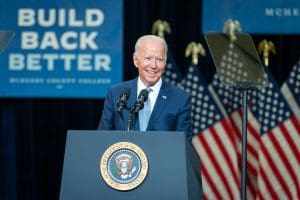

Tackling climate change and shifting the economy towards renewable energy has been a key part of the Biden administration’s agenda. However, this effort must first confront an overly complicated and non-neutral tax code, particularly in how it treats nuclear energy, for the White House to reach its ambitious goals.

6 min read

While it makes sense to ensure cryptocurrency transactions are treated similarly to other financial assets, the nature of these requirements as written are potentially unworkable.

3 min read

A vehicle miles traveled (VMT) proposal gaining steam in Pennsylvania would be the equivalent of a state gas tax of more than $2 per gallon, and that’s not all the Commonwealth is considering.

7 min read

The good news is that lawmakers avoided raising taxes to cover the cost of the new spending and instead used some reasonable fees and asset sales. The bad news is that half of the offsets come from unused, debt-financed COVID-19 relief funds and the economic return on many of these investments is questionable.

7 min read

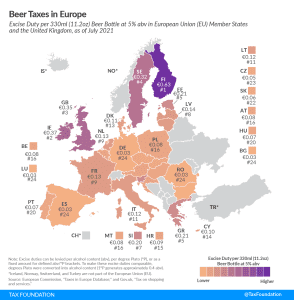

Finland has the highest excise tax on beer in Europe, followed by Ireland and the United Kingdom. Compare beer taxes in Europe this International Beer Day

3 min read

As lawmakers explore funding mechanisms for additional federal infrastructure investment, they should focus on permanent, sustainable, and transparent revenue options that conform to the benefit principle. Permanent user fees, appropriately adjusted to restore and maintain their purchasing power, would serve as ideal revenue sources for federal infrastructure investments.

5 min read

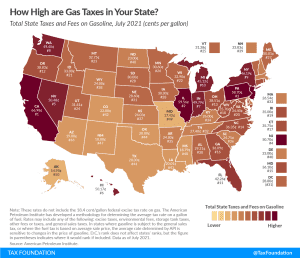

California pumps out the highest state gas tax rate of 66.98 cents per gallon, followed by Illinois (59.56 cpg), Pennsylvania (58.7 cpg), and New Jersey (50.7 cpg).

3 min read

While it is good that policymakers are taking the impact of the economy on tax revenue seriously, it is important to remember that the dynamic effect of increased spending would only offset a small portion of the total spending. In other words, new spending—like tax cuts—rarely pays for itself.

3 min read

If states wish to tax digital streaming and download services, they should do it the right way, by including them in their sales tax base—preferably as part of broader reforms paired with commensurate rate reductions—rather than inventing new excise taxes or shoehorning taxation of the new economy into outdated statutes.

4 min read

Senate Majority Leader Chuck Schumer (D), Senate Finance Committee Chairman Ron Wyden (D), and Sen. Cory Booker (D) released their discussion draft—the Cannabis Administration and Opportunity Act—for federal descheduling of marijuana. While federal descheduling impacts all states, it does not deschedule marijuana in states which choose to keep their own ban.

6 min read

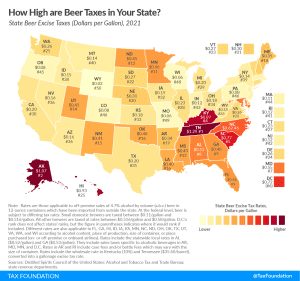

2021 state beer excise tax rates vary widely: as low as $0.02 per gallon in Wyoming and as high as $1.29 per gallon in Tennessee. Missouri and Wisconsin tie for second lowest at $0.06 per gallon, and Alaska is second highest with its $1.07 per gallon tax.

3 min read

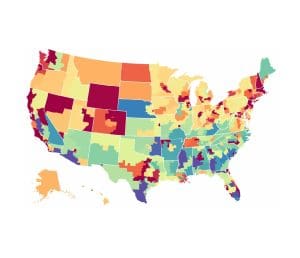

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

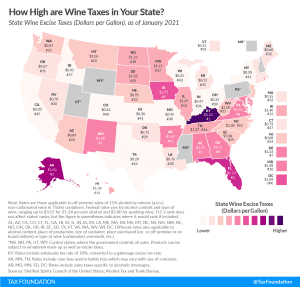

States tend to tax wine at a higher rate than beer but at a lower rate than distilled spirits due to wine’s mid-range alcohol content. You’ll find the highest wine excise taxes in Kentucky at $3.23 per gallon, far above Alaska’s second-place $2.50 per gallon. Those states are followed by Florida ($2.25), Iowa ($1.75), and Alabama and New Mexico (tied at $1.70).

2 min read

With many state legislative sessions wrapping up for this year, and a new fiscal year about to begin, it’s a good time to examine some of the 2021 legislative trends—and sports betting taxes are among the more prominent.

5 min read