Louisiana Considers Temporary Suspension of Part of Corporation Franchise Tax

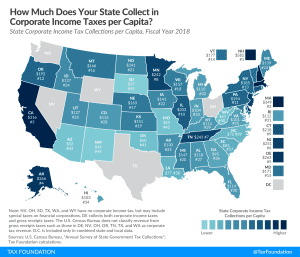

State recovery plans should lessen the burden on businesses by shifting from capital stock taxes and other taxes that are charged regardless of profitability. Louisiana does well to target its Corporation Franchise Tax, a burdensome tax that would target businesses that may already be struggling.

2 min read