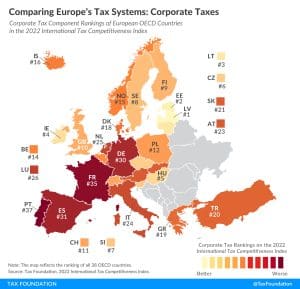

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read

We find that the dynamic cost of permanent bonus depreciation rises by about 7 percent under 4 percent inflation, but the economic benefit, measured by the size of the economy, rises by about 25 percent.

4 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

Federal tax collections are approaching the highest levels in U.S. history set during World War II and again during the dot-com bubble in 2000. Meanwhile, federal spending in FY 2022 was over 25 percent of GDP—a level only exceeded during the height of the pandemic in 2020 and 2021, and during World War II.

4 min read

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

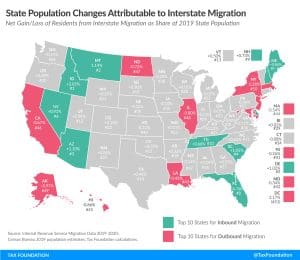

IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

12 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

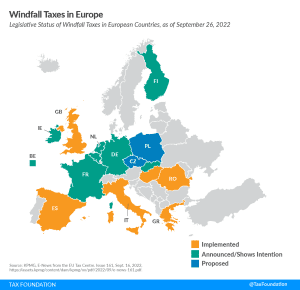

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

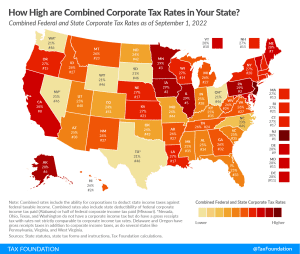

When examining tax burdens on businesses, it is important to consider both federal and state corporate taxes. Corporate taxes are one of the most economically damaging ways to raise revenue and are a promising area of reform for states to increase competitiveness and promote economic growth, benefiting both companies and workers.

3 min read

For many years, the UK has adopted a strikingly ungenerous approach to capital cost recovery – the ability of firms to write off investment against tax. This has coincided with consistently low levels of business investment. The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery is set to expire.

34 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

The Inflation Reduction Act includes a book minimum tax, which is raising the eyebrows of accountants everywhere. Scott Dyreng, a professor of accounting at Duke University, and Daniel Bunn join Jesse to discuss how these minimum taxes work and how companies aim to comply with all these new complex rules and tax increases.

The phaseout of 100 percent bonus depreciation, scheduled to take place after the end of 2022, will increase the after-tax cost of investment in the U.S. Permanently extending it would increase long-run economic output by 0.4 percent and increase employment by 73,000 FTE jobs.

20 min read

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read