Breaking Down the Inflation Reduction Act’s Green Energy Tax Credits

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

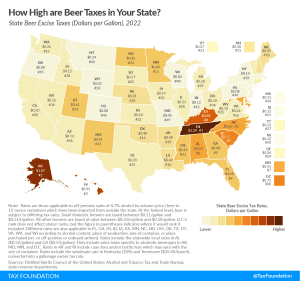

Tennessee, Alaska, Hawaii, and Kentucky levy the highest beer excise tax rates in the nation. How does your state compare?

3 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

In response to high oil prices, Sen. Wyden has proposed raising taxes on oil and gas companies in three ways. His “Taxing Big Oil Profiteers Act” would create an additional 21 percent tax on so-called excess profits earned over 10 percent of revenues of oil companies with annual revenues over $1 billion; levy a tax on stock buybacks; and remove last-in, first-out (LIFO) tax treatment of inventory accounting.

7 min read

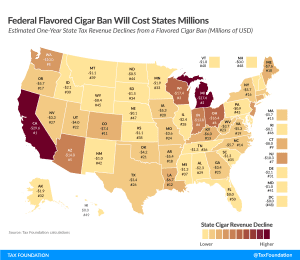

The FDA’s proposal to ban flavored cigars would carry significant revenue implications for many state governments.

7 min read

In dollar terms, the industries that would account for the largest book minimum tax liabilities are manufacturing, at $73.2 billion, followed by finance, insurance, and management at $46.9 billion.

6 min read

How will the Inflation Reduction Act taxes impact inflation, economic growth, tax revenue, and everyday taxpayers? See Inflation Reduction Act tax changes.

12 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

New Jersey lawmakers should be weary of flavor bans after seeing the results in Massachusetts.

3 min read

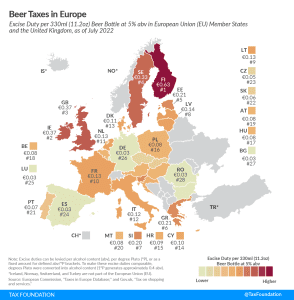

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min read

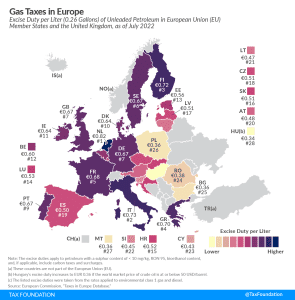

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read

While the bulk of the proposed tax increases and spending programs remain under debate, Democratic lawmakers have reportedly agreed on prescription drug pricing provisions as a starting point for a revived Build Back Better package.

3 min read

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

4 min read

Congress should prioritize evaluation of recent international tax trends and the model rules and adjust U.S. rules in a way that supports investment and innovation and moves towards simplicity.

25 min read

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

Oil prices have skyrocketed, posing a new risk to the post-pandemic recovery. Feeling the pressure to respond, policymakers have proposed everything from gas tax holidays, tapping into strategic reserves, and even rebate cards. One idea that has crawled back from the dead: “Windfall Profits Taxes.” This idea is seemingly simple: legislation targeted at the “excess” profits of oil companies. However, as with anything in tax policy, the reality is much more complicated.

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read