Featured Articles

All Related Articles

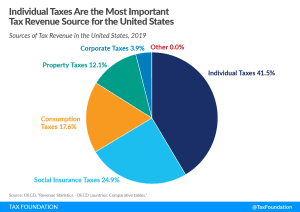

Sources of U.S. Tax Revenue by Tax Type, 2021 Update

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

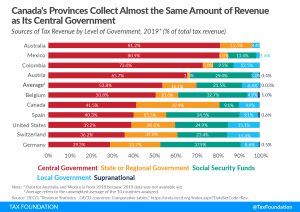

Sources of Government Revenue in the OECD, 2021 Update

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

The European Commission and the Taxation of the Digital Economy

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

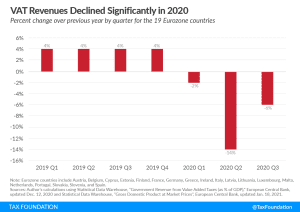

Value-added Taxes in the Pandemic

Many governments have chosen to use VAT as a tool to provide tax relief for consumption in various sectors throughout the pandemic, but in the long term, VAT should not be used as a tool for relief.

3 min read

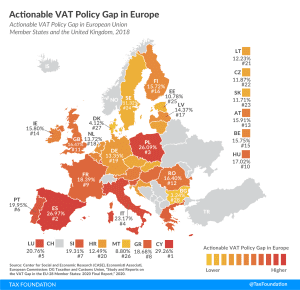

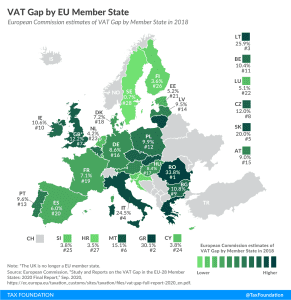

Actionable VAT Policy Gap in Europe, 2021

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Consumption Tax Policies in OECD Countries

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

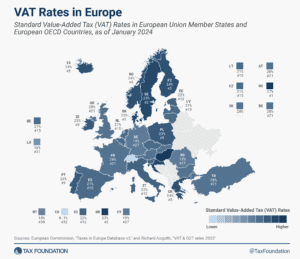

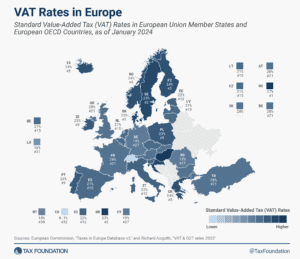

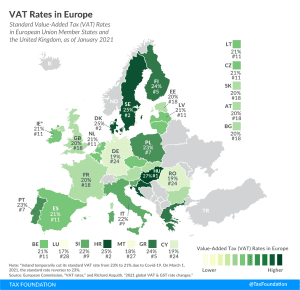

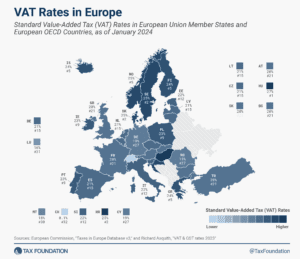

VAT Rates in Europe, 2021

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

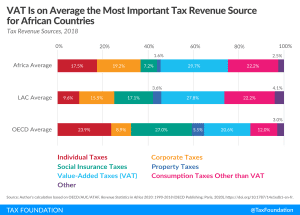

OECD Report: Tax Revenue in African Countries

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

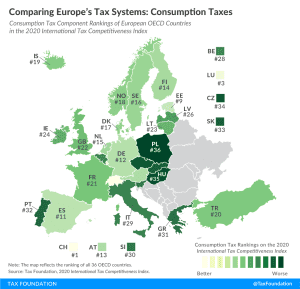

Comparing Europe’s Tax Systems: Consumption Taxes

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

Spain’s Recovery Budget Comes with Tax Hikes

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

A Framework for the Future: Reforming the UK Tax System

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

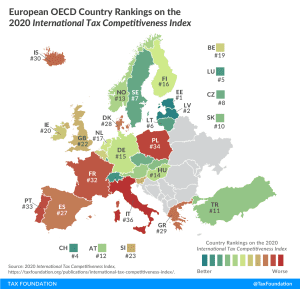

International Tax Competitiveness Index 2020

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

New European Commission Report: VAT Gap

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

Contrary to Popular Belief, Value-Added Taxes Found to Be Slightly Progressive

Value-added taxes (VAT) are traditionally considered regressive, meaning they place a disproportionate burden on low-income taxpayers. However, a recent OECD study used household expenditures micro-data from 27 OECD countries to reassess this conclusion.

5 min read

Where Should the Money Come From?

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read

Brazil has the Opportunity to Implement a Simple Consumption Tax and Foster Tax Progressivity at the Same Time

Brazil has one of the world’s most complex tax systems. Brazil has the opportunity to implement a simple consumption tax and foster tax progressivity at the same time.

5 min read

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read