Summary of the Latest Federal Income Tax Data, 2018 Update

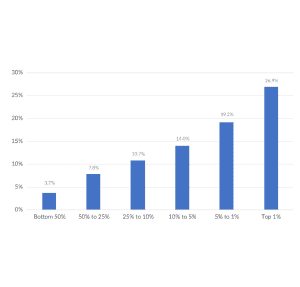

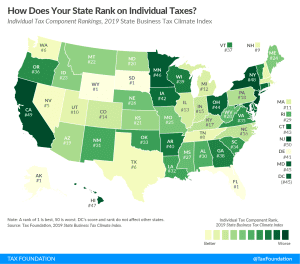

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

The top 50 percent of all taxpayers pay 97 percent of all individual income taxes, while the bottom 50 percent paid the remaining 3 percent.

21 min read

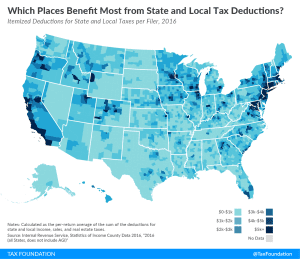

Do taxpayers in your area rely heavily on state and local tax deductions? See how the Tax Cuts and Jobs Act tax plan may impact taxpayers in your county.

2 min read

The Tax Cuts and Jobs Act simplified tax filings via an expanded standard deduction, but currently, these individual tax changes are to expire after 2025.

2 min read

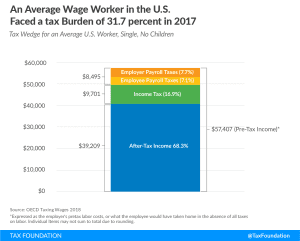

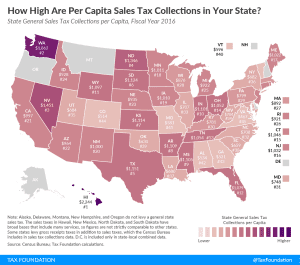

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read

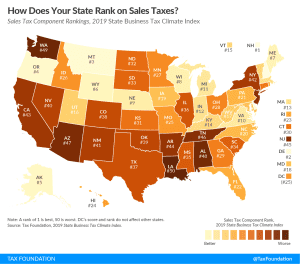

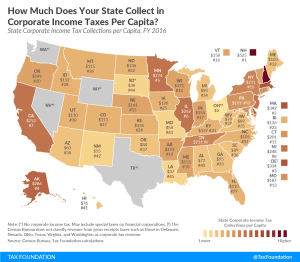

What is included in the “Wayfair checklist,” what policy choices do legislators have to make their state compliant, and, ultimately, how prepared is each state to start requiring that online retailers collect sales tax?

42 min read