State Tax Changes Taking Effect July 1, 2024

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

11 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

For over a century, lawmakers have exempted politically favored organizations and industries from the tax code. As a result, the tax-exempt nonprofit economy now comprises 15 percent of GDP, roughly equal to the fifth-largest economy in the world.

41 min read

The all-in Oregon state and local tax rate on large businesses could exceed 56 percent under a proposed ballot measure that purports to impose only a small tax increase on large businesses.

6 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

6 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

31 min read

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

Gross receipts taxes impose costs on consumers, workers, and shareholders alike. Shifting from these economically damaging taxes can thus be a part of states’ plans for improving their tax codes in an increasingly competitive tax landscape.

7 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

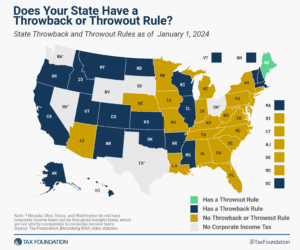

States have generally tried to encourage capital investment. Throwback and throwout rules are an unfortunate example of penalizing it.

4 min read

BEAT is intended to address a legitimate problem, and there are virtues to BEAT’s overall strategic approach; however, its execution leaves room for improvement.

7 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read