Featured Articles

All Related Articles

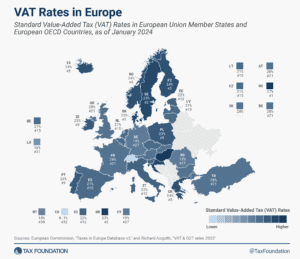

Sources of U.S. Tax Revenue by Tax Type, 2023

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

The EU’s Windfall Profits Tax: How “Tax Fairness” Continues to Get in the Way of Energy Security

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

Sources of Government Revenue in the OECD, 2023

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read

Tennessee Looking Toward Pro-Growth Change in 2023

With other states upping their game to attract ever-more-mobile people and businesses, lawmakers and the governor are not content to leave Tennessee’s business taxes in their current, uncompetitive form.

7 min read

JCT Tax Expenditure Report: Not All Expenditures Are Created Equal

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

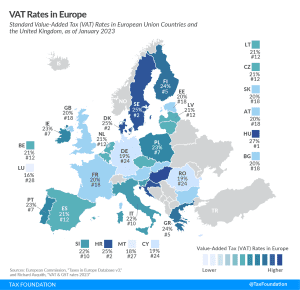

VAT Rates in Europe, 2023

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

State Tax Policy as an Inflation Response

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read

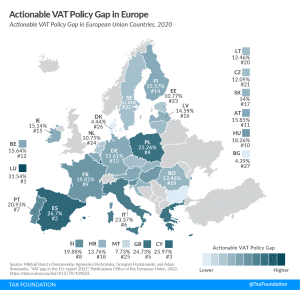

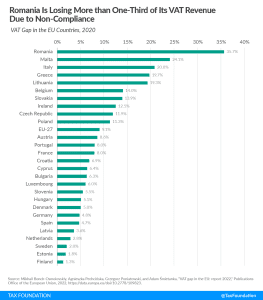

Actionable VAT Policy Gap in Europe, 2023

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

VAT Expansion and Labor Tax Cuts

Since VAT revenues are such a significant and stable contributor to overall government revenues, EU policymakers should pay particular attention to how efficiently those revenues are raised.

22 min read

Spain’s Race to the Bottom in the International Tax Competitiveness Index

Since 2020, Spain has dropped from 26th to 34th on the International Tax Competitiveness due to multiple tax hikes, new taxes, and weak performances in all five index components.

7 min read

Colombia Is in Urgent Need of Pro-Growth Comprehensive Tax Reform

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

2023 State Business Tax Climate Index

While there are many ways to show how much is collected in taxes by state governments, our Index is designed to show how well states structure their tax systems by focusing on the how more than the how much in recognition of the fact that there are better and worse ways to raise revenue.

129 min read

International Tax Competitiveness Index 2022

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

What the EU Gets Wrong About “Tax Fairness” and How Principled Tax Policy Can Help

A more principled EU tax system will increase economic growth across the economy and provide the government with stable finances for spending priorities.

7 min read

Impact of Italian Elections on National Tax Policy and EU Fiscal Policy

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

The Sticks: Inflation Reduction Act’s Energy-Related Tax Increases

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

Taxes and the UK’s new Prime Minister

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

New Mexico and the Question of Tax Competitiveness

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Europe Opened the Pandora Box of Reduced VAT Rates

With this new VAT directive, the EU has invited member states to adopt policies that create new complexities, are poorly targeted, and undermine an Own Resource.

5 min read