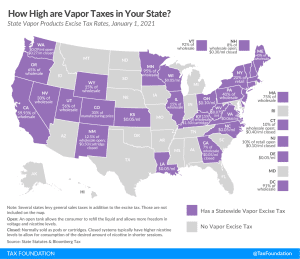

Vaping Taxes by State, 2021

Several states are considering introducing or increasing taxes on vapor products to make up declining tax revenue from traditional tobacco products or to fill budget holes in the wake of the coronavirus pandemic. However, lawmakers should approach the issue carefully because flawed excise tax design on vapor products could drive consumers back to more harmful combustible products like cigarettes.

3 min read