All Related Articles

Sales Taxes on Soda, Candy, and Other Groceries, 2018

When policymakers get in the habit of handpicking goods for which the sales tax does or does not apply, the tax base simultaneously erodes and becomes more complex.

25 min read

The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade

Taxpayers in every income level will receive a tax cut in 2018 and for most of the next decade. See how the size of that tax cut will vary for each income group over the next decade with our new, long-term distributional analysis.

33 min read

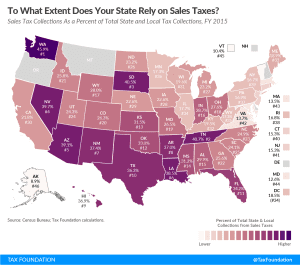

To What Extent Does Your State Rely on Sales Taxes?

Sales taxes represent a major source of state and local revenue. Click to see how much your state relies on sales taxes and for a state-by-state comparison.

3 min read

Are Sugar-Sweetened Beverage Taxes Regressive? Evidence from Household Retail Purchases

Soda taxes are proposed with the promise to improve public health outcomes, but they come with equity concerns because of their regressive nature.

23 min read

The Impact of the Tax Cuts and Jobs Act by Congressional District

A look at the data & methodology behind the Tax Foundation’s Mapping 2018 Tax Reform project which compares average 2018 tax cuts by congressional district.

3 min read

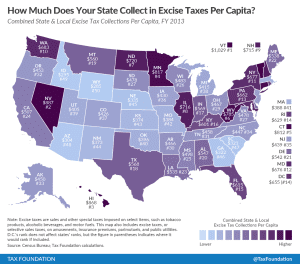

How Much Does Your State Collect in Excise Taxes?

Excise taxes make up a relatively small portion of state and local tax collections—about 11 percent—but per capita collections vary widely from state to state.

3 min read

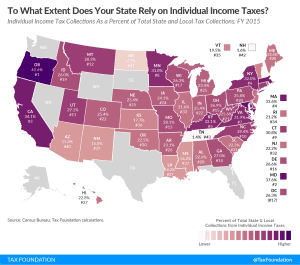

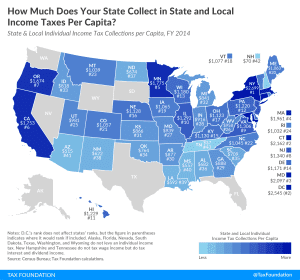

State and Local Individual Income Tax Collections Per Capita

On average, state and local governments collected $1,144 per person from individual income taxes, but collections varied widely from state to state.

2 min read

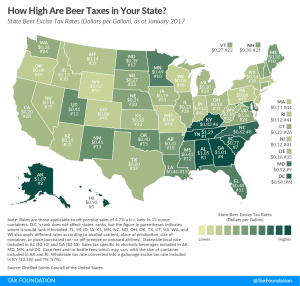

Beer Taxes by State, 2018

3 min read

Capital Cost Recovery across the OECD, 2018

One hundred percent expensing for short-life business investments was a great start but needs to be enacted on a permanent basis for it to have an impact on long-term decision-making.

15 min read

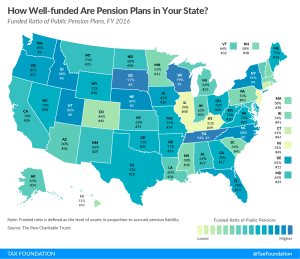

How Well-Funded are Pension Plans in Your State?

More than half the states have pension plans that are less than two-thirds funded, and five states have pension plans that are less than 50 percent funded.

2 min read

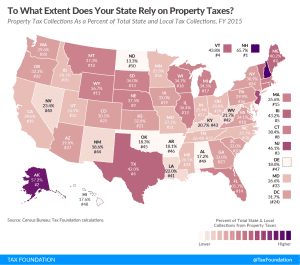

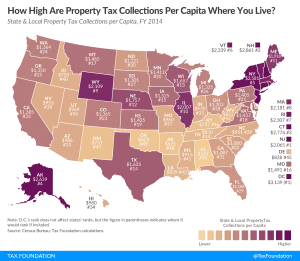

Average Per Capita Property Taxes: How Does Your State Compare?

While property taxes inevitably draw the ire of some residents living in high-tax jurisdictions, property values are a relatively good indicator of the value of local services received, such as well-funded roads and schools. At the same time, good local public services can make municipalities more desirable, thereby increasing residential property value.

3 min read

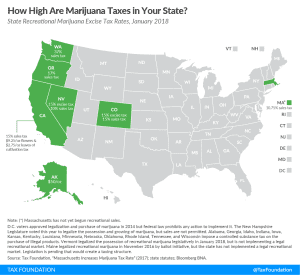

Recreational Marijuana Taxes by State, 2018

As public opinion increasingly favors the legalization of recreational marijuana, a growing number of states must determine how to structure marijuana taxes.

3 min read