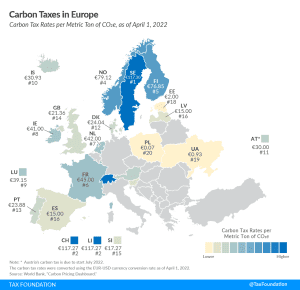

Carbon Taxes in Europe, 2022

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read