Featured Articles

All Related Articles

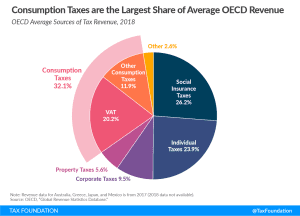

Consumption Tax Policies in OECD Countries

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

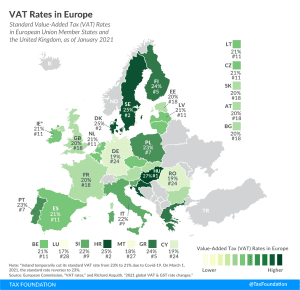

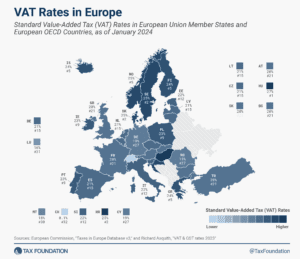

VAT Rates in Europe, 2021

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

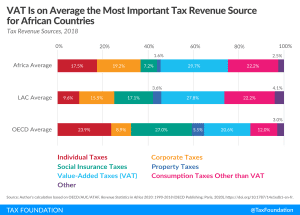

OECD Report: Tax Revenue in African Countries

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

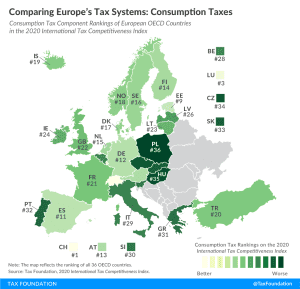

Comparing Europe’s Tax Systems: Consumption Taxes

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read

Spain’s Recovery Budget Comes with Tax Hikes

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

A Framework for the Future: Reforming the UK Tax System

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

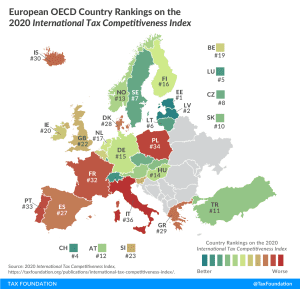

International Tax Competitiveness Index 2020

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

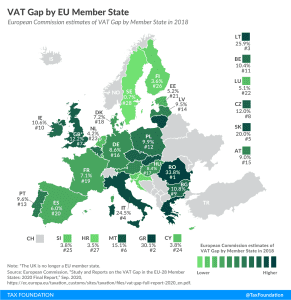

New European Commission Report: VAT Gap

Just as COVID-19 is putting pressure on other sources of revenue, the loss of VAT revenues resulting from the crisis will force governments to evaluate their VAT systems.

3 min read

Contrary to Popular Belief, Value-Added Taxes Found to Be Slightly Progressive

Value-added taxes (VAT) are traditionally considered regressive, meaning they place a disproportionate burden on low-income taxpayers. However, a recent OECD study used household expenditures micro-data from 27 OECD countries to reassess this conclusion.

5 min read

Where Should the Money Come From?

The fiscal response to the COVID-19 pandemic will require policymakers to consider what revenue resources should be used to fill budget gaps. Tax policy experts have proposed wealth taxes, (global) corporate minimum taxes, excess profits taxes, and digital taxes as opportunities for governments to raise new revenues.

20 min read

Brazil has the Opportunity to Implement a Simple Consumption Tax and Foster Tax Progressivity at the Same Time

Brazil has one of the world’s most complex tax systems. Brazil has the opportunity to implement a simple consumption tax and foster tax progressivity at the same time.

5 min read

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Germany Adopts a Temporary VAT Cut

Tax policy responses to the pandemic should be designed to provide immediate support while paving the way to recovery. A temporary VAT rate cut in the context of an inefficient VAT system is likely to deliver mixed results at best.

4 min read

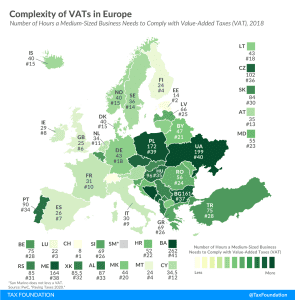

Complexity of VATs in Europe

2 min read

California Considers Business Head Tax Plan that Seattle Repealed

With California’s unemployment rate approaching 25 percent, it is somewhat surprising to find policymakers contemplating a literal tax on jobs.

3 min read

Lessons from Alberto Alesina for U.S. Lawmakers

Alesina’s work suggests that raising taxes to reduce the federal deficit and national debt would be an economic mistake. The less economically damaging path is to cut spending, what some have called austerity policies.

3 min read

A Comparison of the Tax Burden on Labor in the OECD, 2020

A higher tax burden on labor often leads to lower employment rates and wages. That’s important for policymakers to remember as they look for ways to help their economies recover from coronavirus-induced shutdowns. If their goal is to encourage employment, policies that lower the tax burden on labor could prove a powerful tool.

20 min read

New OECD Study: Consumption Tax Revenues during Economic Downturns

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read