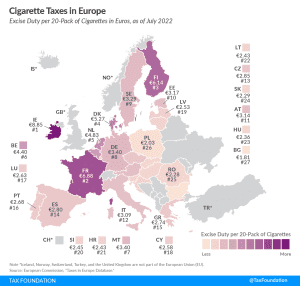

Cigarette Taxes in Europe, 2022

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read

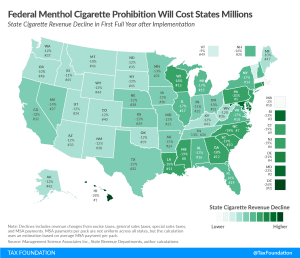

Tax Foundation comments on the state tax and revenue implications of the proposed tobacco product standard for menthol in cigarettes.

Amidst bipartisan climate negotiations on Capitol Hill, there have been renewed calls for a carbon tax. Carbon taxes have long been magnets for political controversy. But from an economic standpoint, they deserve to be taken seriously. Here’s why.

Learn more about the FDA’s proposal to ban the sale of menthol cigarettes and flavored cigars. Including its effect on revenue & public health measures.

4 min read

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Lawmakers in Colorado, and in the several other states considering flavor bans, should think twice before following in the footsteps of Massachusetts. A statewide ban on flavored tobacco products is more than likely to costs millions of dollars, increase smuggling, and have a negligible effect on public health.

5 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

States are flush with cash, but taxpayers’ purchasing power is being eroded by high inflation. Tax rebates, gas tax holidays, and other temporary tax expedients have the potential to add to existing inflation—but good intentions do not always make for good policy.

5 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

As oil prices skyrocket, a windfall profits tax targeted at oil company profits could punish domestic production and increase reliance on imports.

3 min read

Given the uncertainty surrounding the war in Ukraine, future trade relations with Russia, and the overall CBAM revenue structure. The EU will need to adjust policy when challenges arise as it looks to increase its role in fiscal affairs through new own resources.

5 min read

Policymakers actively marginalized the manufacturing sector by saddling them with cost recovery rules that prevent them from deducting the full cost of investment in physical plant and equipment. Going forward, policymakers should avoid haphazard fixes, targeted measures, and protectionism.

50 min read

The unified EU signing of the “Versailles Declaration” is a historic break from the past. Russia’s war against Ukraine has made energy (and related tax policies) an even more urgent focus for the EU.

6 min read

A gas tax holiday may be good politics, but it’s unlikely to achieve its aims. There are far better ways to provide tax relief—short- or long-term—than an inefficient gas tax suspension.

4 min read

The cost of gas is going up. To address this, policymakers have proposed suspending the gas tax. But could this actually make matters worse? We discuss why suspending the gas tax might be a mistake and what lawmakers could do to help with the rising costs of gas.

The FDA’s expected announcement of a national ban on menthol-flavored cigarettes and cigars with a characterizing flavor would carry significant revenue implications for both the federal government and state governments, with likely limited benefits in smoking cessation.

6 min read

If policymakers are looking to change the tax code to help fight inflation, they should pump the brakes on the federal gas tax holiday and instead consider structural reforms to raise the economy’s productive capacity in the long term.

4 min read