Facts & Figures 2023: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The UK’s adoption of full expensing is a welcome step that may generate short-run economic benefits. However, for the reform to have a meaningful effect on the UK’s international competitiveness and long-run economic performance, it must be made permanent—which the British government has said it hopes to do.

6 min read

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

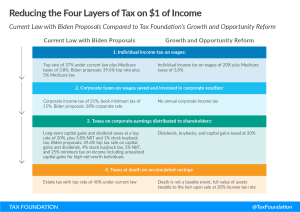

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

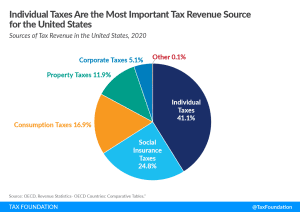

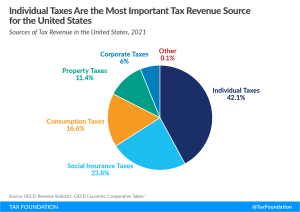

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Immediately balancing the $20 trillion budget shortfall would take drastic, unwanted policy changes. Instead, lawmakers should target a more achievable goal, such as stabilizing debt and deficits with an eye toward comprehensive tax reform that can produce sufficient revenue with minimal economic harm.

4 min read

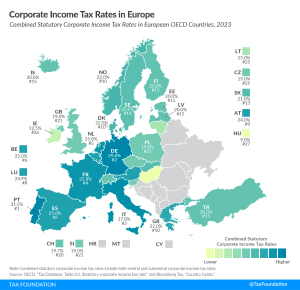

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

The FairTax is a proposal to replace all major sources of the federal government’s revenue—the individual income tax, corporate income tax, estate and gift taxes, and payroll tax—with a national sales tax and rebate, abolishing the IRS in the process.

7 min read

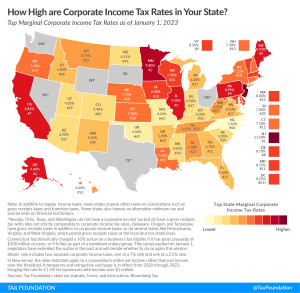

New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively.

6 min read

Erica York, senior economist at the Tax Foundation, joins Jesse to discuss how the book minimum tax came to be, if it will really stop companies from paying zero in taxes, if the new Republican House will revisit this debate, and what the tax’s impact will be on jobs and economic growth.

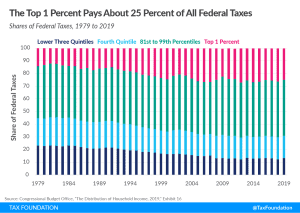

Newly published data from the CBO indicates in 2019, before the onset of the pandemic, American incomes continued to rise as part of a broad economic expansion. It also shows that, contrary to common perceptions, the federal tax system is progressive.

4 min read

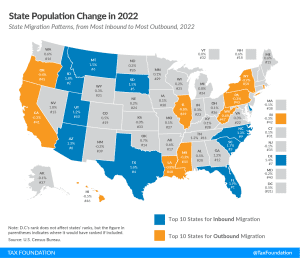

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

If bonus depreciation is allowed to phase out, then the tax bias against capital investments will increase, discouraging firms from making otherwise profitable investments.

14 min read